IAC Inc. (NASDAQ:IAC) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

IAC Inc. (NASDAQ:IAC) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.3% in the last twelve months.

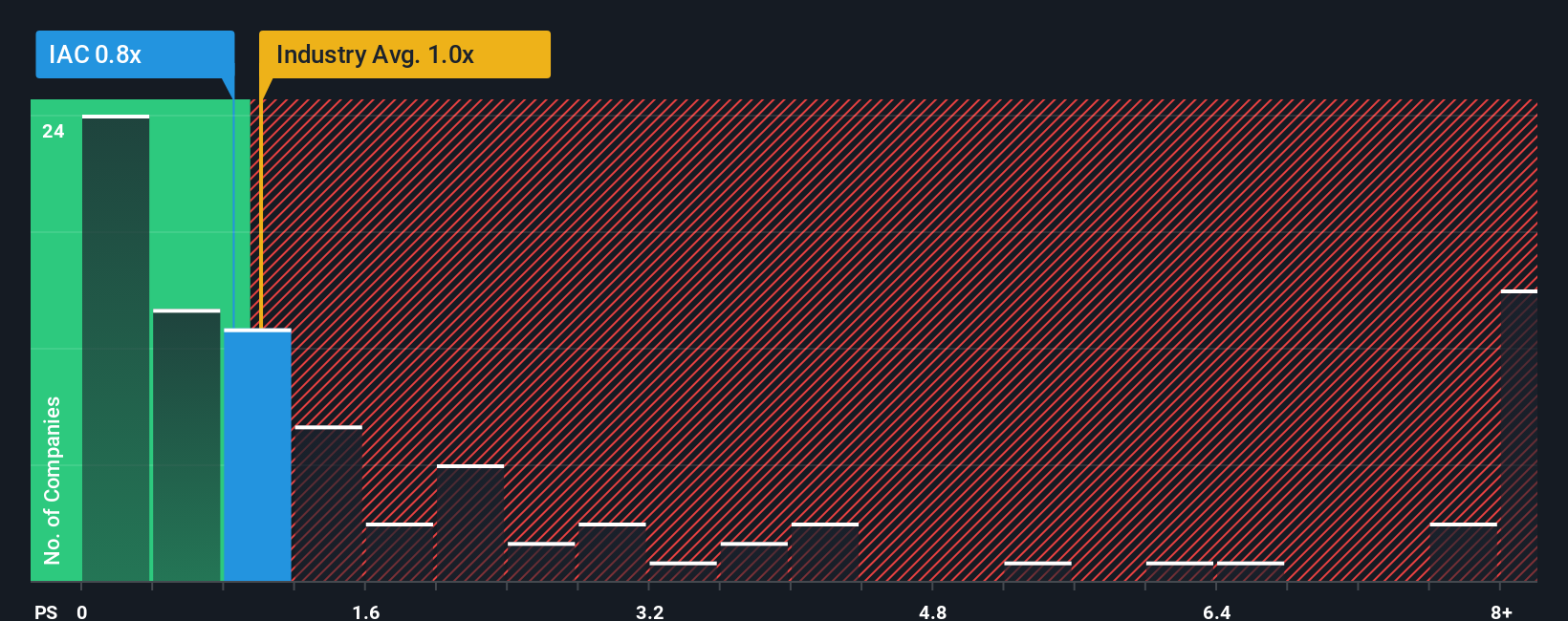

Although its price has surged higher, it's still not a stretch to say that IAC's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Interactive Media and Services industry in the United States, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for IAC

How IAC Has Been Performing

With revenue growth that's superior to most other companies of late, IAC has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on IAC.What Are Revenue Growth Metrics Telling Us About The P/S?

IAC's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 29% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 12% each year as estimated by the twelve analysts watching the company. With the industry predicted to deliver 14% growth per year, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that IAC's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

IAC appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of IAC's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for IAC with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報