Insmed (INSM) Is Down 11.3% After Ending Brensocatib CRS Trial and Buying INS1148 – What's Changed

- Earlier this month, Insmed announced that its Phase 2b BiRCh trial of brensocatib in chronic rhinosinusitis without nasal polyps failed to meet all primary and secondary efficacy endpoints, prompting an immediate halt to development in this indication despite a clean safety profile.

- At the same time, Insmed moved to bolster its respiratory and inflammatory pipeline by acquiring INS1148, a Phase 2–ready monoclonal antibody initially aimed at interstitial lung disease and moderate-to-severe asthma.

- We’ll now examine how discontinuing brensocatib in chronic rhinosinusitis without nasal polyps reshapes Insmed’s investment narrative and pipeline focus.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Insmed Investment Narrative Recap

To own Insmed, you need to believe its value rests on executing the recent BRINSUPRI launch in bronchiectasis and advancing a broader respiratory portfolio, despite continued losses. The BiRCh failure in chronic rhinosinusitis without nasal polyps looks immaterial to the near term brensocatib launch story, but it does underline how dependent the company remains on a handful of late stage assets.

The acquisition of INS1148, a Phase 2 ready monoclonal antibody for interstitial lung disease and moderate to severe asthma, is particularly relevant here. It shows Insmed reinforcing its respiratory and inflammatory pipeline at the same time as it narrows brensocatib’s focus, which may matter for how investors weigh upcoming catalysts against ongoing clinical and reimbursement risks.

Yet beneath the excitement around BRINSUPRI’s launch and new assets, investors should be aware of the risk that...

Read the full narrative on Insmed (it's free!)

Insmed’s narrative projects $1.9 billion revenue and $293.8 million earnings by 2028.

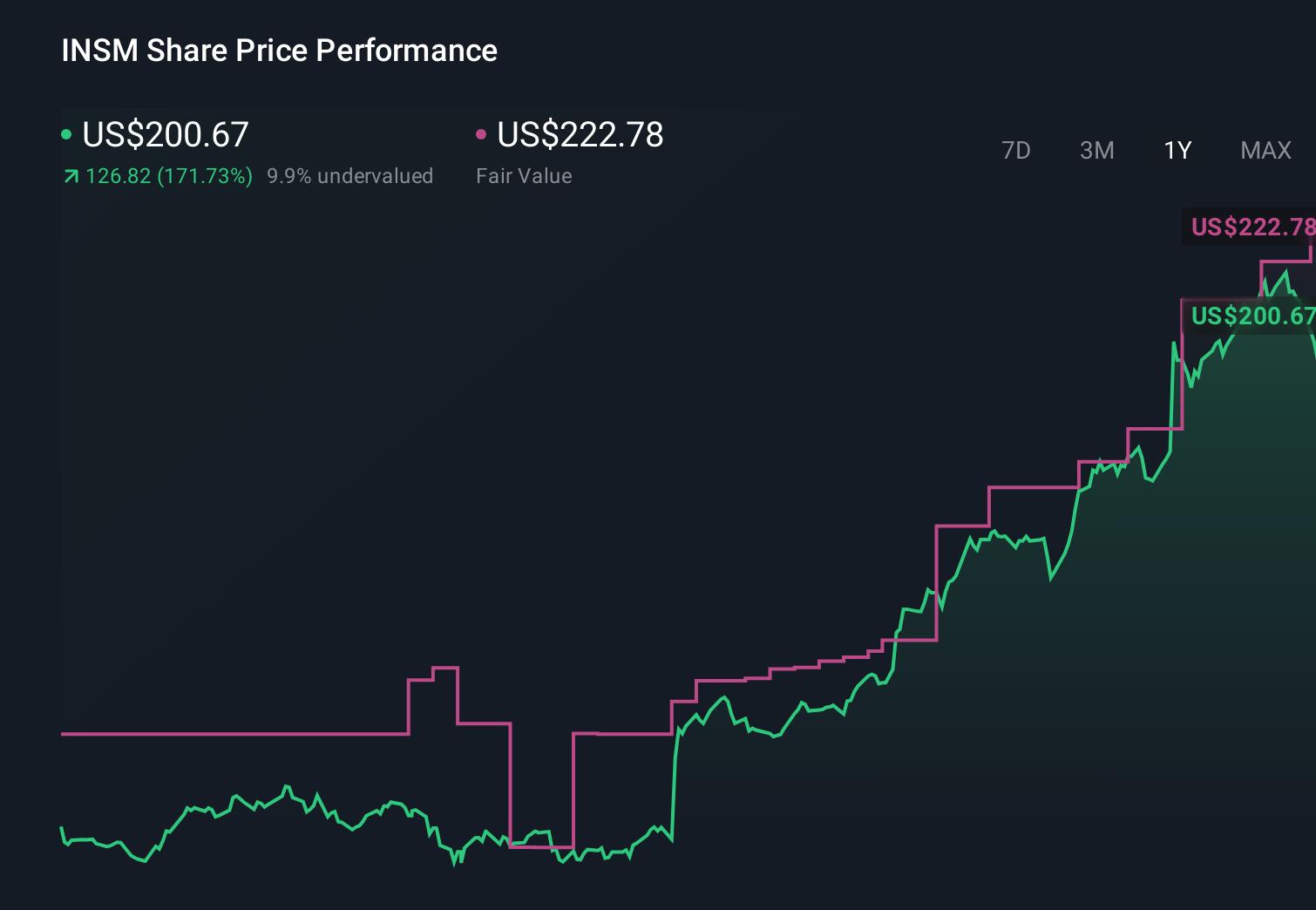

Uncover how Insmed's forecasts yield a $222.78 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$215 to over US$21,000 per share, showing just how far apart individual views can be. You are seeing that wide dispersion at the same time as the market weighs the BiRCh trial setback against the importance of brensocatib’s bronchiectasis launch for Insmed’s future performance.

Explore 4 other fair value estimates on Insmed - why the stock might be worth just $214.78!

Build Your Own Insmed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insmed research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insmed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insmed's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報