Revisiting BioMarin (BMRN) Valuation After Its Recent Share Price Rebound

BioMarin Pharmaceutical (BMRN) has quietly staged a double digit rebound over the past month, even though the longer term chart still shows steep drawdowns that left many growth investors underwater.

See our latest analysis for BioMarin Pharmaceutical.

At a share price of $61.15, BioMarin’s sharp 1 day and 1 month share price returns contrast with a still negative year to date move and a three year total shareholder return that remains deeply underwater. This suggests sentiment is improving, but long term holders are only starting to see the pressure ease.

If BioMarin’s rebound has you rethinking the wider sector, this could be a good moment to scan for opportunities across healthcare stocks that match your risk and growth preferences.

With BioMarin trading at a hefty discount to analyst targets despite solid revenue and earnings growth, investors face a key question: is this a mispriced rare disease leader, or is the market already baking in future gains?

Most Popular Narrative: 30.9% Undervalued

Compared to BioMarin Pharmaceutical’s last close at $61.15, the most widely followed narrative sees fair value materially higher, implying substantial upside if its assumptions play out.

Company's operational leverage and disciplined cost management as new products move from R&D to commercial stage combined with efforts to improve patient adherence and maximize market penetration are likely to support margin expansion and drive earnings growth.

Want to see what powers that upside case? The narrative leans on accelerating earnings, a richer margin profile, and a future earnings multiple usually reserved for sector leaders. Curious which specific growth and profitability bets need to land for that valuation to hold?

Result: Fair Value of $88.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, downside risks remain, including intensifying competition around Voxzogo, as well as higher R&D and SG&A spending that could pressure margins and earnings.

Find out about the key risks to this BioMarin Pharmaceutical narrative.

Another Angle on Valuation

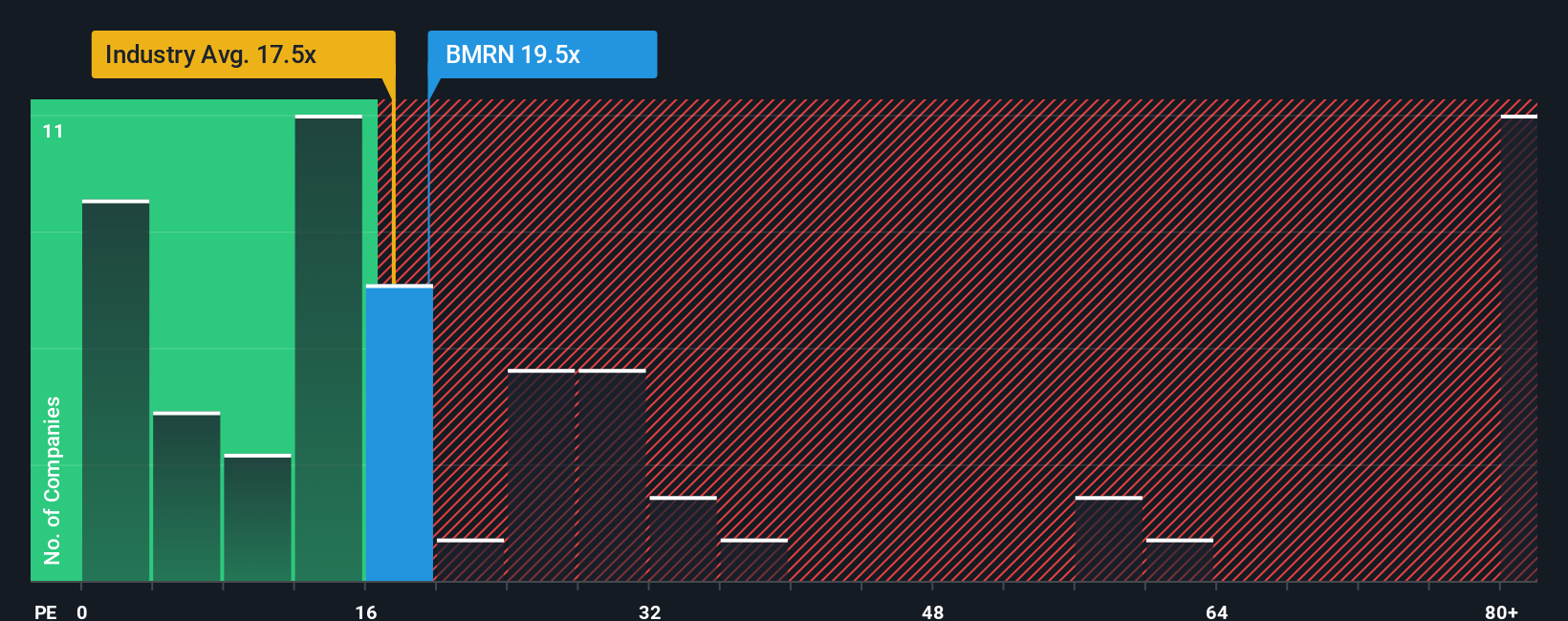

Even with the 30.9 percent upside implied by the narrative fair value, BioMarin’s 22.6 times earnings multiple sits above both the US Biotechs industry at 20.7 times and peers at 20.4 times. The fair ratio points closer to 24.6 times. However, does paying a premium today leave less margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioMarin Pharmaceutical Narrative

If you are not fully convinced by this view or prefer digging into the numbers yourself, you can craft a fresh perspective in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BioMarin Pharmaceutical.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful screener to work, or you risk missing focused opportunities that could reshape your portfolio’s next leg higher.

- Capture potential bargains by targeting cash flow strength and valuation support with these 914 undervalued stocks based on cash flows.

- Position for structural growth by zeroing in on innovation themes through these 25 AI penny stocks.

- Strengthen your income stream by focusing on reliable payouts using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報