Suburban Propane Partners (SPH): Valuation Check After $350 Million Debt Refinance and Balance Sheet Reshuffle

Suburban Propane Partners (SPH) is shaking up its balance sheet with a new $350 million, 6.5% senior notes offering due 2035, effectively swapping upcoming 2027 debt for longer dated obligations.

See our latest analysis for Suburban Propane Partners.

The refinancing move comes after a steady year in which Suburban Propane Partners’ share price has climbed to $18.54, while a 1 year total shareholder return of 14.27 percent signals gradual, income driven momentum rather than a sharp rerating.

If this kind of capital structure refresh has you thinking more broadly about portfolio ideas, it could be worth exploring fast growing stocks with high insider ownership as a next stop.

With units trading modestly above analyst targets yet sitting on a sizeable intrinsic value discount and decades of steady cash generation, is Suburban Propane Partners quietly undervalued, or is the market already discounting its next leg of growth?

Most Popular Narrative: 9.1% Overvalued

With Suburban Propane Partners closing at $18.54 against a narrative fair value of $17.00, the story hinges on how far future earnings can stretch today's price.

Expanding renewable natural gas (RNG) capacity through ongoing upgrades and new facilities in Columbus, Ohio and Upstate New York positions the company to access higher growth, lower carbon markets and capitalize on a shift in demand toward cleaner fuels, which is likely to support future revenue and margin growth once projects are operational.

Want to see the math behind that slightly rich valuation? The narrative leans on rising margins, steadier earnings, and a leaner future profit multiple. Curious which assumptions really move the dial here, and how they turn modest top line expectations into that fair value target? The full narrative spells out the playbook.

Result: Fair Value of $17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weather-driven propane volatility and stubbornly low renewable credit prices could easily derail margin expansion and challenge that seemingly modest valuation premium.

Find out about the key risks to this Suburban Propane Partners narrative.

Another Angle on Valuation

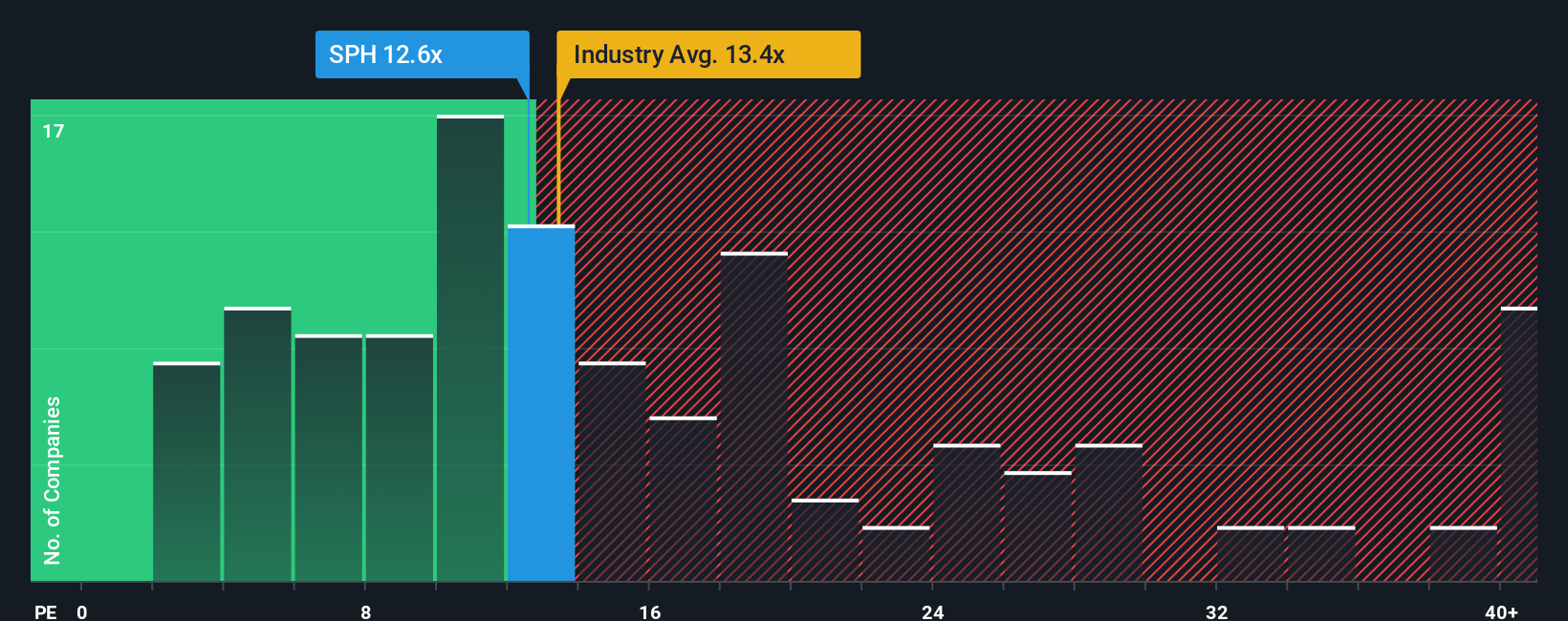

Strip out the narrative and look at the simple price to earnings ratio, and Suburban Propane Partners suddenly looks cheap, not rich. It trades at about 11.5 times earnings versus 14.3 times for global gas utilities and a fair ratio of 18.3 times. Is the real risk that the market rerates it higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Suburban Propane Partners Narrative

If you are not fully convinced by this perspective or prefer diving into the numbers yourself, you can build a personalized view in under three minutes, Do it your way.

A great starting point for your Suburban Propane Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn this insight into action by using the Simply Wall St Screener to find fresh opportunities that match your strategy before other investors move in.

- Capture mispriced opportunities by targeting these 914 undervalued stocks based on cash flows that may offer stronger upside potential relative to their current market prices.

- Ride long term innovation trends with these 25 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence across multiple industries.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can help anchor total returns with reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報