Xeris Biopharma (XERS): Assessing Valuation as Investors Back Its Shift to Profitable Specialty Pharma

Recent analysis suggests Xeris Biopharma Holdings (XERS) is shifting from survival mode to a profit focused specialty pharma story, with three commercial drugs and a growing pipeline reshaping how investors view the stock.

See our latest analysis for Xeris Biopharma Holdings.

That improving story is already showing up in the tape, with the share price at $7.34 after a 1 day share price return of 4.71 percent and a powerful year to date share price return of 112.14 percent. The 3 year total shareholder return of 482.54 percent signals that investors have steadily been re rating the stock despite the occasional pullback.

If Xeris has you rethinking what a small cap pharma can become, it might be worth scanning similar specialty names through healthcare stocks for fresh ideas.

With revenue still growing double digits, a discounted share price versus analyst targets and profits finally coming into view, the key question now is simple: is Xeris still mispriced, or is the market already discounting that next leg of growth?

Most Popular Narrative: 36.2% Undervalued

With Xeris Biopharma Holdings last closing at $7.34 against a narrative fair value of $11.50, the valuation hinges on aggressive growth and margin expansion assumptions.

The impending launch of XP-8121, which utilizes proprietary delivery technology to address a significant unmet need in hypothyroidism, opens the door to a high value market segment underserved by innovation, potentially driving new revenue streams and long term margin expansion.

Want to see how fast growing revenues, rising margins and a richer earnings multiple are stitched together into that valuation gap? The narrative walks through the specific growth runway, profit inflection and future pricing power that need to fall into place, and how long they are expected to last.

Result: Fair Value of $11.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case still hinges on flawless execution, with dependence on a narrow drug portfolio and rising SG&A potentially squeezing margins if growth disappoints.

Find out about the key risks to this Xeris Biopharma Holdings narrative.

Another View: Rich on Sales, Cheap on Story?

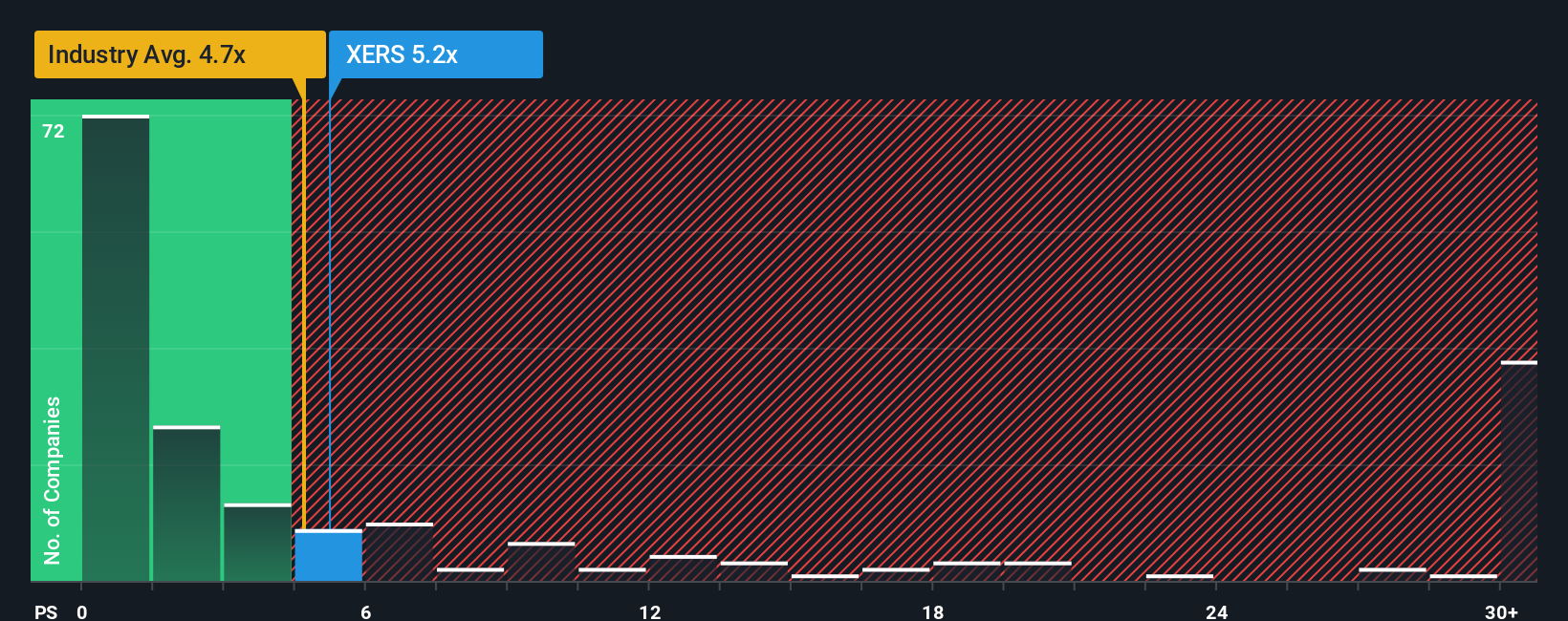

While narrative and analyst targets present Xeris as meaningfully undervalued, its 4.6x price to sales ratio looks elevated compared with peers at 1.8x and even the US pharma average at 4.2x. The fair ratio of 6.1x suggests more upside, but also sharper downside if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xeris Biopharma Holdings Narrative

If you would rather dig into the fundamentals yourself and stress test every assumption, you can build a personalized Xeris thesis in minutes: Do it your way.

A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by scanning focused stock lists built from real fundamentals, not headlines or hype.

- Supercharge your hunt for overlooked bargains by targeting companies flagged as undervalued on cash flows through these 913 undervalued stocks based on cash flows.

- Capitalize on the AI boom by zeroing in on high potential innovators featured in these 24 AI penny stocks.

- Strengthen your income strategy by pinpointing reliable payers with attractive yields using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報