Adidas (XTRA:ADS) Valuation Check After Its Attention-Grabbing Terrex Yurt Campaign in Kazakhstan

The buzz around adidas (XTRA:ADS) this week is not from a new shoe drop but from its Adidas Terrex campaign, which now features a fully branded yurt in Kazakhstan as a holiday-season marketing stage.

See our latest analysis for adidas.

That playful Terrex yurt push lands at a tricky moment for investors, with adidas shares now around $165.1 after a solid 1 month share price return but a sharply negative year to date share price return, while the 3 year total shareholder return is still comfortably positive.

If the Terrex campaign has you thinking about where growth and brand power might show up next, it could be worth scanning auto manufacturers for other consumer facing names reshaping their categories.

With shares down nearly 30% this year but trading at a hefty discount to analyst targets, investors face a pivotal question: is adidas quietly undervalued here, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 25.7% Undervalued

With the most followed narrative placing adidas fair value well above the recent €165.1 close, the gap hinges on how far earnings and margins can stretch.

The ongoing shift to direct to consumer e commerce and retail channels (+9% e commerce, +9% brick & mortar, continued D2C expansion) is improving adidas' control over branding, driving higher margin sales, and strengthening customer data utilization, which will gradually enhance net and gross margins as the channel mix evolves.

Want to see what these higher margin assumptions really imply? The narrative quietly bakes in bold revenue growth, fatter profits, and a future earnings multiple that assumes adidas keeps outrunning the wider market.

Result: Fair Value of $222.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could be challenged if tariff driven cost pressures bite harder than expected, or if intensifying competition erodes pricing power.

Find out about the key risks to this adidas narrative.

Another View: Valuation Through Earnings

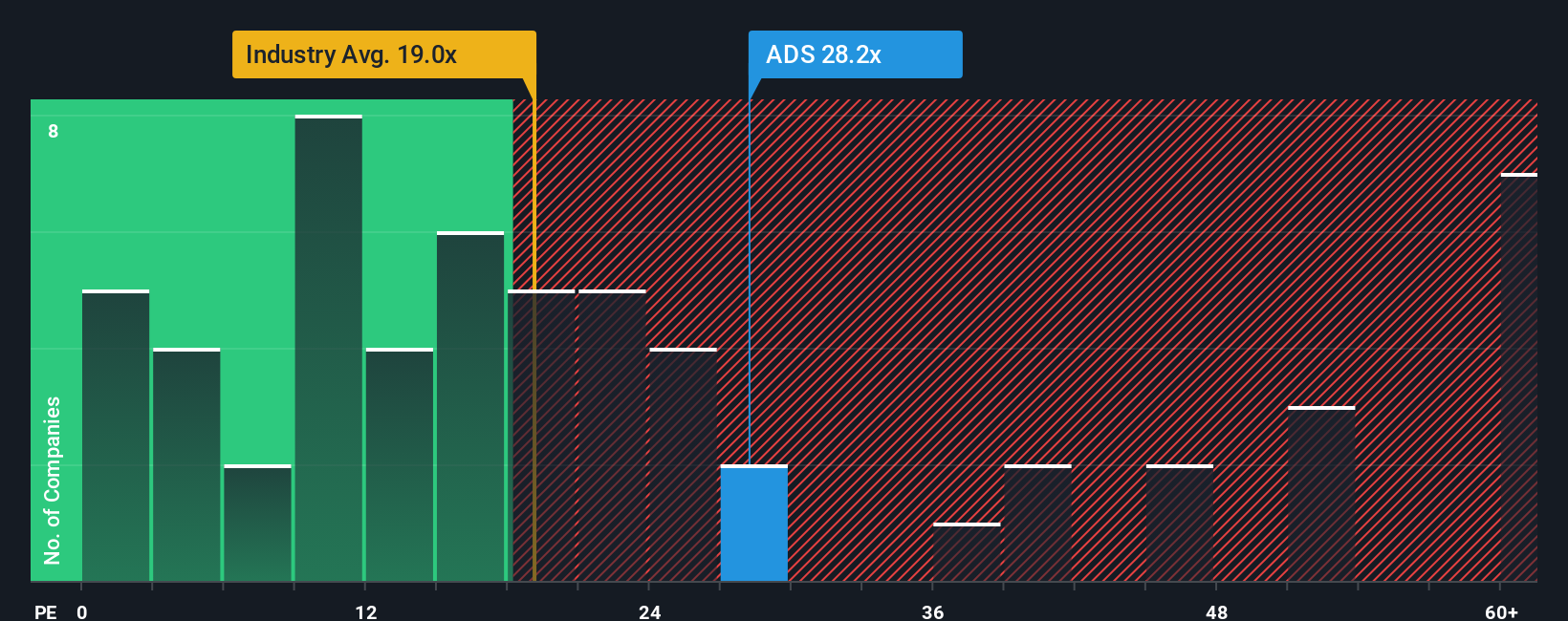

On earnings, the picture looks less generous. Adidas trades on about 24.3 times profit, richer than both its 22.4 times fair ratio and the 20.1 times European luxury average, even if it is cheaper than some peers on 33.2 times. Is the brand premium worth that valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own adidas Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a fresh view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding adidas.

Ready for more investment ideas?

Do not stop at adidas; sharpen your edge by using the Simply Wall St Screener to uncover fresh opportunities that match how you like to invest.

- Capture potential bargain opportunities by targeting quality companies trading below their estimated worth through these 914 undervalued stocks based on cash flows and position yourself ahead of a possible rerating.

- Ride structural shifts in healthcare by focusing on innovators using machine learning and data to transform patient outcomes with these 29 healthcare AI stocks before the crowd fully catches on.

- Tap into asymmetric upside in the digital asset ecosystem by scanning these 79 cryptocurrency and blockchain stocks for businesses building real value around blockchain infrastructure and payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報