Should UNFI’s AI-Driven Ecommerce, Retail Media, and ESOP Share Sale Require Action From Investors?

- In December 2025, United Natural Foods, Inc. filed a US$49.70 million shelf registration for 1,500,000 common shares tied to an ESOP-related offering and, at its Investor Day, highlighted technology-enabled ecommerce growth, AI-driven supply chain tools, and resumed stock buybacks as it pursues low-single digit sales growth and low-double digit EBITDA growth through fiscal 2028.

- By pairing leaner distribution center operations with an expanded retail media network and advanced digital capabilities for independent grocers and brands, the company is aiming to strengthen its role as a technology-enabled partner while aligning governance and capital allocation decisions more closely with long-term shareholder interests.

- We’ll now examine how UNFI’s push into AI-enabled ecommerce and retail media at Investor Day may reshape its existing investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

United Natural Foods Investment Narrative Recap

To own UNFI, you need to believe it can turn a low-margin, scale distribution business into a more efficient, tech-enabled platform that steadily improves profitability. The ESOP-related shelf registration and Investor Day updates look incremental rather than thesis-changing, while the key short term catalyst remains execution on AI and lean operations, and the biggest risk is that ongoing IT and cybersecurity investment needs keep weighing on margins and cash flow.

The Investor Day focus on AI-enabled demand forecasting, digital tools for independents, and a growing retail media network ties directly into UNFI’s push to squeeze more profit from its existing footprint. If these initiatives lift efficiency and monetization without materially increasing capital strain, they could help offset pressures from large retailers’ bargaining power and support the company’s stated targets through fiscal 2028.

Yet, against these ambitions, the lingering threat of rising IT and cybersecurity spend is something investors should be aware of as...

Read the full narrative on United Natural Foods (it's free!)

United Natural Foods' narrative projects $32.5 billion revenue and $107.8 million earnings by 2028.

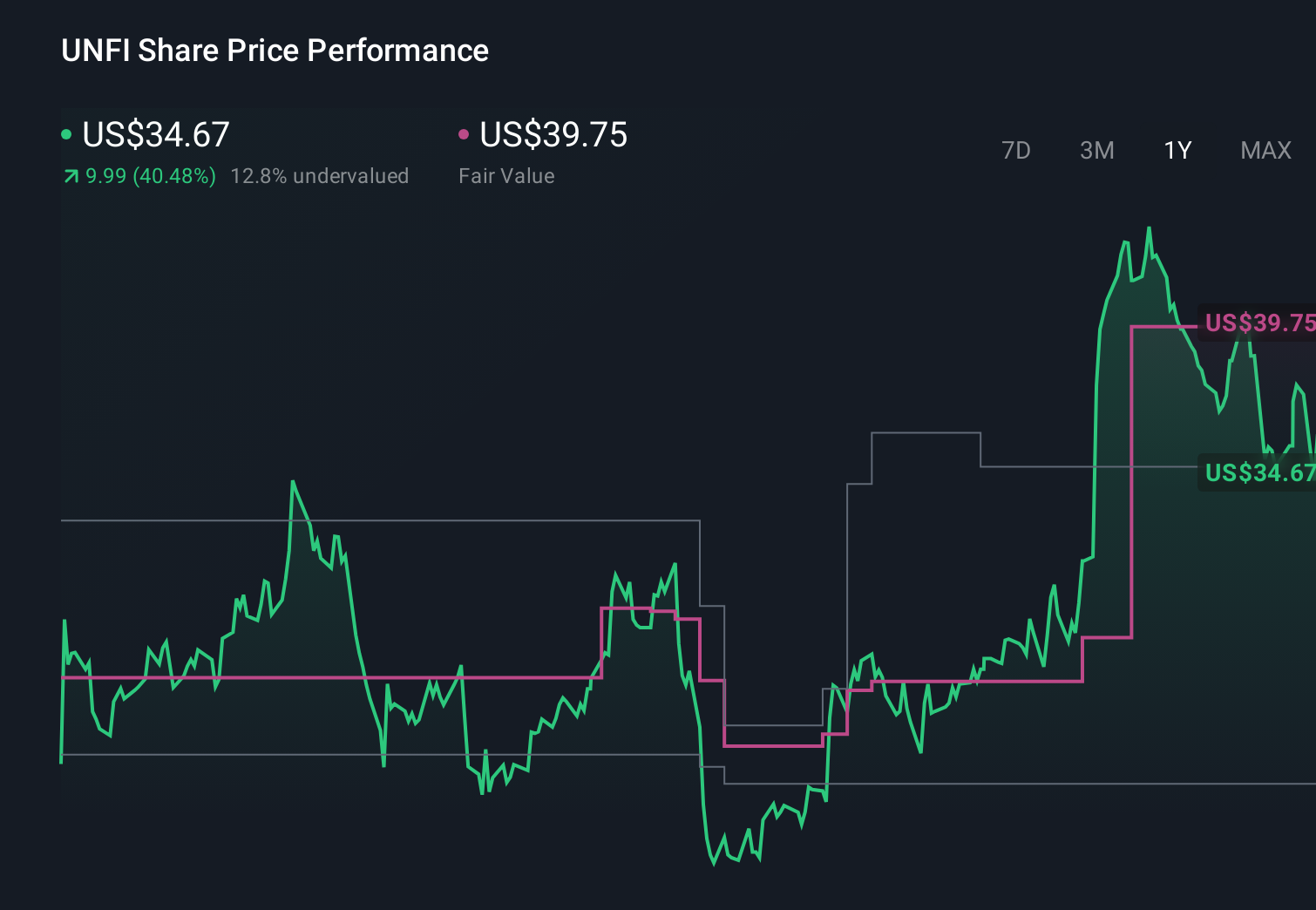

Uncover how United Natural Foods' forecasts yield a $39.75 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$5 to US$157.81, underscoring how far apart individual views can be. When you weigh those opinions against UNFI’s need for heavy ongoing IT and cybersecurity investment, it highlights why examining several different risk and reward angles can be so important.

Explore 5 other fair value estimates on United Natural Foods - why the stock might be worth over 4x more than the current price!

Build Your Own United Natural Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Natural Foods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Natural Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Natural Foods' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報