Assessing Daikin Industries (TSE:6367) Valuation After Its Strategic European Heat Pump Expansion With Copeland

Daikin IndustriesLtd (TSE:6367) is pushing deeper into Europe through an expanded joint venture with Copeland, targeting the fast growing residential heat pump market as the region leans harder into its energy transition.

See our latest analysis for Daikin IndustriesLtd.

Even with this heat pump push in Europe, Daikin’s share price return has only climbed modestly over the year, though a solid 90 day share price return suggests momentum is quietly building as investors warm to its long term growth story.

If this kind of structural transition theme interests you, it is worth scanning aerospace and defense stocks for other industrial names reshaping their sectors under long dated policy and spending tailwinds.

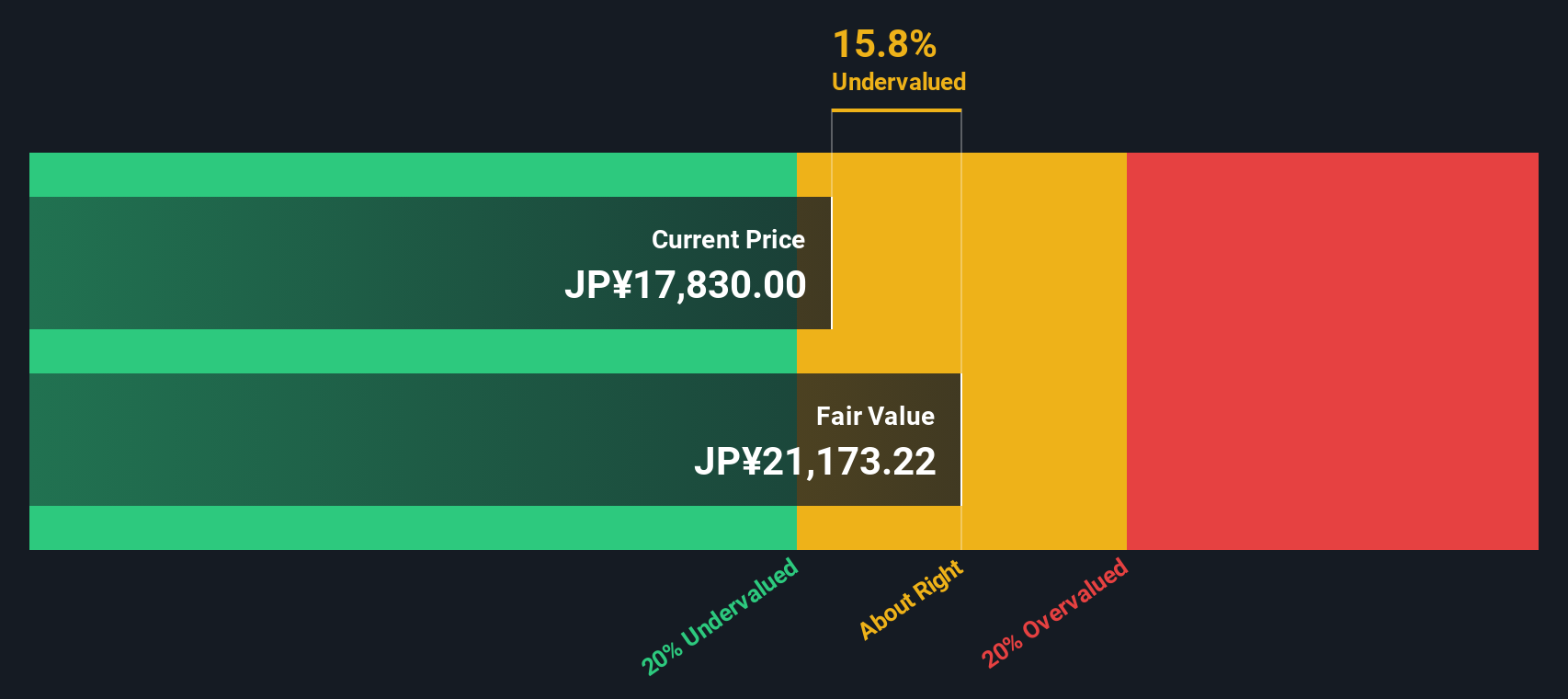

With the stock up about 13 percent over the past year but still trading at a mid teens discount to both analyst targets and intrinsic value estimates, is Daikin quietly undervalued or already pricing in its next leg of growth?

Price to Earnings of 20.9x, is it justified?

On a price to earnings multiple, Daikin trades at 20.9 times earnings, a level that screens as good value versus peers and some fair value gauges.

The price to earnings ratio compares the share price to current earnings per share, so for a diversified industrial like Daikin it is a shorthand for how much investors are paying for each unit of profit today.

Daikin looks moderate rather than stretched on this lens. Its 20.9 times earnings sits below the fair price to earnings estimate of 23.9 times and far below the 56.1 times peer average, suggesting the market is not fully capitalising its earnings track record or forward growth profile.

That said, the same 20.9 times earnings still sits above the broader Japanese building industry average of 15.1 times. This underlines how investors are already assigning Daikin a meaningful quality and growth premium even if the multiple remains restrained versus its closest peers.

Explore the SWS fair ratio for Daikin IndustriesLtd

Result: Price to Earnings of 20.9x (UNDERVALUED)

However, investors still need to watch for execution risk in Europe’s heat pump rollout, as well as any cyclical slowdown that crimps demand across construction and industrial customers.

Find out about the key risks to this Daikin IndustriesLtd narrative.

Another View: What Does Our DCF Say?

Our DCF model points to a fair value of about ¥23188 per share, leaving Daikin trading roughly 15.5 percent below that mark. That supports the idea that the current price still bakes in some caution, not optimism. Is the market underestimating its heat pump upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Daikin IndustriesLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Daikin IndustriesLtd Narrative

If you see things differently or want to dig into the numbers yourself, you can build a fresh view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Daikin IndustriesLtd.

Looking for your next investment move?

Before you move on, you may wish to scan fresh ideas on Simply Wall Street, where curated screens can help you spot opportunities others are still overlooking.

- Capture potential mispricings by targeting companies trading below their cash flow value using these 914 undervalued stocks based on cash flows tailored for value focused investors.

- Explore structural shifts in technology by focusing on innovative businesses involved in the next wave of automation and intelligence with these 25 AI penny stocks.

- Strengthen your income stream by seeking companies with reliable payouts and notable yields through these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報