What KGW Group Berhad's (KLSE:KGW) 27% Share Price Gain Is Not Telling You

KGW Group Berhad (KLSE:KGW) shareholders have had their patience rewarded with a 27% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 5.6% isn't as impressive.

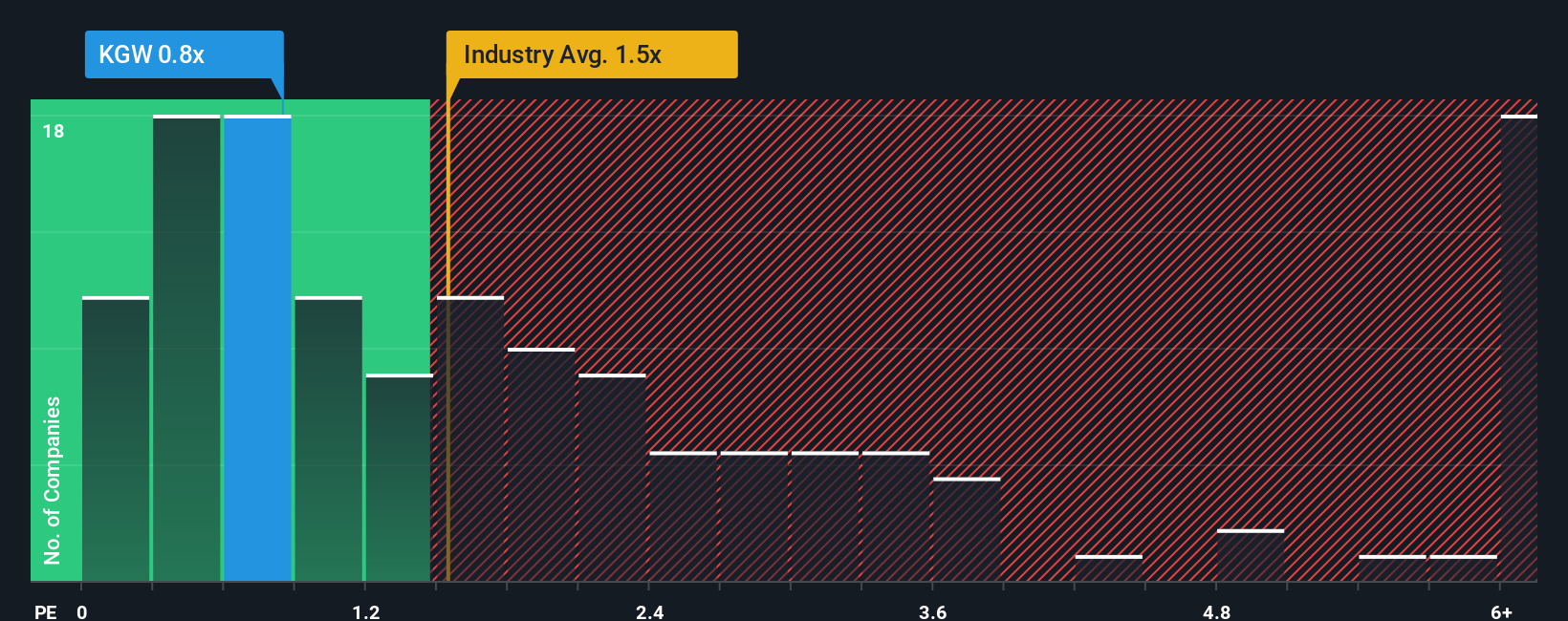

In spite of the firm bounce in price, it's still not a stretch to say that KGW Group Berhad's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Shipping industry in Malaysia, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for KGW Group Berhad

How Has KGW Group Berhad Performed Recently?

For instance, KGW Group Berhad's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on KGW Group Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

KGW Group Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. The last three years don't look nice either as the company has shrunk revenue by 58% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to decline by 3.7% over the next year, or less than the company's recent medium-term annualised revenue decline.

With this information, it's perhaps strange that KGW Group Berhad is trading at a fairly similar P/S in comparison. In general, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

KGW Group Berhad appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that KGW Group Berhad currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for KGW Group Berhad (2 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on KGW Group Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報