Corporación América Airports (NYSE:CAAP) Valuation After November’s Strong Passenger Traffic Growth and Network Expansion

Corporación América Airports (NYSE:CAAP) just posted another month of steady traffic growth, with November passenger numbers up about 9% year on year and Argentina leading gains thanks to new routes and added frequencies.

See our latest analysis for Corporación América Airports.

The market seems to be catching on to that steady operational momentum, with a 30 day share price return of 13.71% and a powerful three year total shareholder return above 200% underscoring how sentiment has shifted in CAAP's favor.

If CAAP's traffic gains have you thinking about where else growth might be building, it could be worth exploring fast growing stocks with high insider ownership as your next set of ideas.

Yet with shares up over 40% in three months and now trading only slightly below analyst targets, is Corporación América Airports still flying under the valuation radar, or is the market already pricing in much of its future growth?

Most Popular Narrative: 3.5% Undervalued

With Corporación América Airports last closing at $25.46 versus a narrative fair value near $26.38, the implied upside is modest but still positive.

Ongoing major infrastructure investments, such as the Florence Airport Master Plan (recently environmentally approved), expansion projects in Armenia, and future growth opportunities in M&A and concessions, should increase capacity and competitiveness, underpinning future top-line and adjusted EBITDA expansion.

Curious how steady traffic turns into a richer valuation story? The narrative leans on rising margins, measured revenue growth, and a lower future earnings multiple than today. Want to see how those moving parts combine into that fair value call?

Result: Fair Value of $26.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Argentina's persistent economic volatility and CAAP's heavy concession and regulatory exposure could still derail those growth assumptions if conditions deteriorate.

Find out about the key risks to this Corporación América Airports narrative.

Another View: Market Ratios Tell a Different Story

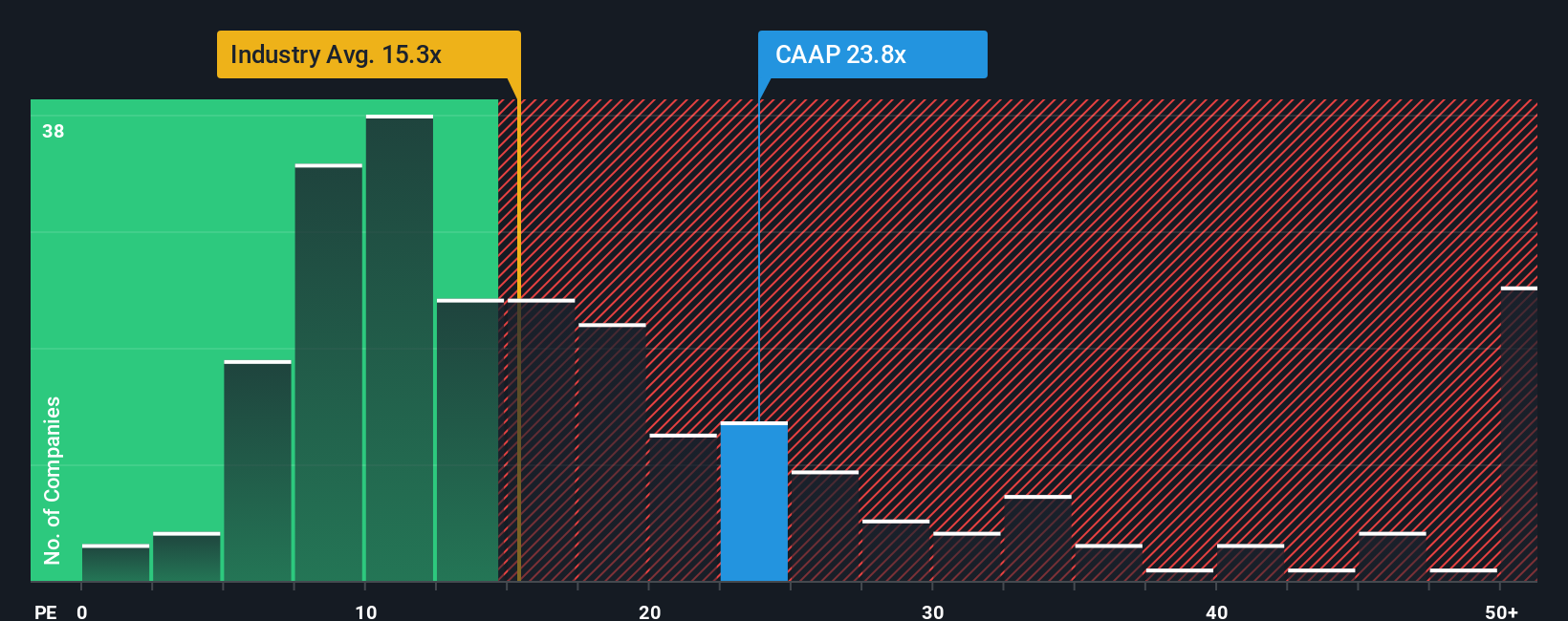

On earnings multiples, CAAP looks less clear cut, trading at about 23.4 times earnings versus a global infrastructure average near 14.4 times and a fair ratio closer to 22 times. That richer pricing cuts into the margin of safety, so how much upside is really left if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corporación América Airports Narrative

If this perspective does not fully align with your view, or you prefer to dig into the numbers yourself, you can build a tailored narrative in minutes: Do it your way.

A great starting point for your Corporación América Airports research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider exploring a few fresh stock ideas using the Simply Wall St Screener so you are not the one chasing the market later.

- Target steady income by reviewing these 13 dividend stocks with yields > 3% that may help strengthen your portfolio with cash distributions.

- Position for the next wave of innovation by scanning these 24 AI penny stocks that are contributing to the development of intelligent technology.

- Look for potential mispriced opportunities by focusing on these 910 undervalued stocks based on cash flows where market expectations may differ from underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報