Watts Water Technologies (WTS): Evaluating Valuation After a Strong Year-to-Date Share Price Rally

Watts Water Technologies (WTS) has quietly delivered a strong run this year, with the stock up roughly 40% year to date as steady revenue and earnings growth keep drawing in patient long term investors.

See our latest analysis for Watts Water Technologies.

That steady backdrop has helped the share price grind higher to around $279.85, with a roughly 5% 1 month share price return contributing to a near 40% year to date share price gain and a 3 year total shareholder return close to 95%, suggesting momentum is still broadly with the bulls.

If Watts’ solid execution has you rethinking what you might be missing elsewhere, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares near record highs and only a small discount to analyst targets and intrinsic value estimates, is Watts still flying under the radar as a quality compounder, or is the market already pricing in years of growth?

Most Popular Narrative: 4.3% Undervalued

With Watts Water Technologies last closing at $279.85 against a narrative fair value near $292.50, the latest storyline still sees modest upside from here.

The accelerating rollout and success of Nexa, Watts' intelligent water management platform, positions the company to capture the growing demand for advanced, data driven water conservation, efficiency, and regulatory compliance solutions, expected to drive higher margin, recurring revenue and support long term earnings and margin expansion.

Want to see what kind of revenue runway and profit margins are being baked into that price tag? The forecasts lean ambitious, especially on earnings power. Curious how far the valuation multiple stretches to make the math work? The full narrative lays out every assumption driving that fair value call.

Result: Fair Value of $292.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained European weakness or slower than expected adoption of Nexa and other digital offerings could quickly challenge those upbeat growth and margin assumptions.

Find out about the key risks to this Watts Water Technologies narrative.

Another Angle on Valuation

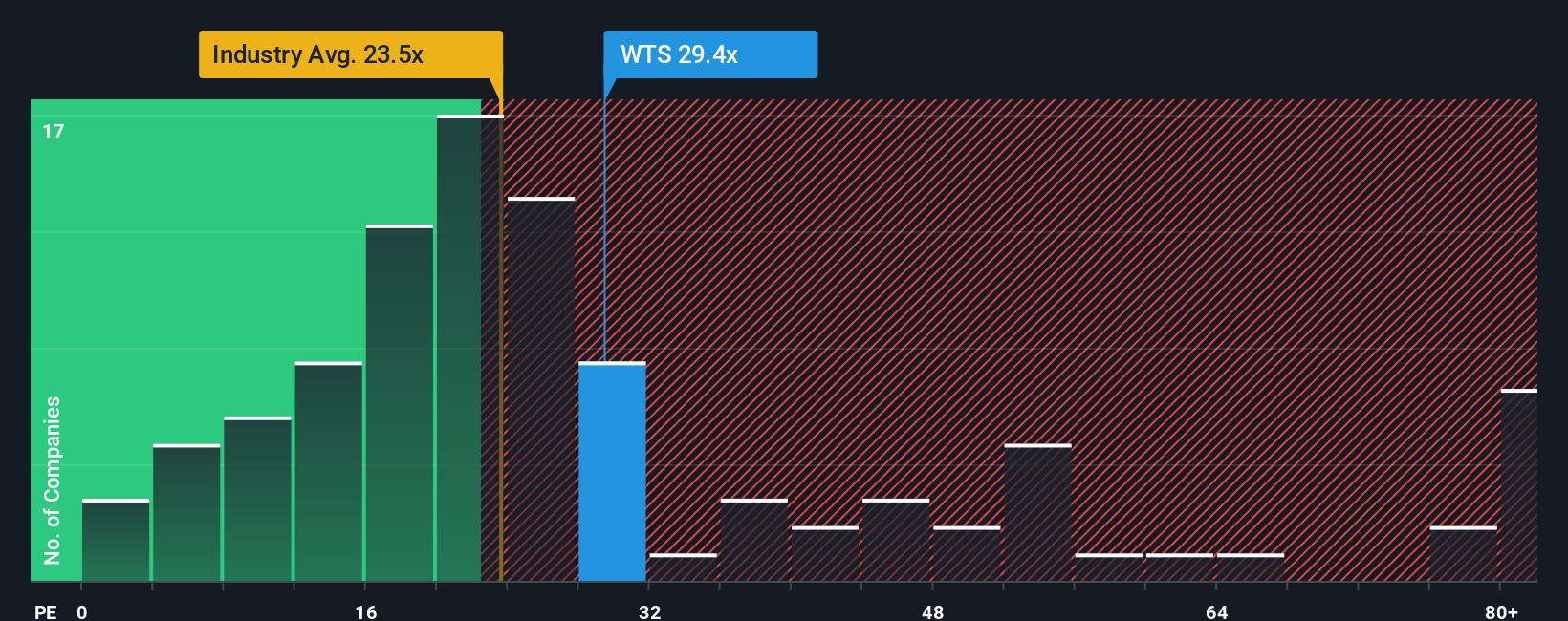

Step away from fair value models and Watts starts to look punchy. The current P/E of 28.7x sits above the US Machinery average of 25.4x and well ahead of a 22.7x fair ratio the market could drift toward, raising the risk of multiple compression if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Watts Water Technologies Narrative

If you are not fully on board with this take, or simply prefer digging into the numbers yourself, you can quickly build your own view in just a few minutes, Do it your way.

A great starting point for your Watts Water Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investment move?

Do not stop at one strong story; use the Simply Wall St Screener to quickly surface focused opportunities that match your strategy and help avoid missing stand out ideas.

- Explore potential income opportunities by reviewing these 13 dividend stocks with yields > 3% that may offer reliable payouts and help stabilize your overall portfolio returns.

- Position yourself early in transformative innovation by analyzing these 28 quantum computing stocks focused on the boundaries of computing power and long term growth potential.

- Look for valuation gaps by targeting these 914 undervalued stocks based on cash flows that could offer meaningful upside as the market responds to their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報