Insperity (NSP): Reassessing Valuation After Expanded Credit Facility and Extended Maturity Terms

Insperity (NSP) just gave itself more financial breathing room by amending its credit agreement to lift revolving capacity to $750 million, with room to reach $800 million, and pushing the maturity out to 2028.

See our latest analysis for Insperity.

The expanded credit line arrives after a volatile stretch, with a strong 1 month share price return of 21.84% coming off a much weaker year to date share price return of 48.87% and a 3 year total shareholder return of 63.24%. This suggests recent momentum is improving but long term holders are still deep in the red.

If Insperity’s shift toward greater financial flexibility has you thinking more broadly about opportunity, it might be worth exploring fast growing stocks with high insider ownership next.

With earnings rebounding but the share price still lagging its past highs, is Insperity now trading at a discount to its improving fundamentals, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 14.2% Undervalued

With Insperity last closing at $38.61 against a narrative fair value of $45, the current setup leans toward a recovery story that is still in progress.

The upcoming launch of Insperity HRScale, a joint solution with Workday, targets a broader and more lucrative mid market segment, leveraging both advanced HR technology and comprehensive services. This is expected to drive higher revenue growth and improved operating leverage as premium pricing and larger average client size become possible.

Want to see how modest revenue gains, a leaner margin structure, and a very specific future earnings multiple all combine into that valuation gap? The full narrative unpacks the math behind every assumption, and the pricing power story that ties it all together.

Result: Fair Value of $45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn healthcare cost inflation and a slower than expected HRScale ramp could easily squeeze margins and derail the anticipated earnings recovery.

Find out about the key risks to this Insperity narrative.

Another Way to Look at Value

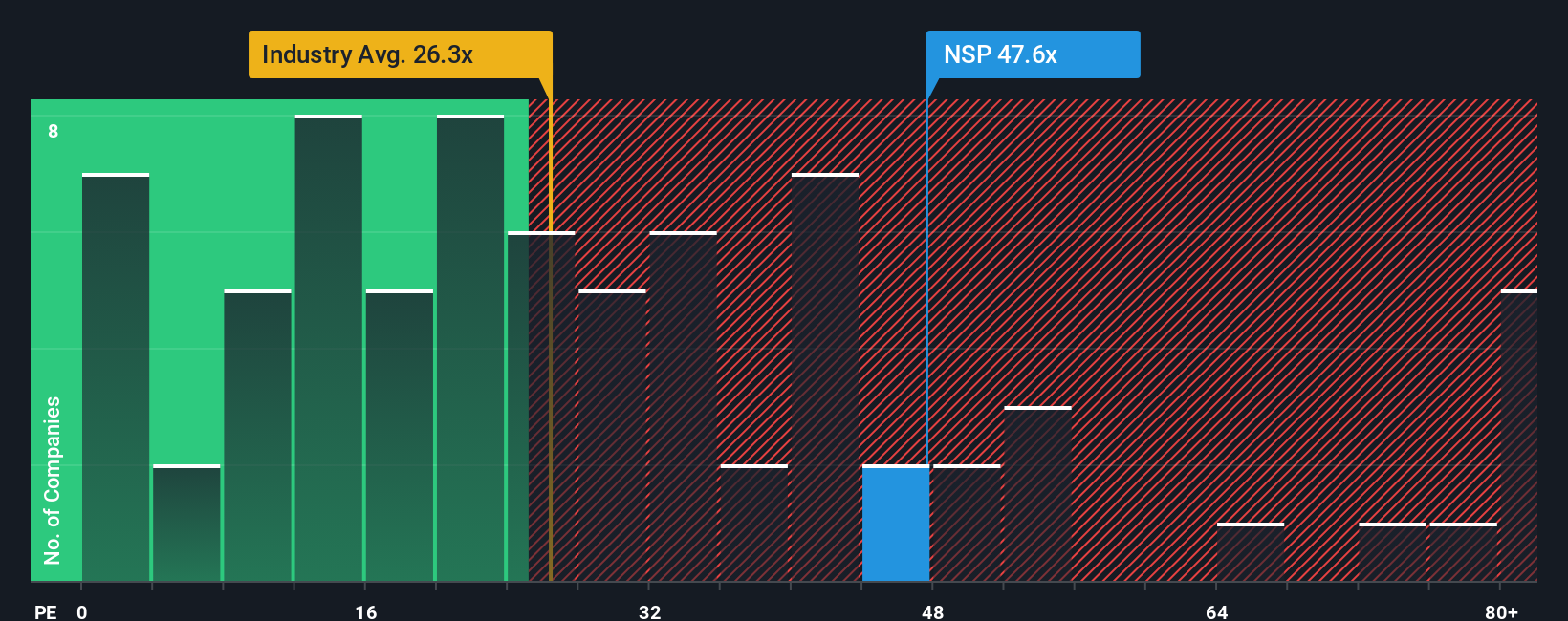

Step away from the narrative fair value and Insperity looks far less forgiving on traditional earnings metrics. Its price to earnings ratio of 85.6 times dwarfs the US Professional Services average of 24.2 times and even overshoots a fair ratio of 64.8 times, tilting the risk reward balance toward overvaluation if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insperity Narrative

If this perspective does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes, starting with Do it your way.

A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

If Insperity is only one piece of your strategy, use the Simply Wall St Screener now to pinpoint fresh, data driven opportunities before the crowd notices.

- Capture potential market mispricings by targeting these 914 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Position yourself ahead of transformative innovation by screening these 28 quantum computing stocks working on breakthroughs that could reshape computing and security.

- Strengthen your income strategy by focusing on these 13 dividend stocks with yields > 3% that can help support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報