Does Fluence Energy Still Offer Value After Storage Contract Wins And Volatile Price Swings?

- If you are wondering whether Fluence Energy is still a smart buy after its recent run, or if the market has already priced in the upside, this article is for you.

- The stock has been volatile lately, dropping around 10% over the last week, but still up roughly 18.7% over the past month and 31.2% over the last year. This shows that sentiment can swing quickly.

- Recent attention has been driven by Fluence winning large scale energy storage contracts and expanding partnerships with major utilities, reinforcing its role in the grid scale transition to renewables. At the same time, investors are weighing execution risks and competition in battery and software solutions, which helps explain the sharp price swings.

- On our valuation checks, Fluence scores a 3/6 value score. This suggests the market might be partially, but not fully, recognizing its potential. Next, we will walk through the main valuation approaches, before finishing with a more holistic way to think about what the stock is really worth.

Approach 1: Fluence Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present using a required rate of return.

For Fluence Energy, Simply Wall St uses a 2 stage Free Cash Flow to Equity model. The company is currently burning cash, with last twelve month free cash flow of roughly $165 Million in the red, which is typical for a fast growing, scale up phase business. Analysts and model estimates see this improving over time, with free cash flow projected to rise to about $188 Million by 2030 and then continue growing at moderating rates thereafter as the business matures.

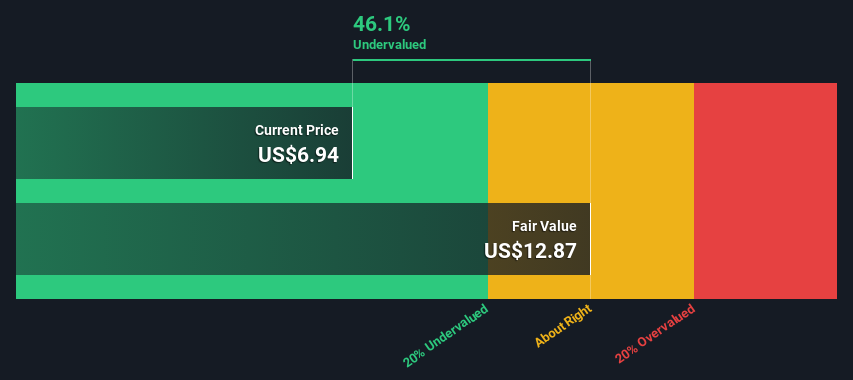

When all these projected cash flows are discounted back to today in dollars, the model arrives at an intrinsic value of roughly $17.40 per share. With the DCF indicating the stock is about 14.7% above this estimate, Fluence appears modestly overvalued on a cash flow basis at the moment, even after recent volatility.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fluence Energy may be overvalued by 14.7%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fluence Energy Price vs Sales

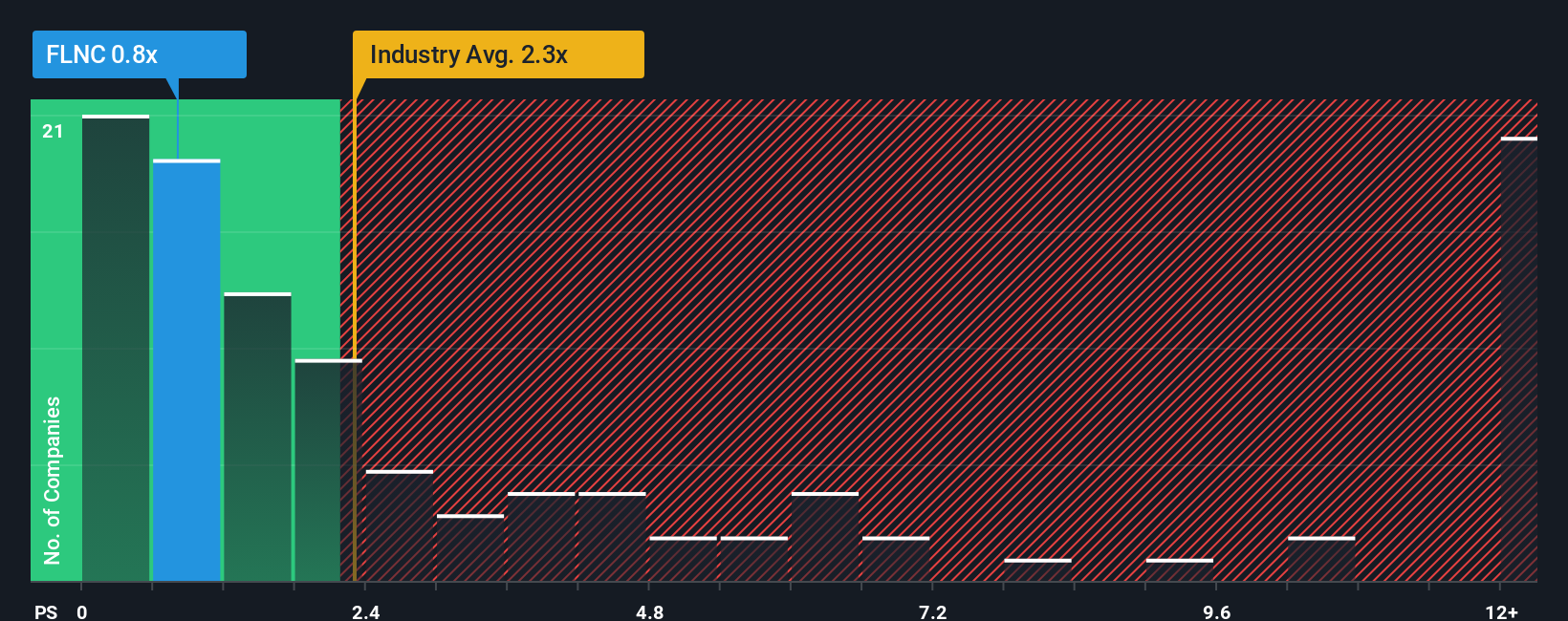

For companies that are still scaling and not consistently profitable, the price to sales ratio is often a more useful yardstick than earnings based metrics, because revenue is less volatile and not yet distorted by heavy investment spending.

In general, investors are willing to pay a higher sales multiple for businesses with stronger growth prospects and lower perceived risk, while slower growing or riskier names usually trade on lower ratios. Fluence currently trades on a price to sales ratio of around 1.16x, which is below both the Electrical industry average of about 2.34x and the broader peer group average of roughly 4.34x. On the surface, that discount suggests the market is cautious about its execution risks and path to profitability.

Simply Wall St’s Fair Ratio framework goes a step further. It estimates what an appropriate price to sales multiple should be for Fluence, given its growth outlook, margins, industry, market cap and risk profile. For Fluence, this Fair Ratio is 1.97x, meaning that, after adjusting for these fundamentals, the stock appears to trade below where it arguably should.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fluence Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page where you turn your view of a company into a simple story. This story connects assumptions about future revenue, earnings and margins to a financial forecast, a fair value, and a clear buy or sell decision by comparing that fair value to today’s price. The whole Narrative automatically updates as new news or earnings arrive. For Fluence Energy, one investor might build a bullish Narrative around rapid storage adoption, rising margins and a fair value closer to $24.80. A more cautious investor might emphasize policy risk and slower U.S. bookings and see fair value nearer $7.70. Both perspectives can coexist and evolve in real time as fresh data comes in.

Do you think there's more to the story for Fluence Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報