Dropbox (DBX) Valuation Check After Recent Share Price Underperformance

Dropbox (DBX) has quietly slipped about 6 % over the past 3 months, even as the broader tech space marched higher. That underperformance is exactly what makes the stock interesting right now.

See our latest analysis for Dropbox.

Over the past year, Dropbox’s share price return has been slightly negative, but a solid three year total shareholder return above 25 % hints that recent weakness reflects shifting sentiment more than a broken long term story.

If Dropbox’s recent drift has you rethinking your tech exposure, it is a good moment to explore other high growth tech and AI stocks that might better match your conviction and risk appetite.

Now, with growth slowing, profits steady, and the share price lagging peers, investors face a crucial question: Is Dropbox quietly trading below its intrinsic value, or is the market already pricing in all future upside?

Most Popular Narrative: 2% Overvalued

With the most followed narrative pointing to a fair value slightly below the last close, the gap between market optimism and modeled outcomes looks narrow but telling.

The analysts have a consensus price target of $28.125 for Dropbox based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $20.0.

Want to see what bridges today’s modest growth outlook with tomorrow’s earnings power? The narrative leans on firm margins, disciplined buybacks, and a future multiple that undercuts many software peers. Curious how those moving parts combine into that tightly clustered fair value band?

Result: Fair Value of $28.13 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that outlook could be upended if revenue contraction persists and competitive pressure from Microsoft and Google accelerates, eroding pricing power and user retention.

Find out about the key risks to this Dropbox narrative.

Another View: Cheap on Earnings

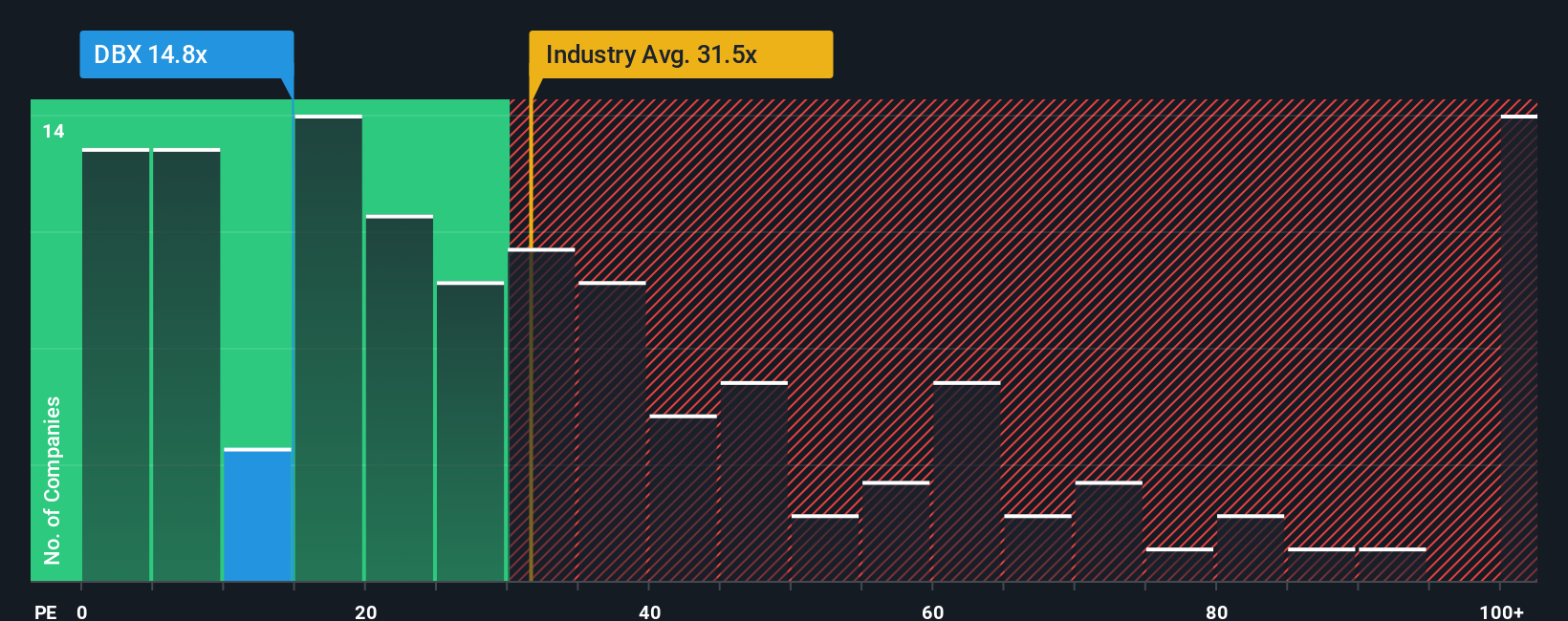

While the narrative model calls Dropbox slightly overvalued, its 14.8x earnings multiple looks thrifty against US software peers at 31.2x and a fair ratio of 24.4x. If sentiment normalizes toward that fair ratio, are investors being paid to wait?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dropbox Narrative

If this takeaway does not quite fit your thesis, or you would rather interrogate the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall Street’s Screener to work and uncover opportunities you would regret missing when the next wave of market winners emerges.

- Target income stability by reviewing these 13 dividend stocks with yields > 3% offering attractive yields that can strengthen your portfolio’s cash flow resilience over time.

- Spot potential future leaders by scanning these 25 AI penny stocks positioned at the forefront of automation, data intelligence, and next generation software solutions.

- Seize valuation mispricings through these 913 undervalued stocks based on cash flows that may be trading below intrinsic worth based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報