Williams-Sonoma (WSM) Dividend Affirmation Prompts Fresh Look at Valuation and Future Earnings Power

Williams-Sonoma (WSM) just gave income-focused investors something to smile about, with its board affirming a quarterly cash dividend of $0.66 per share, a move that underscores management’s confidence in its future earnings power.

See our latest analysis for Williams-Sonoma.

The dividend news comes after a solid run, with a roughly 9 percent 1 month share price return and a powerful 3 year total shareholder return of about 236 percent, suggesting momentum is still broadly intact.

If that income plus growth mix appeals to you, it could be worth exploring fast growing stocks with high insider ownership as another way to spot compelling ideas before they are widely noticed.

Yet with the stock hovering just below analyst price targets after a strong multi year run, investors now face a key question: is Williams Sonoma still trading at a discount, or is future growth already fully priced in?

Most Popular Narrative Narrative: 3.7% Undervalued

With the narrative fair value sitting modestly above the last close, the current share price implies only a slim cushion for execution risk.

Supply chain optimization, including AI-driven forecasting, multi-sourcing strategies, and domestic manufacturing investments, is improving cost efficiency and order fulfillment, mitigating margin pressures from tariffs and global volatility and protecting net margins. Persistent focus on sustainability, quality, and design authority (including expansion of sustainable product lines and enhanced product transparency) is strengthening brand differentiation and meeting evolving consumer expectations, supporting both customer loyalty and long-term gross margin stability.

Curious how steady but unspectacular revenue growth, resilient margins, and a richer future earnings multiple can still support upside from here? The narrative’s detailed forecasts spell it out.

Result: Fair Value of $198.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff volatility and a weaker housing backdrop could squeeze margins and dampen demand, which could quickly test the assumptions behind that modest undervaluation.

Find out about the key risks to this Williams-Sonoma narrative.

Another Lens on Valuation

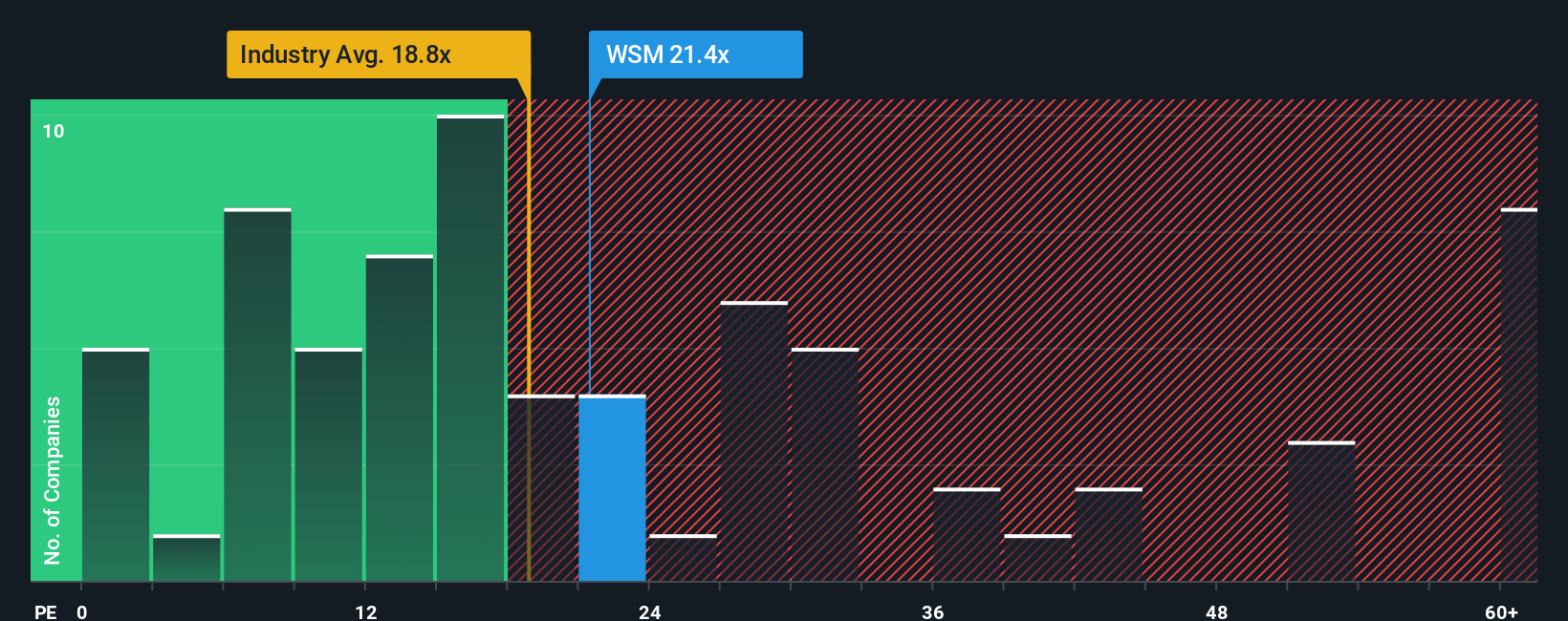

On a simple earnings multiple, Williams Sonoma screens as expensive, with a price to earnings ratio of about 20 times versus a fair ratio of 17 times. That premium narrows somewhat against peers on roughly 25 times, but it still leaves less room for disappointment if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams-Sonoma Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Williams-Sonoma.

Ready to uncover your next opportunity?

Do not stop at one strong story when you can quickly scan fresh opportunities on Simply Wall Street’s powerful screener and position yourself ahead of the crowd.

- Capitalize on mispriced quality by targeting these 914 undervalued stocks based on cash flows that pair solid fundamentals with meaningful upside potential based on cash flow strength.

- Ride structural growth trends by focusing on these 25 AI penny stocks positioned at the intersection of intelligent software, automation, and real world adoption.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can potentially boost portfolio yield without sacrificing balance sheet resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報