Hino Motors (TSE:7205) Valuation After Mitsubishi Fuso Integration Moves and SAWAFUJI Buyout Support

Hino Motors (TSE:7205) just made two strategic calls, selling majority stakes in six domestic sales subsidiaries and backing a SPARX led buyout of key supplier SAWAFUJI ELECTRIC, both tied to its Mitsubishi Fuso integration.

See our latest analysis for Hino Motors.

Despite the latest restructuring moves, Hino Motors’ recent momentum has been modest. The 90 day share price return is 4.32 percent, while the one year total shareholder return is a much weaker negative 19.55 percent. This signals that confidence is still rebuilding rather than fully turning.

If this shift in strategy has you thinking about where else capital could work harder in autos, it might be worth exploring other auto manufacturers as potential next ideas.

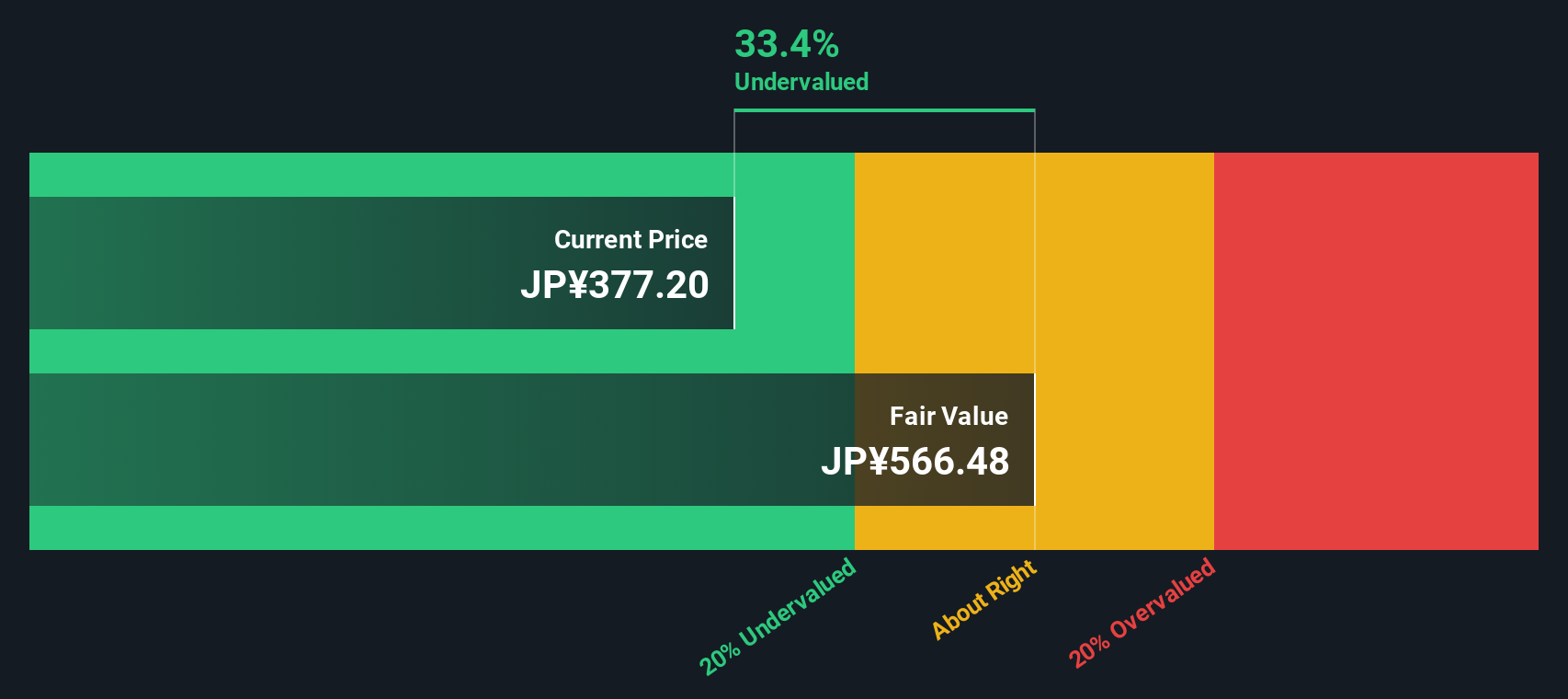

With the shares still down sharply over one and five years, yet trading at a hefty intrinsic discount, is Hino a mispriced restructuring story in early recovery, or are markets already baking in all the future integration upside?

Price-to-Earnings of 9.2x: Is it justified?

On a price-to-earnings basis, Hino Motors looks cheap at 9.2x earnings, particularly given the recent share price slide and ongoing restructuring headline noise.

The price-to-earnings multiple compares the current share price with the company’s earnings per share, and is a widely used gauge for mature industrials like Hino. For a business that has just swung back to profitability and is expected to grow earnings, a single digit multiple suggests the market remains cautious about how durable that recovery will be.

Compared to both the Japanese machinery industry average of 12.3x and a fair price-to-earnings ratio estimate of 22.5x, Hino’s 9.2x stands out as materially lower. That gap points to a valuation that could potentially rerate higher if markets gain confidence in the earnings outlook and integration story.

Explore the SWS fair ratio for Hino Motors

Result: Price-to-Earnings of 9.2x (UNDERVALUED)

However, lingering emission scandal fallout and potential bumps in the Mitsubishi Fuso integration could quickly erase any valuation upside that investors are banking on.

Find out about the key risks to this Hino Motors narrative.

Another Take on Value

Our DCF model presents a similar picture, with Hino’s shares at ¥391 sitting roughly 40 percent below an estimated fair value of about ¥654. That still suggests potential undervaluation, but it also raises the question: are markets underestimating the restructuring risks, or simply slow to reprice the recovery?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hino Motors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hino Motors Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes with Do it your way.

A great starting point for your Hino Motors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before markets move without you, put Simply Wall Street’s Screener to work and line up your next opportunities with clear data and focused strategies.

- Capitalize on mispriced potential by targeting these 914 undervalued stocks based on cash flows that may offer stronger long term upside than legacy restructurings.

- Ride structural growth trends by zeroing in on these 29 healthcare AI stocks transforming diagnostics, treatment pathways, and medical efficiency worldwide.

- Position ahead of the next digital wave by tracking these 79 cryptocurrency and blockchain stocks reshaping payments, infrastructure, and blockchain enabled services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報