Taking Stock of Tandem Diabetes Care (TNDM) After t:slim App Launch and Rising Growth Optimism

Tandem Diabetes Care (TNDM) just rolled out its t:slim mobile app in Canada for both Android and iOS users, extending smartphone control to t:slim X2 pump wearers and adding another catalyst to an already improving story.

See our latest analysis for Tandem Diabetes Care.

The Canadian launch of the t:slim app slots into a broader rebound story, with a 30 day share price return of 17.77 percent and a powerful 90 day share price return of 75.58 percent, even though the one year total shareholder return is still down sharply.

If this kind of health tech momentum interests you, it could be worth scanning other promising names through our dedicated healthcare stocks and seeing what else matches your criteria.

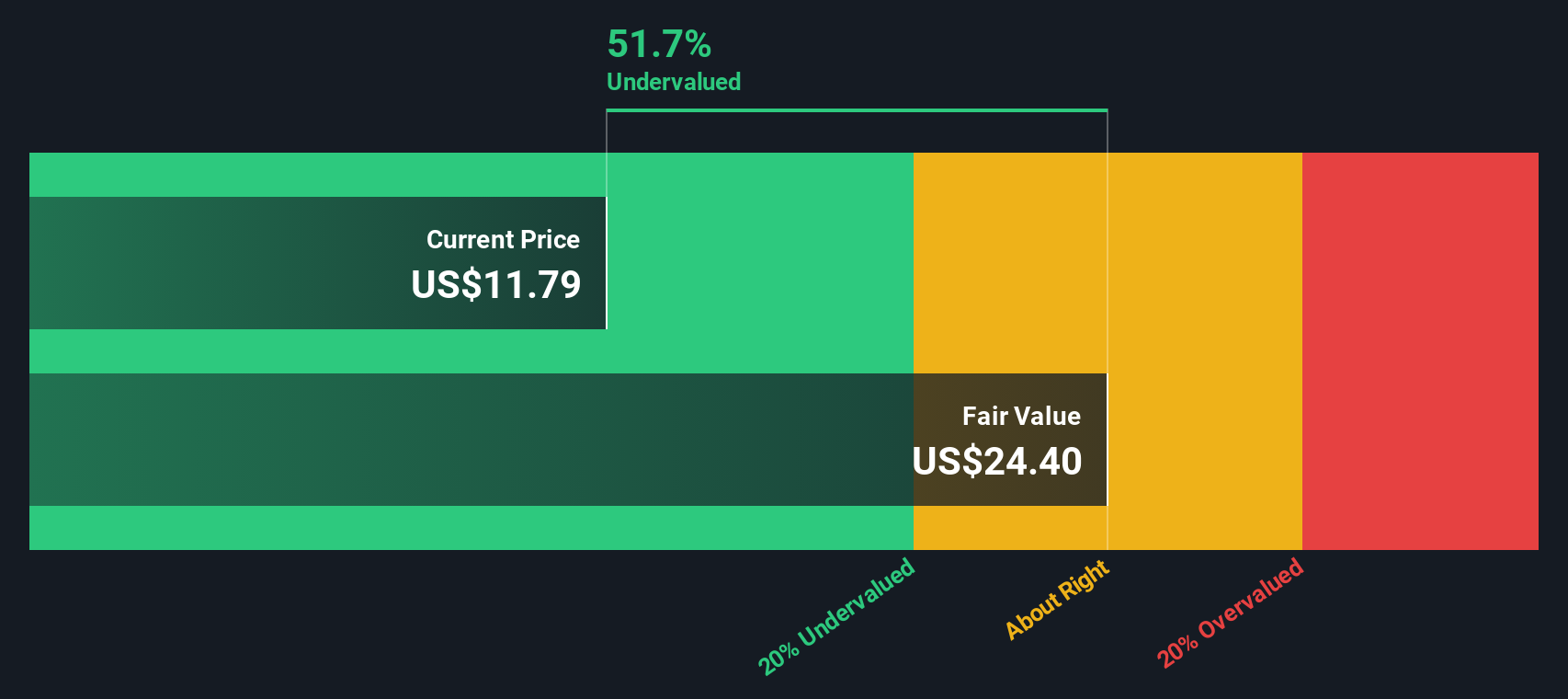

Yet despite the sharp rebound, the stock still trades only modestly below analyst targets and near our estimate of fair value. This raises the key question: Is Tandem still a misunderstood comeback story, or is future growth already priced in?

Most Popular Narrative Narrative: 6.9% Overvalued

With Tandem Diabetes Care closing at $22.07, the most followed narrative pegs fair value slightly lower at about $20.64, implying a premium for execution.

The analysts have a consensus price target of $22.619 for Tandem Diabetes Care based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $11.0.

Want to see what kind of revenue runway, margin lift, and future profit multiple are baked into this premium tag? The narrative spells out a surprisingly aggressive profitability path and a valuation bar usually reserved for market darlings. Curious which specific financial levers need to fire perfectly to make it all add up?

Result: Fair Value of $20.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competitive pressure and slower than expected renewals could quickly challenge those upbeat growth assumptions and force a rethink on valuation.

Find out about the key risks to this Tandem Diabetes Care narrative.

Another Angle on Value

While the narrative lens sees Tandem as about 6.9 percent overvalued, our DCF model paints a softer picture, with the shares trading roughly 1.5 percent below fair value at about $22.4. If cash flows say one thing and sentiment another, which signal do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tandem Diabetes Care Narrative

If you see Tandem differently, or prefer to stress test the numbers yourself, you can spin up a fresh take in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tandem Diabetes Care.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning focused stock lists on Simply Wall St that match specific return, growth, and innovation themes.

- Capture potential multi baggers early by reviewing these 3623 penny stocks with strong financials that already show convincing fundamentals instead of mere hype.

- Position your portfolio at the frontier of automation and machine learning with these 25 AI penny stocks shaped by powerful technological tailwinds.

- Boost your income potential and stabilize returns by targeting companies in these 13 dividend stocks with yields > 3% offering yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報