Dominion Energy (D): Revisiting Valuation After Nuclear Partnership With Amazon and Rising Data Center Power Demand

Dominion Energy (D) has been getting fresh attention after its nuclear focused Memorandum of Understanding with Amazon and its inclusion among top utility picks for hedge funds, all against a backdrop of surging data center driven demand.

See our latest analysis for Dominion Energy.

Even with the Amazon nuclear partnership and hedge fund interest grabbing headlines, Dominion’s share price return has been steadier than explosive, with a roughly 9 percent year to date gain and a one year total shareholder return of about 16 percent, suggesting gradually improving sentiment rather than a runaway rally.

If you are watching how data center power demand is reshaping utilities, it can also be worth scanning fast growing stocks with high insider ownership to spot other under the radar businesses where insiders have meaningful skin in the game.

With the stock still trading below the average analyst price target but boasting solid recent returns, the key question now is whether Dominion remains undervalued or if the market is already pricing in that future growth.

Most Popular Narrative Narrative: 7% Undervalued

With Dominion Energy last closing at $59.43 versus a narrative fair value near $63.93, the story frames the stock as modestly mispriced while hinging on specific growth and margin assumptions.

Large scale investments in regulated renewables, especially the Coastal Virginia Offshore Wind (CVOW) project, position Dominion to benefit from the accelerating energy transition, earning stable regulated returns and expanding rate base, with a positive impact on long term earnings.

Curious how steady growth, rising margins, and a lower future earnings multiple can still justify a higher value than today? Want to see the full playbook behind that outlook?

Result: Fair Value of $63.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that outlook still hinges on smooth CVOW execution and constructive regulators, with cost overruns or tougher rate decisions potentially eroding the upside.

Find out about the key risks to this Dominion Energy narrative.

Another Angle on Value

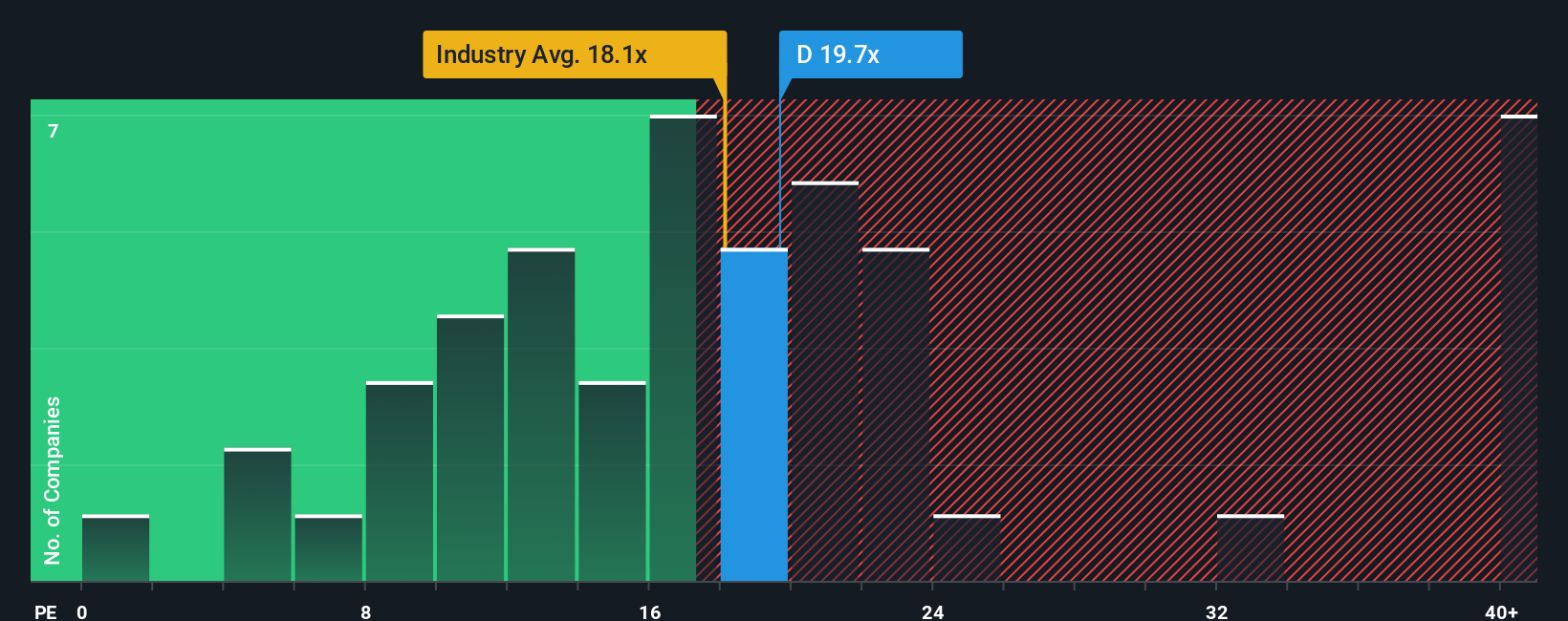

Looking at valuation through the lens of earnings, Dominion trades at about 19.4 times earnings, slightly cheaper than peers at 20.9 times but richer than the global integrated utilities average of 17.9 times. With a fair ratio nearer 24.8 times, is the market still underestimating its cash flow resilience?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dominion Energy Narrative

If this outlook does not quite fit your view, or you would rather dive into the numbers yourself, you can build a custom narrative in just a few minutes, starting with Do it your way.

A great starting point for your Dominion Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one utility when the market is full of opportunities. Use the Simply Wall Street Screener to uncover focused, data backed stock ideas.

- Capture potential high yield income streams by targeting these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

- Position yourself early in transformative technology by scanning these 24 AI penny stocks pushing the boundaries of artificial intelligence.

- Lock in value oriented opportunities by searching through these 913 undervalued stocks based on cash flows where prices still lag underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報