After Leaping 27% Flight Centre Travel Group Limited (ASX:FLT) Shares Are Not Flying Under The Radar

Flight Centre Travel Group Limited (ASX:FLT) shareholders have had their patience rewarded with a 27% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.1% over the last year.

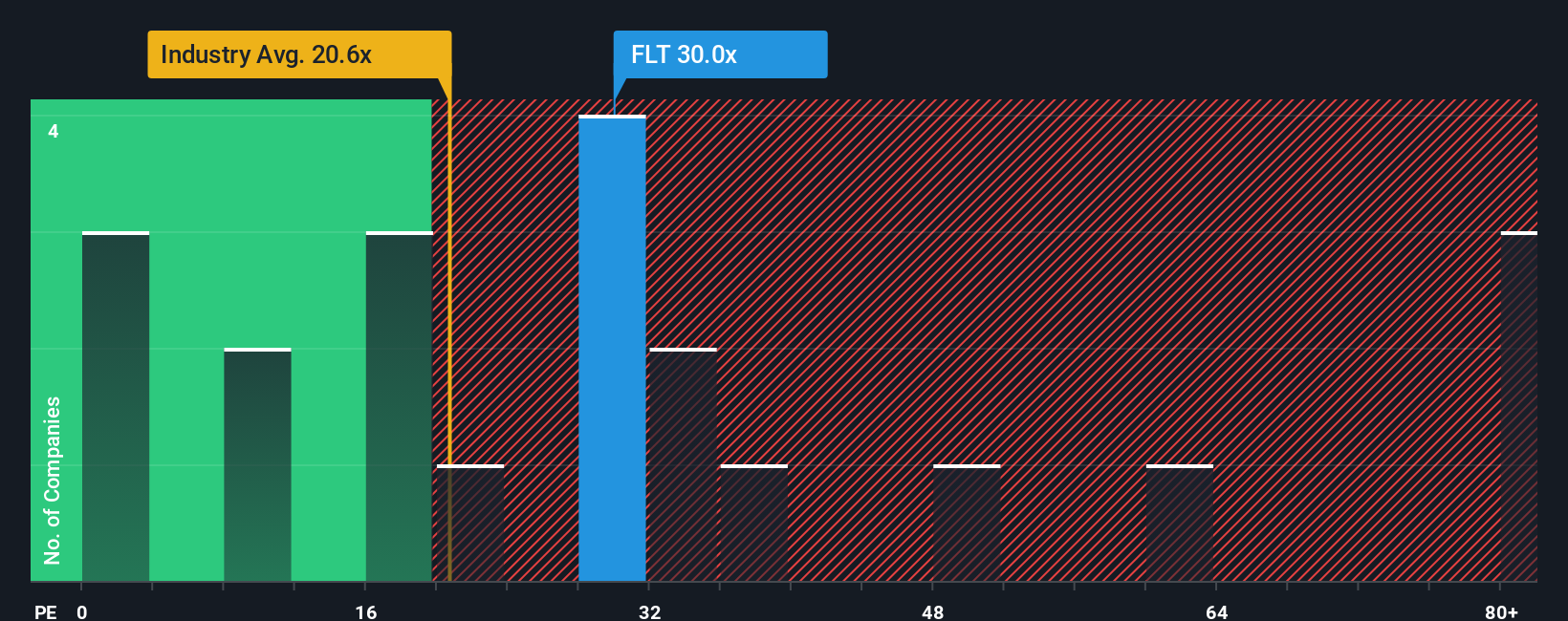

Following the firm bounce in price, Flight Centre Travel Group may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 30x, since almost half of all companies in Australia have P/E ratios under 21x and even P/E's lower than 12x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Flight Centre Travel Group's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Flight Centre Travel Group

How Is Flight Centre Travel Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Flight Centre Travel Group's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 43% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 18% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Flight Centre Travel Group's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Flight Centre Travel Group's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Flight Centre Travel Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Flight Centre Travel Group that you need to take into consideration.

Of course, you might also be able to find a better stock than Flight Centre Travel Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報