ROHM (TSE:6963): Valuation Check After New Energy-Efficient Motor Driver IC Launch Targets Electrification Demand

ROHM (TSE:6963) just rolled out two new brushed DC motor driver ICs that target energy efficient home and industrial appliances, a product move that neatly lines up with growing electrification demand.

See our latest analysis for ROHM.

That backdrop helps explain why, even with a modest 1 day share price gain of 0.69 percent and a recent pullback, ROHM still boasts a strong year to date share price return of 40.99 percent and a robust 1 year total shareholder return of 54.45 percent. This suggests momentum is broadly intact, despite longer term total shareholder returns over three and five years remaining slightly negative.

If this kind of electrification driven story interests you, it is a good moment to explore other semiconductor and device names via high growth tech and AI stocks and see what else the market might be underpricing.

With earnings rebounding sharply but the stock already up strongly this year and trading only slightly below analyst targets, is ROHM still quietly undervalued, or is the market already assuming the next leg of growth?

Most Popular Narrative Narrative: 4% Undervalued

With ROHM last closing at ¥2117 against a narrative fair value of roughly ¥2205, the current setup leans toward modest upside if assumptions hold.

ROHM is planning to increase its production capacity and efficiency for SiC (silicon carbide) power devices, correlating with expected battery EV market growth, which should enhance revenue and earnings as demand eventually picks up. The company is implementing a new organizational structure to better cater to customer needs and market applications, which aims to improve sales and potentially increase net margins by offering more integrated, solution based proposals.

Curious how steady mid single digit growth, a sharp profit swing, and a richer future earnings multiple can still imply upside from here? The narrative spells it out in detail.

Result: Fair Value of ¥2204.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industrial demand weakness, or a sharper than expected slowdown in the battery EV market, could quickly puncture the current upside narrative.

Find out about the key risks to this ROHM narrative.

Another View: Multiples Flash a Caution Signal

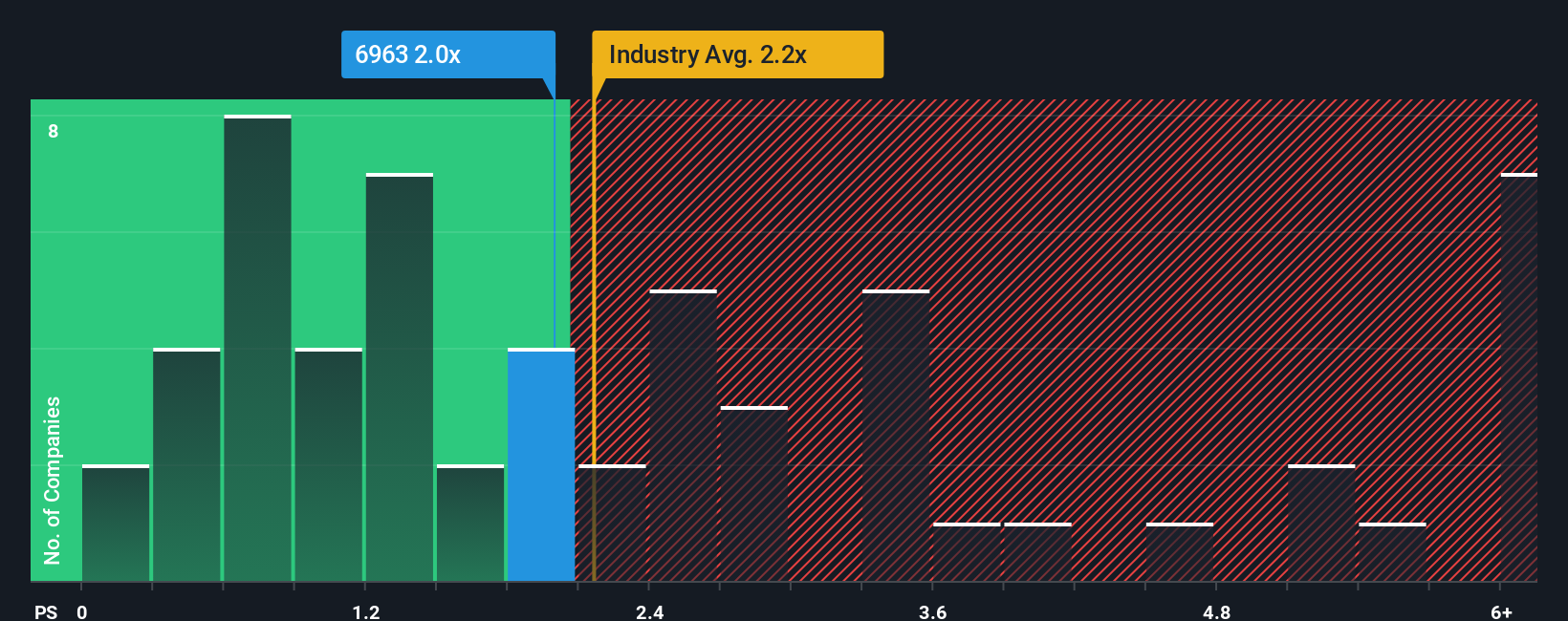

While the narrative fair value suggests ROHM is about 4 percent undervalued, the price to sales lens tells a tighter story. The stock trades at 1.8x sales versus a fair ratio of 1.6x, even if that is slightly cheaper than peers and the industry, so is there really a margin of safety here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ROHM Narrative

If you view the story differently or want to stress test your own assumptions, build a custom narrative in under three minutes: Do it your way.

A great starting point for your ROHM research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in the next step for your portfolio by scanning fresh opportunities our community is tracking with the Simply Wall St Screener.

- Target dependable income streams by reviewing these 13 dividend stocks with yields > 3% that may strengthen your long term returns while markets stay unpredictable.

- Capitalize on structural growth in automation and data by focusing on these 25 AI penny stocks positioned to benefit as AI spending accelerates.

- Position yourself ahead of the crowd by examining these 80 cryptocurrency and blockchain stocks that could capture upside from the next leg of blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報