A Fresh Look at ArcBest (ARCB) Valuation After Stifel Lifts Its Price Target and Reaffirms Buy Rating

Stifel’s refreshed call on ArcBest (ARCB), keeping a Buy rating while lifting its outlook, has put the trucking and logistics name back on investors’ radar as sentiment across Wall Street turns more constructive.

See our latest analysis for ArcBest.

The upgraded call comes as momentum has quietly turned in ArcBest’s favor, with the share price at 80.47 dollars and a strong 1 month share price return of just over 32 percent helping to claw back some of this year’s earlier weakness. However, the 1 year total shareholder return remains in negative territory, while the 5 year total shareholder return near doubles investors’ money. This pattern suggests near term sentiment is improving after a tougher stretch.

If this shift in sentiment has you rethinking your watchlist, it could be a good moment to look beyond trucking and explore fast growing stocks with high insider ownership for other compelling growth stories.

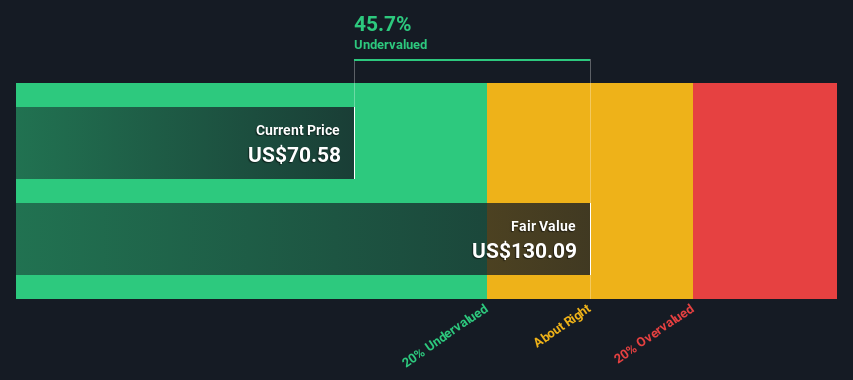

With ArcBest still trading at a modest discount to both analyst targets and some intrinsic value estimates, yet facing cooling ROIC and earnings pressure, are investors looking at an overlooked opportunity or a stock that already reflects expectations of a rebound?

Most Popular Narrative: 1% Undervalued

With ArcBest closing at 80.47 dollars against a narrative fair value of 81 dollars, the story hinges on modest upside built on disciplined assumptions.

The analysts have a consensus price target of $88.667 for ArcBest based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $72.0.

Curious how steady revenue gains, shifting margins, and a richer earnings multiple all combine to justify that target range? The full narrative explains the underlying assumptions and calculations.

Result: Fair Value of $81 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight softness and elevated labor costs could squeeze margins and undermine the earnings recovery that supports ArcBest’s modest upside narrative.

Find out about the key risks to this ArcBest narrative.

Another Angle on Valuation

While the fair value narrative pegs ArcBest as only about 1 percent undervalued, our DCF model paints a richer picture, suggesting the shares sit roughly 15 percent below intrinsic value. If cash flows are closer to right than sentiment is, could the upside be larger than this narrative implies?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ArcBest Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can build a custom view in minutes: Do it your way.

A great starting point for your ArcBest research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now and uncover stocks that match your strategy using the Simply Wall Street Screener, so you are not sidelined while others seize tomorrow’s winners.

- Capture early-stage growth potential by reviewing these 3616 penny stocks with strong financials that pair compelling stories with improving fundamentals.

- Position your portfolio for the next wave of innovation by targeting these 25 AI penny stocks transforming industries with real world AI adoption.

- Lock in compelling value opportunities by scanning these 918 undervalued stocks based on cash flows where strong cash flows are not yet fully recognized by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報