Toro (TTC): Reassessing Valuation After Earnings Beat, Strong Guidance, and New Capital Return Plans

Toro (TTC) just delivered a quarter that cleared Wall Street’s bar, leaned on its Professional segment to do the heavy lifting, and paired the beat with upbeat guidance, dividend growth, and fresh buyback firepower.

See our latest analysis for Toro.

At a latest share price of $77.67, Toro has enjoyed a 1 month share price return of 13.07%, even though its 1 year total shareholder return of negative 2.71% and 3 year total shareholder return of negative 27.74% show a longer term reset in expectations. This suggests recent momentum is tentatively rebuilding as investors react to earnings, guidance, and the new buyback.

If Toro’s mix of steady cash returns and cautious growth appeals to you, this is also a good moment to explore aerospace and defense stocks as another way to find resilient, equipment focused names.

With the stock still trading at a modest discount to analyst targets despite years of derating, are investors getting paid for Toro’s slow and steady turnaround, or is the market already baking in the next leg of growth?

Most Popular Narrative: 16.1% Undervalued

With Toro last closing at $77.67 versus a narrative fair value of $92.60, the story leans toward upside if its execution matches expectations.

Analysts expect the number of shares outstanding to decline by 4.63% per year for the next 3 years.

To value all of this in today's terms, we will use a discount rate of 8.28%, as per the Simply Wall St company report.

Curious how modest headline growth assumptions still support a higher fair value? The real twist lies in margin expansion, shrinking share count, and a reset earnings multiple. Want to see how those moving parts translate into that target?

Result: Fair Value of $92.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic setup could be derailed by a deeper, longer slump in residential demand, or by renewed margin pressure from higher input costs and tariffs.

Find out about the key risks to this Toro narrative.

Another Lens on Value

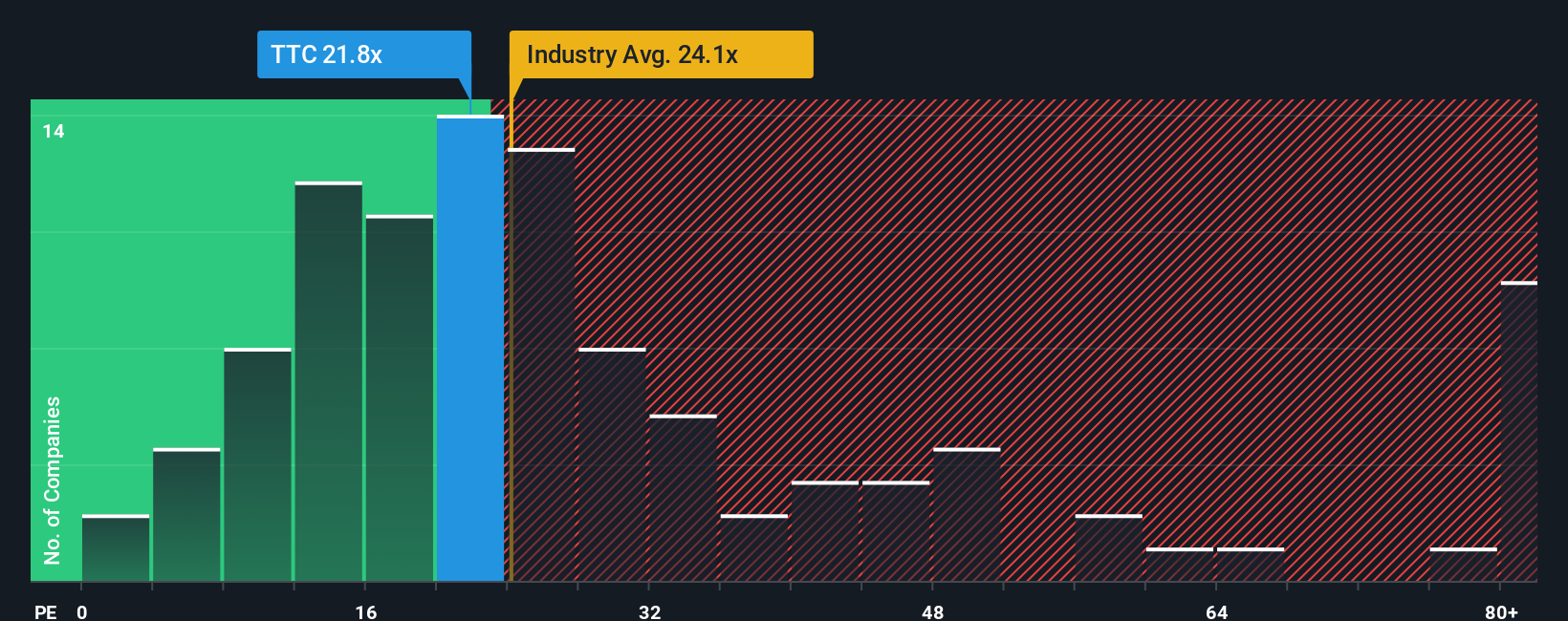

On earnings, Toro looks less like a bargain. It trades at 24.1 times profit versus a 22.9 fair ratio and about 19.1 for peers, which points to a valuation premium rather than a discount. Is the market sensibly pricing quality, or just paying up for comfort?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toro Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Toro.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by scanning focused stock shortlists built from hard data, not hype, across different themes and risk levels.

- Target steady income streams by reviewing these 13 dividend stocks with yields > 3% that can potentially support your portfolio through changing market cycles.

- Position yourself ahead of emerging trends by evaluating these 24 AI penny stocks poised to benefit from the rapid adoption of artificial intelligence.

- Spot potential bargains early by sorting through these 913 undervalued stocks based on cash flows that may be trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報