Moog (MOG.A) Valuation Check After New Iron Nitride Actuator Partnership for Defense Modernization

Niron Magnetics and Moog (MOG.A) just unveiled a partnership to test Iron Nitride based actuators for guided munitions, tying Moog directly into the U.S. defense push for resilient, domestically sourced tech.

See our latest analysis for Moog.

The news comes on top of a strong run, with Moog’s share price up 25.4 percent over the past month and 26.1 percent over the last quarter, while its five year total shareholder return above 200 percent suggests momentum has been building for some time.

If this defense driven move has caught your eye and you want to see what else is gaining traction in the sector, now could be a good time to explore aerospace and defense stocks.

With shares hovering just below analyst targets yet still trading at a hefty premium to historical levels, are investors looking at an underrated compounder in defense systems, or a stock that already reflects years of growth to come?

Most Popular Narrative: 3.5% Undervalued

With Moog last closing at $247.63 against a most followed fair value of $256.50, the narrative is leaning toward modest upside from here.

Operational efficiency initiatives (including facility consolidation, divestiture of noncore product lines, and the 80/20 simplification program) are resulting in higher productivity and margin improvement; this should continue to drive both operating margins and free cash flow higher despite near term tariff and working capital headwinds.

Want to see how steady but accelerating revenue, rising profitability, and a richer future earnings multiple all fit together into that target? Take a closer look at the narrative math that turns today’s defense momentum into tomorrow’s valuation roadmap.

Result: Fair Value of $256.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and ongoing free cash flow conversion challenges could undermine the margin expansion that underpins today’s modest undervaluation thesis.

Find out about the key risks to this Moog narrative.

Another Lens on Value

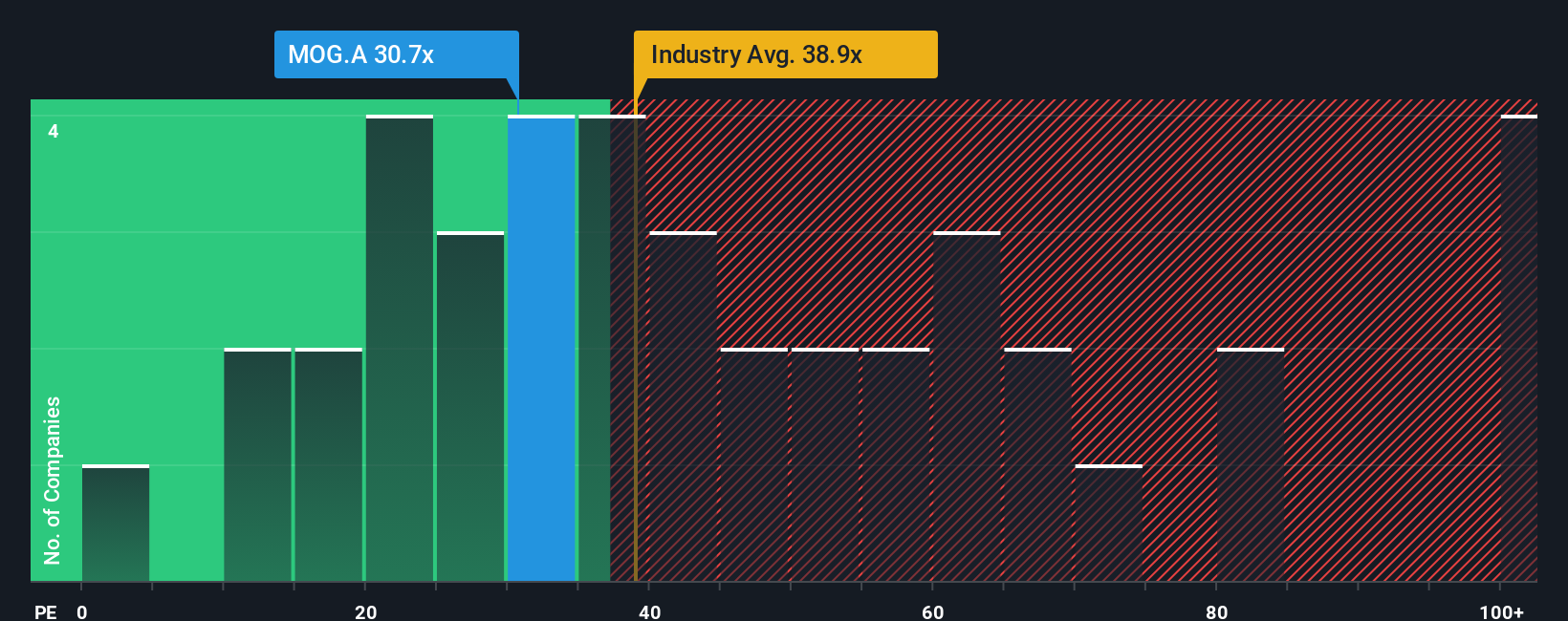

On a plain earnings multiple, Moog looks less forgiving. The shares trade on 33.4 times earnings versus a fair ratio of 27.8 times. This suggests the market is already paying up for future growth and leaving less room for disappointment than a simple fair value target implies.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moog Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Moog research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Moog has sharpened your appetite for opportunity, do not stop here. Let Simply Wall Street's powerful Screener help you pinpoint your next smart move.

- Capture potential market reratings by scanning through these 914 undervalued stocks based on cash flows that look mispriced relative to their fundamentals and future cash flows.

- Capitalize on developments in intelligent automation by targeting these 25 AI penny stocks positioned at the intersection of software, data, and scalable infrastructure.

- Strengthen your income strategy with these 13 dividend stocks with yields > 3% that combine robust balance sheets with yields that can support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報