Some Scholar Education Group (HKG:1769) Shareholders Look For Exit As Shares Take 26% Pounding

Scholar Education Group (HKG:1769) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

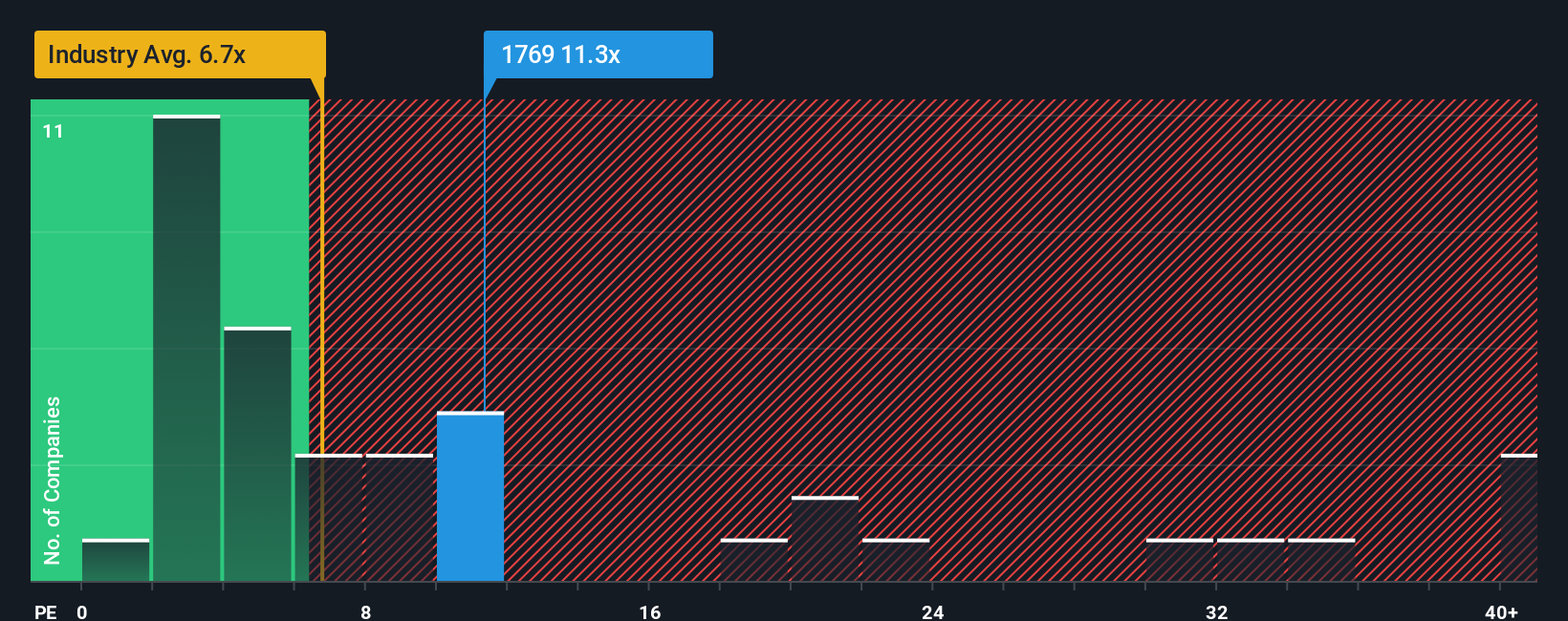

Although its price has dipped substantially, there still wouldn't be many who think Scholar Education Group's price-to-earnings (or "P/E") ratio of 11.3x is worth a mention when the median P/E in Hong Kong is similar at about 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

It looks like earnings growth has deserted Scholar Education Group recently, which is not something to boast about. It might be that many expect the uninspiring earnings performance to only match most other companies at best over the coming period, which has kept the P/E from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Check out our latest analysis for Scholar Education Group

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Scholar Education Group's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Scholar Education Group's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On Scholar Education Group's P/E

Scholar Education Group's plummeting stock price has brought its P/E right back to the rest of the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Scholar Education Group revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 3 warning signs for Scholar Education Group (1 makes us a bit uncomfortable!) that you should be aware of.

If you're unsure about the strength of Scholar Education Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報