Does Sunrun’s Texas Virtual Power Plant Deal With NRG Change The Bull Case For RUN?

- Earlier this week, NRG Energy announced a multi-year partnership with Sunrun to expand solar-plus-storage adoption in Texas, aggregating home batteries into a virtual power plant that can supply dispatchable capacity to ERCOT during peak demand.

- The deal positions Sunrun as a key residential grid-services provider in Texas, earning fees for capacity aggregation while paying participating Reliant customers for sharing stored solar power.

- We’ll now explore how Sunrun’s role in building a virtual power plant with NRG could reshape its investment narrative and growth drivers.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

Sunrun Investment Narrative Recap

To own Sunrun, you need to believe residential solar-plus-storage and virtual power plants can scale fast enough to offset tax-credit expirations and funding constraints. The NRG partnership reinforces Sunrun’s grid-services catalyst in the near term, but it does not fundamentally reduce the biggest current risk around policy changes and the eventual 25D and 48E incentive roll-offs.

The most relevant recent announcement here is Sunrun’s new PG&E PeakShift virtual power plant program in California, which, like the NRG deal, monetizes aggregated home batteries as grid capacity. Together, these programs show how storage and grid services could become a more meaningful revenue stream just as traditional rooftop-solar demand faces potential pressure from shrinking tax incentives and higher customer acquisition costs.

Yet behind these growth opportunities, investors should also be aware of Sunrun’s heavy reliance on tax credits and external capital, because if those supports tighten or shift...

Read the full narrative on Sunrun (it's free!)

Sunrun's narrative projects $2.9 billion revenue and $465.4 million earnings by 2028. This requires 10.4% yearly revenue growth and an earnings increase of roughly $3.1 billion from about -$2.6 billion today.

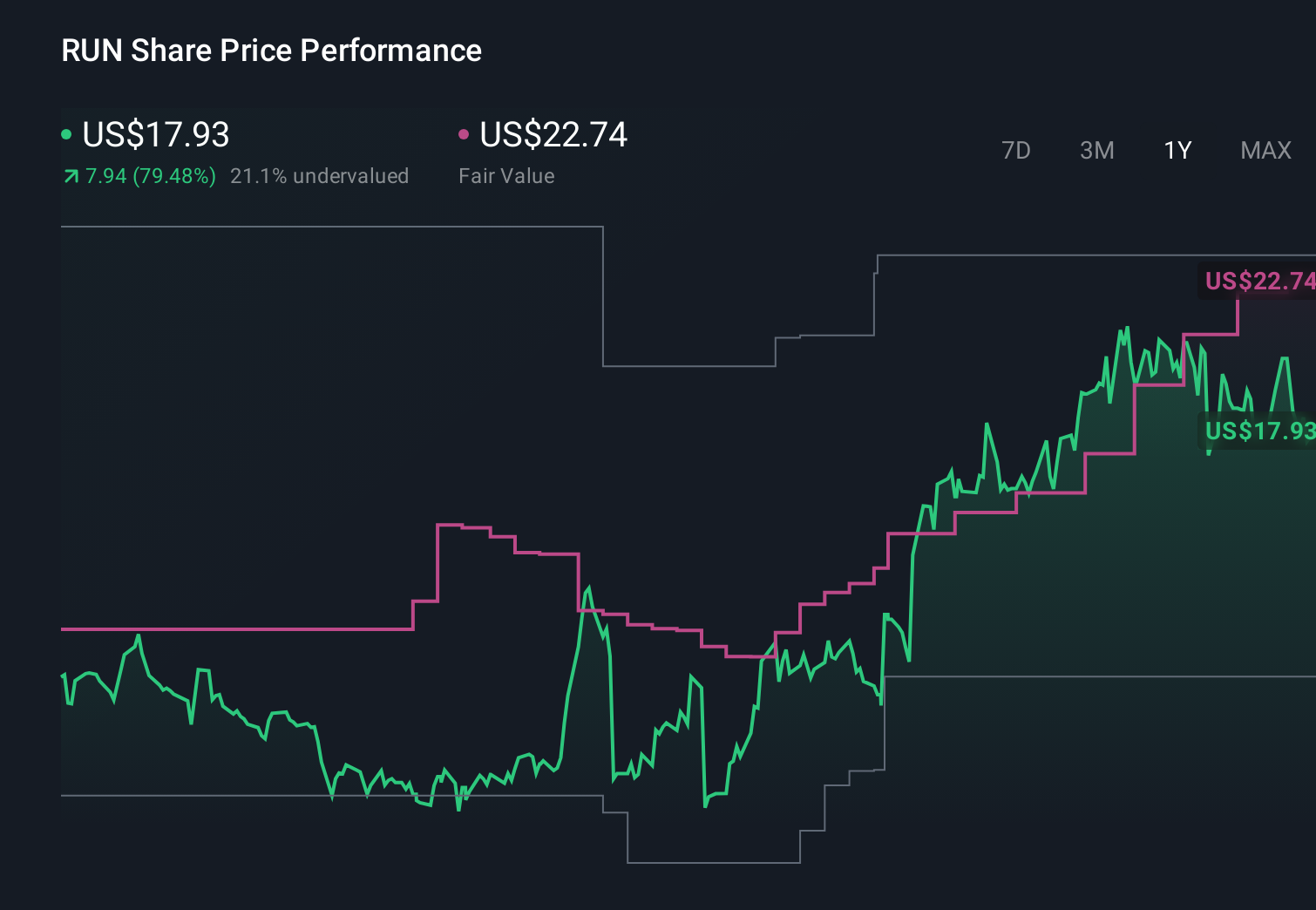

Uncover how Sunrun's forecasts yield a $22.74 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates for Sunrun range from US$13.14 to US$23.58, highlighting very different expectations. As you weigh those views, consider how much the emerging grid services business can realistically offset future incentive roll-offs and financing risks.

Explore 6 other fair value estimates on Sunrun - why the stock might be worth 28% less than the current price!

Build Your Own Sunrun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報