Moelis (MC) Valuation Check After Keefe, Bruyette & Woods Downgrade and Mixed Analyst Outlook

Moelis (MC) is back in the spotlight after Keefe, Bruyette & Woods cut its rating from Outperform to Market Perform, a shift that has sharpened investor focus on what comes next for the advisory firm.

See our latest analysis for Moelis.

The analyst reshuffle comes after a choppy stretch for Moelis, with a strong 30 day share price return of 14.22 percent helping to claw back some of the 5.59 percent year to date share price decline. The 3 year total shareholder return of 106.20 percent still points to powerful long term momentum.

If this kind of advisory stock story has your attention, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares still trading below the latest analyst price targets but boasting robust revenue and earnings growth, is Moelis quietly undervalued at this level, or has the market already incorporated the firm’s next phase of expansion into the current price?

Most Popular Narrative: 8.4% Undervalued

With Moelis last closing at $70.05 versus a narrative fair value of $76.50, the story hinges on whether growth can outrun today’s multiple.

The firm's growing recurring and retained advisory assignments, particularly through expansion of capital structure advisory and creditor-side franchises, provide more predictable and less volatile fee income streams, smoothing out earnings cyclicality and improving the quality of earnings, potentially leading to a valuation re rating.

Want to see what is hiding behind that potential re rating? The narrative leans on faster growth, fatter margins and a disciplined earnings multiple. Curious how they fit together?

Result: Fair Value of $76.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched hiring and compensation, alongside cyclically choppy deal flow, could squeeze margins and derail the earnings ramp implied in today’s narrative.

Find out about the key risks to this Moelis narrative.

Another Lens on Valuation

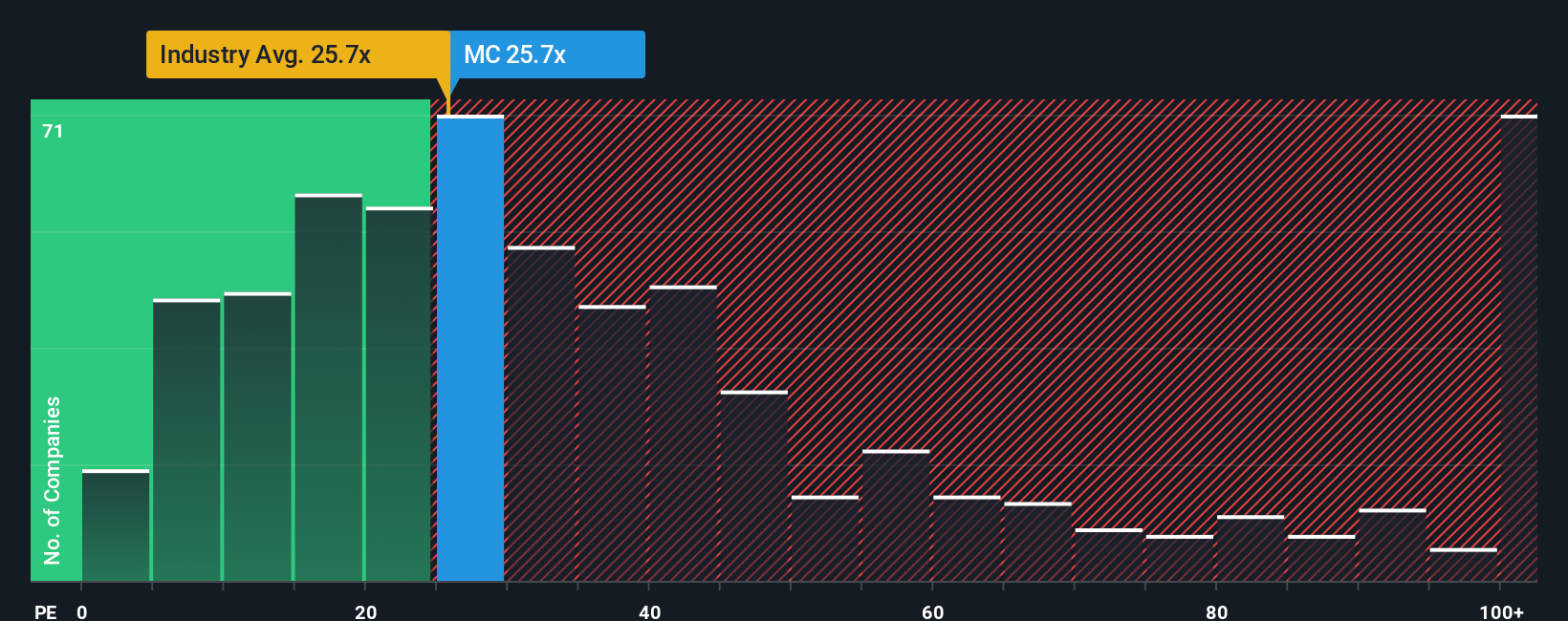

On earnings multiples, Moelis looks far less of a bargain. Its P/E of 22.1 times is well above peer averages of 8.6 times and also above its own fair ratio of 18.2 times. This suggests investors are already paying up for growth and leaving less margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moelis Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research with Moelis. Stay ahead of the crowd by using the Simply Wall Street Screener to uncover focused opportunities other investors might overlook.

- Capitalize on underpriced potential by targeting companies flagged as misvalued through these 914 undervalued stocks based on cash flows that could offer a stronger margin of safety.

- Position yourself at the frontier of innovation by tracking game changing businesses through these 25 AI penny stocks before their growth stories become obvious.

- Strengthen your income stream by zeroing in on companies featured in these 13 dividend stocks with yields > 3% that may provide more reliable cash returns than headline names.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報