Assessing Tokyotokeiba (TSE:9672)’s Valuation After Board Moves on Treasury Share Acquisition and Cancellation

TokyotokeibaLtd (TSE:9672) has called a December 19 board meeting to review acquiring, repurchasing via ToSTNeT-3, and canceling treasury shares, a move that directly targets capital structure and shareholder returns.

See our latest analysis for TokyotokeibaLtd.

The capital return plan lands after a strong run, with TokyotokeibaLtd posting a roughly 15% one month share price return and a robust 37% one year total shareholder return, suggesting positive momentum and rising confidence in its prospects.

If this kind of capital allocation story has your attention, it could be worth exploring fast growing stocks with high insider ownership as you look for the next set of compelling opportunities.

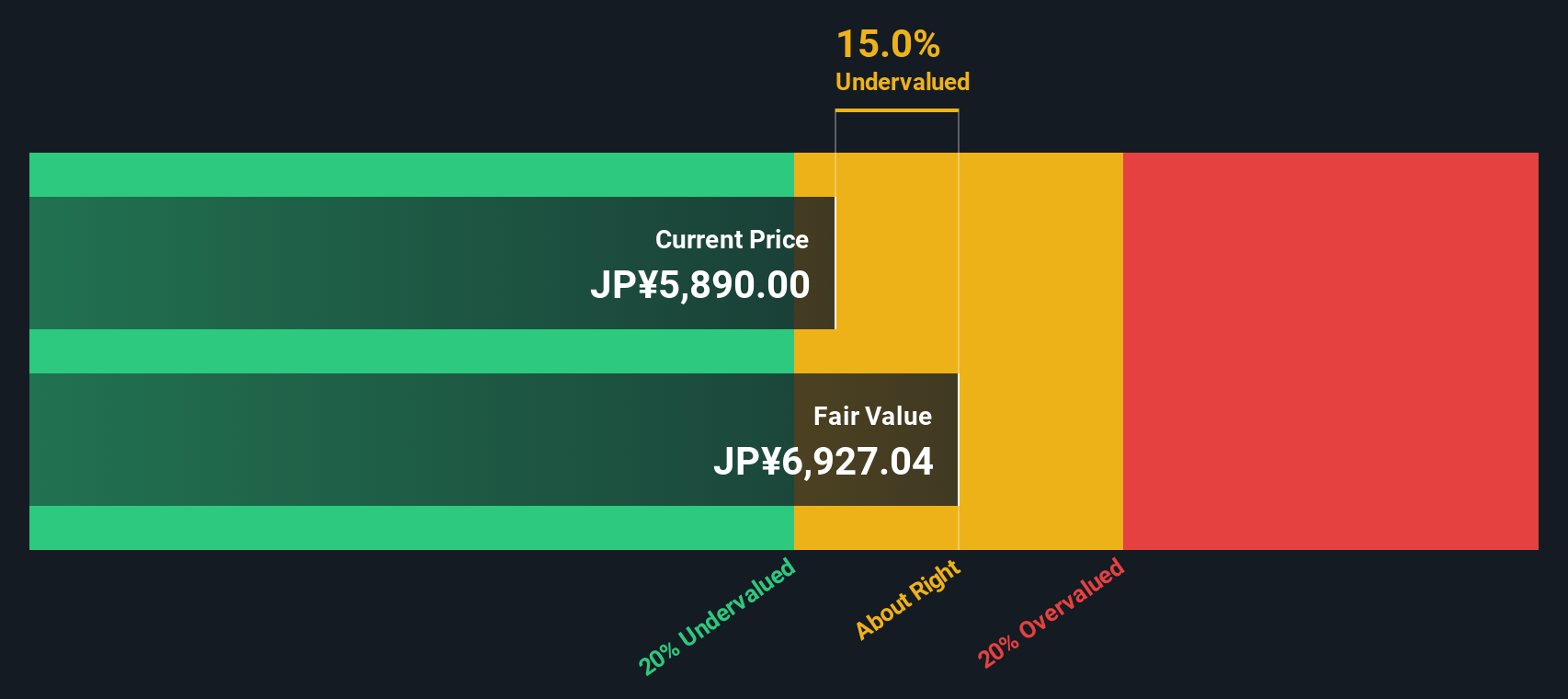

Yet with shares up strongly over one and three years, trading only slightly below analyst targets but at a notable intrinsic discount, is TokyotokeibaLtd still mispriced or is the market already factoring in future growth?

Price-to-Earnings of 15.8x: Is it justified?

On a last close of ¥5890, TokyotokeibaLtd trades on a 15.8x price to earnings ratio, pointing to a notable valuation gap versus peers.

The price to earnings multiple compares what investors pay for each unit of current earnings. It is a key lens for relatively mature, profitable companies like TokyotokeibaLtd.

Here, the company stands out as good value, with its 15.8x multiple sitting well below both the peer average of 25.5x and the wider JP Hospitality industry average of 23.1x. Regression based estimates suggest the market could ultimately move closer to a fair price to earnings level of 23.1x for this earnings profile.

This combination of a discounted current multiple and a higher estimated fair ratio indicates the market is pricing TokyotokeibaLtd more conservatively than its earnings quality and growth would typically command in this sector.

Explore the SWS fair ratio for TokyotokeibaLtd

Result: Price-to-Earnings of 15.8x (UNDERVALUED)

However, investors should watch for slowing tourism-linked demand or regulatory changes around racing facilities, which could pressure margins and undermine the current valuation case.

Find out about the key risks to this TokyotokeibaLtd narrative.

Another Angle on Value

Our DCF model paints a similar picture, suggesting fair value around ¥6967 versus the current ¥5890, implying TokyotokeibaLtd is still about 15% undervalued. If both earnings multiples and cash flow estimates point the same way, is the discount really about risk rather than mispricing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TokyotokeibaLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TokyotokeibaLtd Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding TokyotokeibaLtd.

Ready for your next investing move?

Stay ahead of the crowd and put your research to work by hunting for fresh opportunities on the Simply Wall St screener before everyone else does.

- Capture potential multi baggers early by zeroing in on these 3624 penny stocks with strong financials that already boast solid financial foundations and room to grow.

- Ride structural growth in automation, data, and machine learning by filtering for these 25 AI penny stocks that could shape the next decade of innovation.

- Lock in compelling entry points by targeting these 914 undervalued stocks based on cash flows where strong cash flow analysis suggests the market has not fully appreciated them yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報