Hilton Grand Vacations (HGV): Valuation Check After $400 Million Timeshare Loan Securitization Deal

Hilton Grand Vacations (HGV) just closed a $400 million securitization of its timeshare loans, a sizable financing move that boosts liquidity and gives investors fresh insight into the company’s funding costs and credit profile.

See our latest analysis for Hilton Grand Vacations.

The securitization lands at a moment when sentiment around Hilton Grand Vacations is perking up, with the share price at $45.34 after a strong 1 month share price return of 21.26 percent and an 18.23 percent year to date share price gain. The 1 year total shareholder return of 15.37 percent points to steady but not explosive long term compounding, which suggests momentum is building as investors reassess the growth and credit story.

If this kind of financing story has you thinking about where else capital and growth are lining up, it might be worth exploring fast growing stocks with high insider ownership as your next discovery stop.

With shares already up solidly this year but still trading below analyst targets and some estimates of intrinsic value, is Hilton Grand Vacations quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative: 12.3% Undervalued

With Hilton Grand Vacations last closing at $45.34 against a narrative fair value of $51.70, the story leans toward upside driven by ambitious growth and margin assumptions.

Analysts expect earnings to reach $785.5 million (and earnings per share of $10.84) by about September 2028, up from $57.0 million today. The analysts are largely in agreement about this estimate.

Curious how earnings are projected to scale so dramatically while valuation multiples compress and share count shrinks. Want to see the full financial playbook behind that upside narrative.

Result: Fair Value of $51.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated bad debt risks and slow net owner growth could quickly challenge the bullish earnings ramp that underpins the current undervaluation story.

Find out about the key risks to this Hilton Grand Vacations narrative.

Another Way to Look at Valuation

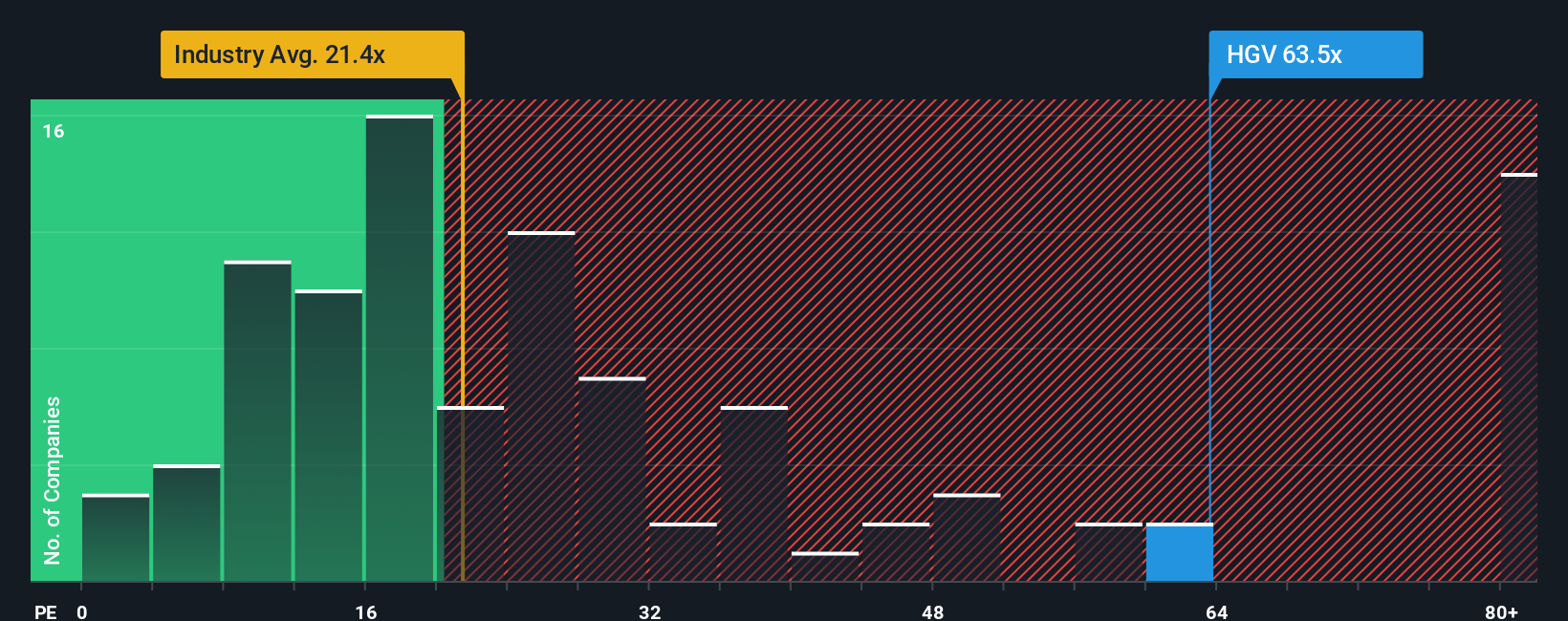

While our fair value narrative suggests Hilton Grand Vacations is 12.3 percent undervalued, a simple earnings based lens tells a different story. The stock trades on a steep 73.2 times earnings, far above both peers at 13 times and its own fair ratio of 69.5 times.

That gap implies the market is already paying up for execution perfection, leaving less room for error than the upside narrative implies. This raises the question of whether this is truly a margin of safety or a crowding risk in disguise.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hilton Grand Vacations Narrative

If this framing does not quite fit your view, or you prefer to dive into the numbers yourself, you can shape a custom narrative in minutes: Do it your way.

A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by scanning focused stock sets on Simply Wall Street, where data backed ideas are ready right now.

- Capture overlooked value with these 914 undervalued stocks based on cash flows to find companies trading below their cash flow potential before the crowd notices.

- Tap into structural growth by scanning these 29 healthcare AI stocks for businesses that are transforming patient care and medical decision making with intelligent tools.

- Supercharge your income strategy by targeting these 13 dividend stocks with yields > 3% that can support long term return goals with meaningful yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報