Mitsubishi Electric (TSE:6503) Valuation After New AI Drunk-Driving Detection Tech Gains Investor Attention

Mitsubishi Electric (TSE:6503) just unveiled AI powered in vehicle tech designed to spot driver intoxication from pulse and driving behavior, a move that puts its automotive safety ambitions firmly in the spotlight.

See our latest analysis for Mitsubishi Electric.

The announcement caps a busy run of AI and sustainability updates, and the market seems to like the direction, with a roughly 71 percent year to date share price return and a near 80 percent one year total shareholder return suggesting momentum is still building rather than fading.

If Mitsubishi Electric's move into safer, smarter vehicles has your attention, it could be worth exploring other innovators among auto manufacturers via auto manufacturers.

With shares already up more than 70 percent this year and trading above analyst targets, the key question now is whether Mitsubishi Electric still offers upside for new investors or if the market has already priced in years of growth.

Most Popular Narrative Narrative: 9.2% Overvalued

With Mitsubishi Electric last closing at ¥4,596 against a narrative fair value of ¥4,209.6, the story leans toward optimism about sustained earnings power.

Continued R&D and cost optimization, reflected in improved cost of sales ratio and operating margins this quarter, position the company to defend margins and introduce new, higher margin products in edge computing, AI, and automation impacting future margin improvement and earnings consistency.

Curious how steady, not explosive, growth can still support a premium price tag? The narrative weaves together modest expansion, firmer margins, and a richer future earnings multiple into one tight valuation case.

Result: Fair Value of ¥4,209.6 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster-than-expected shifts toward software-centric automation or intensifying low-cost Asian competition could pressure margins and challenge the premium valuation narrative.

Find out about the key risks to this Mitsubishi Electric narrative.

Another Lens on Value

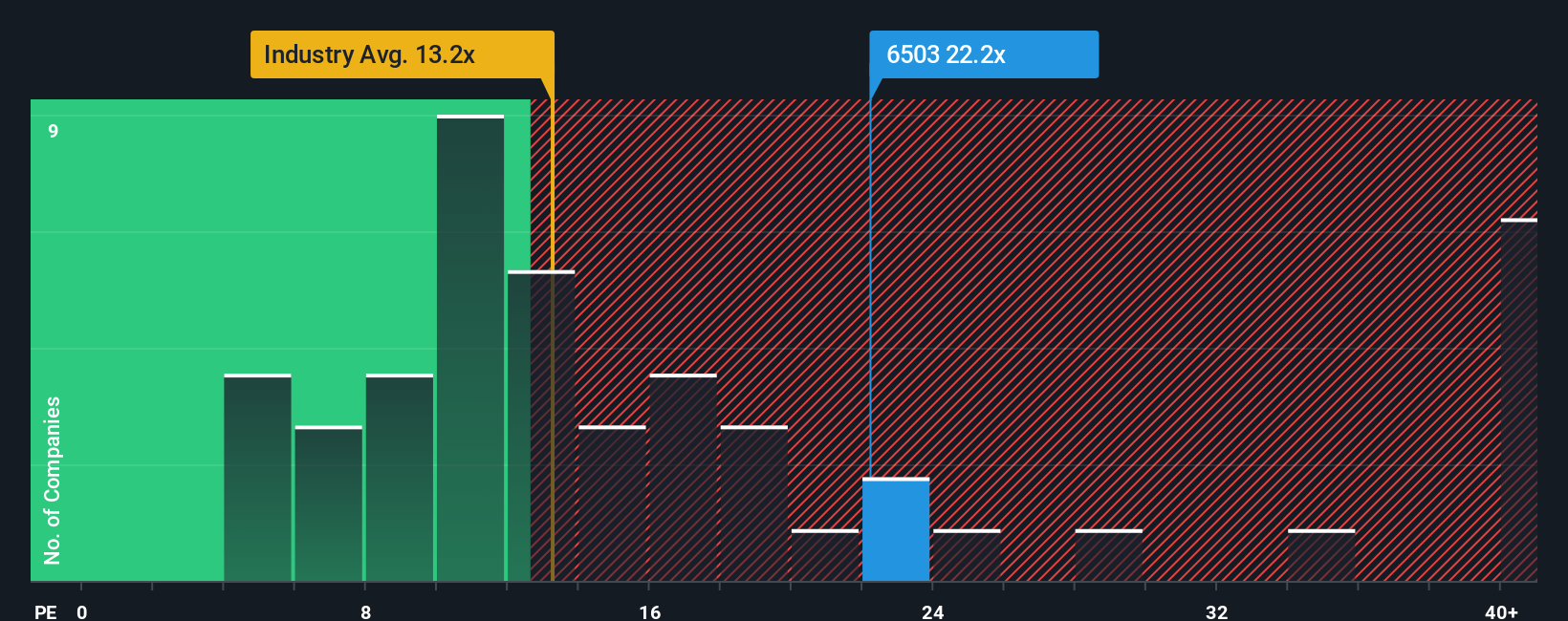

Looked at through earnings ratios, Mitsubishi Electric trades at 23.8 times earnings, richer than both the Electrical industry at 13.9 times and close peers at 22.2 times, yet below a fair ratio of 26.3 times. That mix of cushion and premium leaves a narrow margin for error, or a narrow window of opportunity, depending on how you see the next few years playing out.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Electric Narrative

If this perspective does not fully resonate, or you simply prefer digging into the numbers yourself, you can craft a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mitsubishi Electric.

Looking for more investment ideas?

Before you move on, consider scanning a few targeted stock ideas that could sharpen your portfolio and broaden your opportunity set.

- Target steady income by reviewing these 13 dividend stocks with yields > 3% that can help anchor your returns even when markets turn choppy.

- Explore developments in healthcare technology by assessing these 29 healthcare AI stocks focused on diagnostics, treatment, and patient outcomes with intelligent tools.

- Review emerging opportunities in financial innovation by evaluating these 79 cryptocurrency and blockchain stocks involved in blockchain, payments, and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報