Investors Continue Waiting On Sidelines For BoomBit S.A. (WSE:BBT)

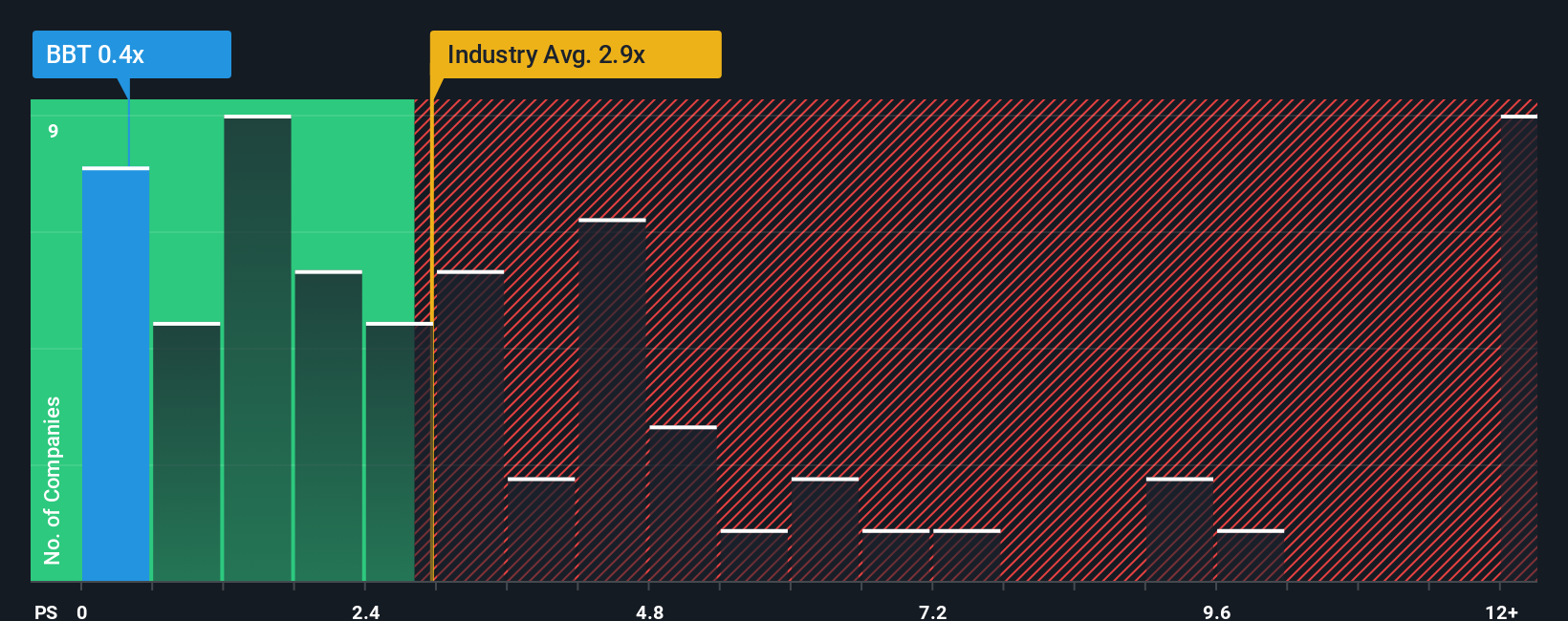

BoomBit S.A.'s (WSE:BBT) price-to-sales (or "P/S") ratio of 0.4x might make it look like a strong buy right now compared to the Entertainment industry in Poland, where around half of the companies have P/S ratios above 2.9x and even P/S above 5x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for BoomBit

How BoomBit Has Been Performing

As an illustration, revenue has deteriorated at BoomBit over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for BoomBit, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like BoomBit's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. As a result, revenue from three years ago have also fallen 31% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 10% either.

In light of this, the fact BoomBit's P/S sits below the majority of other companies is unanticipated but certainly not shocking. In general, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares heavily.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of BoomBit revealed its three-year contraction in revenue is impacting its P/S more than we would have predicted, given the industry is set to shrink at a similar rate. When we see a revenue growth decline that is on par with its peers, we can only assume potential risks are what might be causing the P/S ratio to be lower than average. One major risk is whether the company can maintain its 'middle of the road' medium-termrevenue growth under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for BoomBit (of which 1 is a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報