The Bull Case For Coloplast (CPSE:COLO B) Could Change Following Executive Team Shake-Up In Key Divisions

- Coloplast has recently announced upcoming changes to its Executive Leadership Team, with long-serving leaders in People & Culture and Interventional Urology set to depart and successors, including incoming Interventional Urology head Kevin Hardage from Teleflex, lined up to ensure business continuity.

- These leadership shifts, particularly in the Interventional Urology division and the global People & Culture function, could influence how effectively Coloplast executes its reorganisation, integration of acquisitions, and user-focused innovation agenda over the next few years.

- We’ll now examine how the planned transition to Kevin Hardage in Interventional Urology may influence Coloplast’s existing investment narrative and outlook.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Coloplast Investment Narrative Recap

To own Coloplast, you need to believe in its user-focused Chronic Care and Acute Care franchises, the integration of acquisitions like Kerecis, and the resilience of its MedTech niches despite recent earnings pressure and a high P/E multiple. The latest leadership changes in Interventional Urology and People & Culture look manageable in the near term and do not materially alter the key short term catalyst around executing the Chronic vs Acute reorganisation, nor the main risk from looming U.S. competitive bidding in Chronic Care.

The most relevant recent announcement here is Coloplast’s August reorganisation into two business units, Chronic Care and Acute Care (which includes Interventional Urology). The incoming Interventional Urology head will inherit a central role in the Acute Care unit, where execution on innovation and acquisition integration is central to supporting management’s guidance for around 7% organic growth and EBIT growth, even as investors weigh pricing, regulatory and recall risks across the wider group.

Yet against this backdrop, investors should be aware that pricing pressure from potential U.S. competitive bidding could...

Read the full narrative on Coloplast (it's free!)

Coloplast's narrative projects DKK34.4 billion revenue and DKK7.3 billion earnings by 2028. This requires 7.3% yearly revenue growth and an earnings increase of about DKK3.2 billion from DKK4.1 billion today.

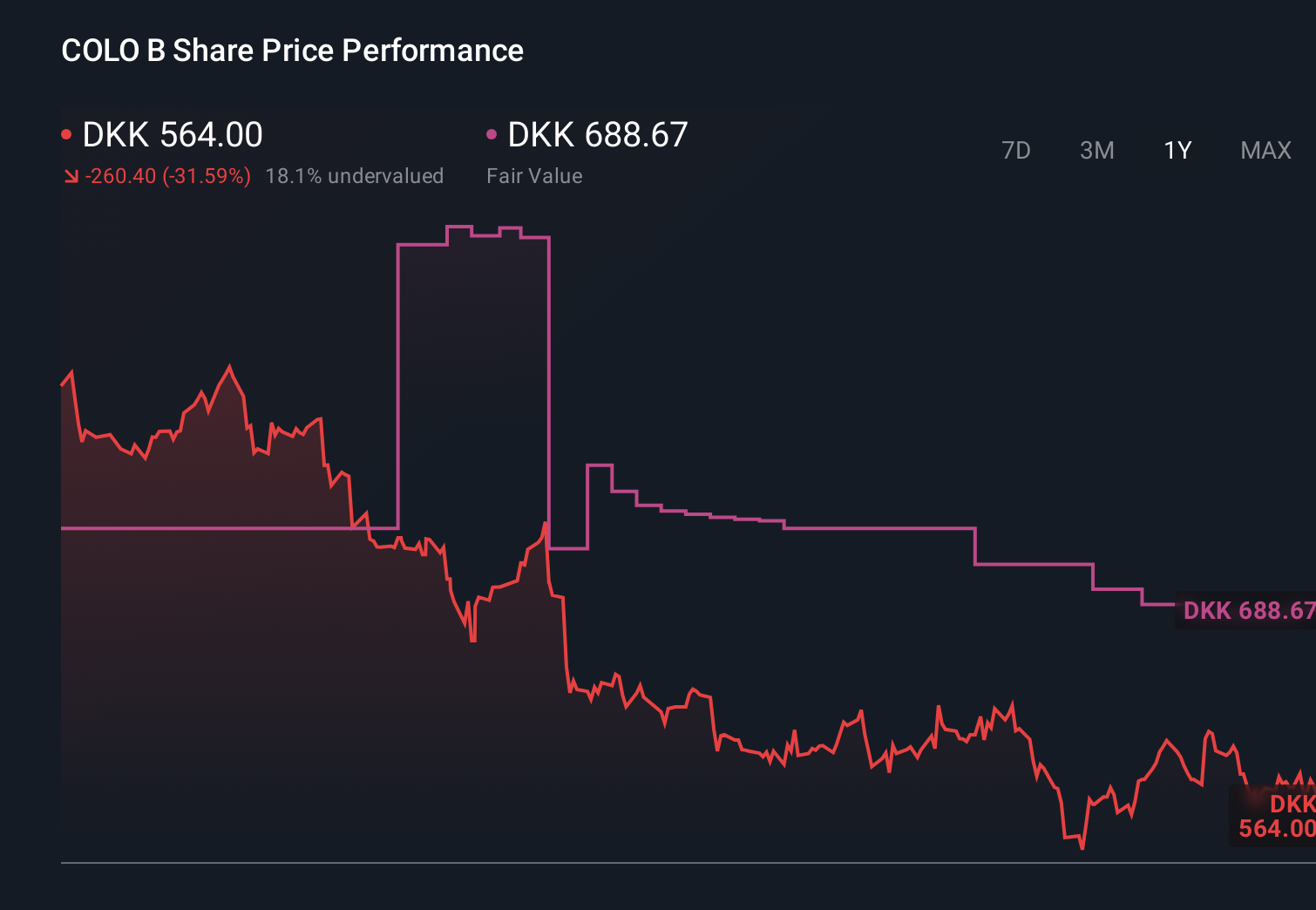

Uncover how Coloplast's forecasts yield a DKK688.72 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for Coloplast span roughly DKK 620 to DKK 1,066, highlighting how far apart individual views can be. Set these against the concentration risk around future U.S. competitive bidding in Chronic Care, and it becomes even more important to compare several viewpoints before deciding how Coloplast might fit in your portfolio.

Explore 5 other fair value estimates on Coloplast - why the stock might be worth as much as 95% more than the current price!

Build Your Own Coloplast Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coloplast research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Coloplast research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coloplast's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報