Assessing AAON (AAON) Valuation After Insider Buying, Leadership Changes and Upgraded Guidance

AAON (AAON) is back on investors radar after Executive Vice President Stephen E. Wakefield bought more than 6,000 shares, just as the company lifted guidance on the back of strong data center driven results.

See our latest analysis for AAON.

Despite strong third quarter results and upgraded guidance, AAON’s share price has slid to about $75. This has led to a steep year to date share price return decline, but the company still has a solid multi year total shareholder return, suggesting momentum has cooled even as insiders lean into the long term story.

If this kind of insider conviction has your attention, it could be a good time to scout other industrial names through fast growing stocks with high insider ownership.

With revenue and earnings still climbing, the stock down nearly 40 percent from its highs, and analysts’ targets sitting far above today’s price, is AAON quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 34.6% Undervalued

With AAON last closing at $75.34 versus a narrative fair value of $115.25, the gap points to a rich long term growth play in progress.

Ongoing investments in new manufacturing capacity and automation (e.g., the Memphis facility) are expected to nearly double BasX capacity by year end, removing current operational constraints and shifting from near term cost drag to profit contribution by 2026 as orders ramp, supporting long term operating leverage.

Curious how this capacity surge turns into value on paper? The narrative leans on aggressive revenue scaling, fatter margins, and a premium future earnings multiple. Want the full playbook behind that fair value math?

Result: Fair Value of $115.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on AAON executing cleanly through its complex ERP rollout and avoiding a sharper than expected slowdown in data center spending.Find out about the key risks to this AAON narrative.

Another Lens on AAON’s Value

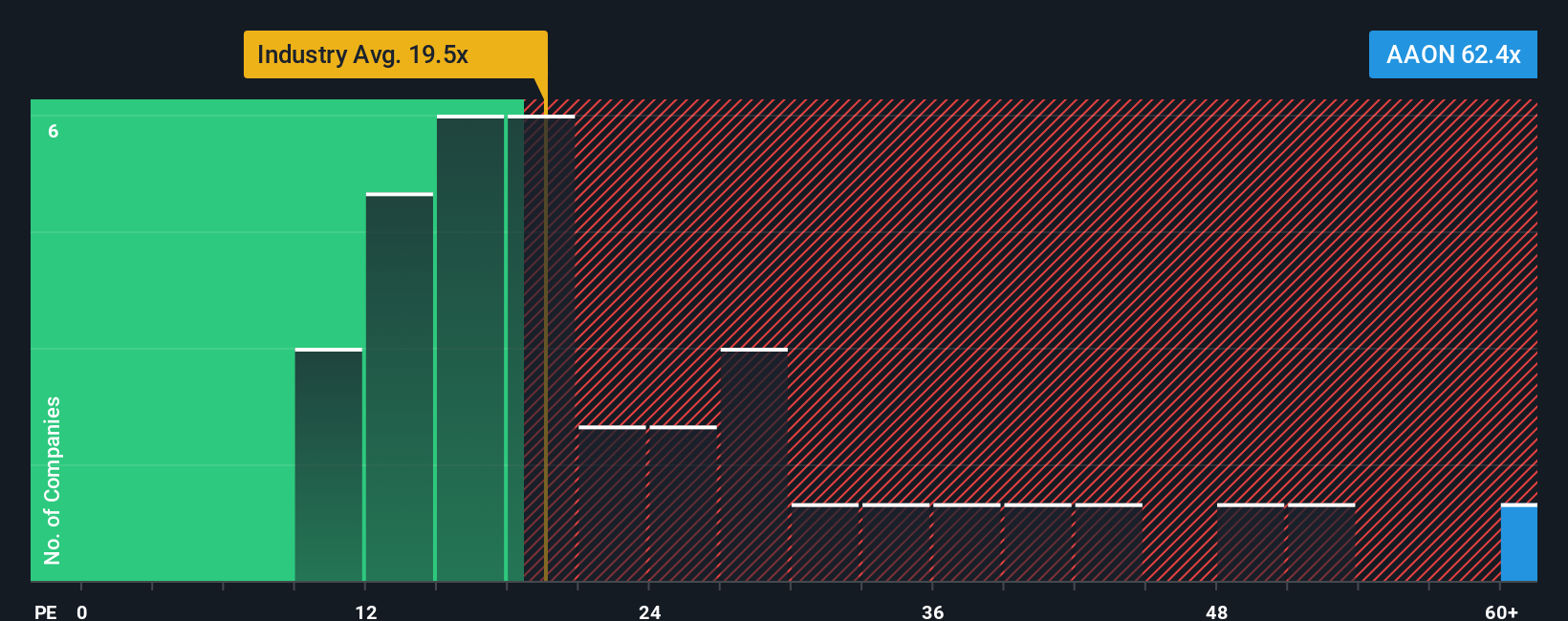

While the fair value narrative leans bullish, the market is telling a different story. At a price to earnings ratio of 61.3 times, AAON trades well above the US Building industry at 19.7 times, its peers at 26.9 times, and even its own 45.2 times fair ratio. This raises the question of how much execution risk is already baked in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAON Narrative

If you see the numbers differently or want to dig into the drivers yourself, you can build a full custom view in minutes with Do it your way.

A great starting point for your AAON research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity with a curated set of ideas built from our smartest screeners on Simply Wall Street.

- Capture early stage growth by reviewing these 3624 penny stocks with strong financials that pair high upside potential with stronger balance sheets than typical speculative names.

- Target structural themes in automation and machine learning through these 25 AI penny stocks, where revenue momentum and innovation are already reshaping earnings trajectories.

- Secure potential value opportunities by scanning these 914 undervalued stocks based on cash flows, focusing on companies whose cash flows may justify far higher prices than the market currently recognizes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報