Louisiana-Pacific (LPX): Rethinking Valuation After a Recent Share Price Rebound

Louisiana-Pacific (LPX) has quietly outperformed over the past month, gaining about 14% even as its year-to-date return remains negative. That mix of recent momentum and longer-term drag creates an interesting potential entry point for some investors.

See our latest analysis for Louisiana-Pacific.

Despite the recent 1 month share price return of 13.6 percent, Louisiana-Pacific’s year to date share price return is still negative. Its 5 year total shareholder return of roughly 135 percent shows the longer term story remains constructive and suggests momentum may be rebuilding after a softer stretch.

If LPX’s rebound has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other fast moving opportunities with committed insiders.

But with revenue and earnings back in growth mode and the share price still well below its recent peak, is Louisiana-Pacific quietly trading at a discount, or are markets already pricing in its next leg of growth?

Most Popular Narrative: 19.5% Undervalued

With the most followed fair value estimate sitting well above the recent 85.21 dollar close, this narrative presents LPX as a discounted growth story in the making.

Ongoing investments in mill automation, process efficiency, and disciplined cost controls, especially during cyclical weakness in OSB, may position LP to expand margins and earnings as capacity utilization increases and the overall demand environment normalizes.

Want to see what kind of revenue runway, margin lift, and future earnings multiple could justify that upside case? The full narrative outlines the growth path underlying this valuation view.

Result: Fair Value of $105.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a deeper housing slowdown and persistently weak OSB pricing could erode volumes and margins, which would challenge the idea that LPX is meaningfully undervalued.

Find out about the key risks to this Louisiana-Pacific narrative.

Another View: Market Ratios Flash a Caution Sign

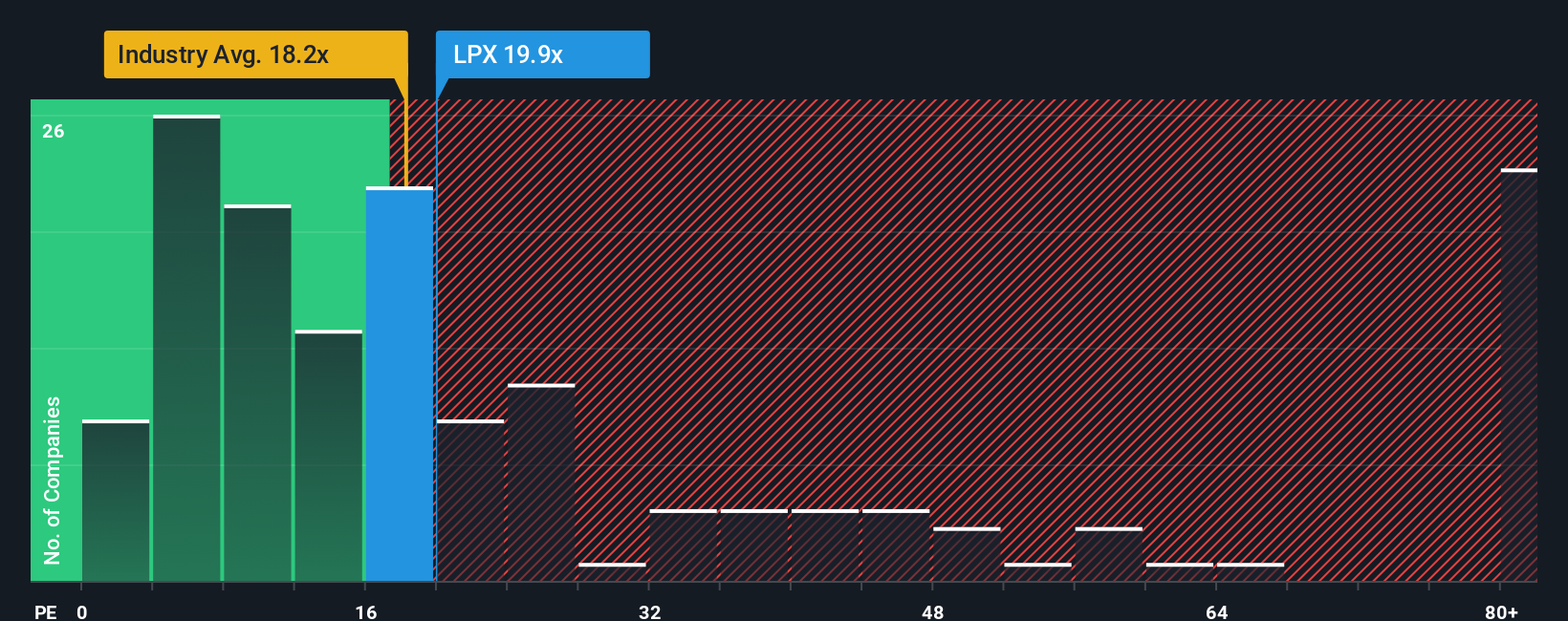

While the narrative points to roughly 20 percent upside, LPX’s current price to earnings ratio of 27.5 times is meaningfully richer than the global forestry average of 18.9 times, the peer average of 17.1 times, and even its own 25.9 times fair ratio. This hints at valuation risk if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Louisiana-Pacific Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh perspective in minutes, Do it your way.

A great starting point for your Louisiana-Pacific research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential opportunity by scanning targeted stock lists that surface ideas many investors may only notice later.

- Seek potential multi-bagger upside by evaluating earlier stage companies with improving fundamentals through these 3614 penny stocks with strong financials.

- Align your portfolio with the automation trend by using these 29 healthcare AI stocks to find innovators working to transform patient care and medical diagnostics.

- Support your income stream and reduce reliance on capital gains with these 13 dividend stocks with yields > 3% focused on companies that regularly pay dividends with attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報