Acuity Brands (AYI): Assessing Valuation After Recent Share Price Gains and QSC Acquisition

Acuity (AYI) has quietly kept climbing, with the stock up about 7% over the past 3 months and roughly 21% this year, as investors reward steady revenue and earnings growth.

See our latest analysis for Acuity.

With the latest share price at $359.83, Acuity’s roughly 3% 1 month share price return and strong three year total shareholder return of about 118% suggest momentum is still very much on the side of patient holders.

If Acuity’s steady climb has your attention, it could be a good moment to see what else is working in the market and explore fast growing stocks with high insider ownership.

Yet despite solid revenue and earnings growth, Acuity trades just below analyst targets and close to estimates of intrinsic value. This raises the question: is this a fresh buying window, or is future growth already fully priced in?

Most Popular Narrative: 9.9% Undervalued

Compared with the last close of $359.83, the most popular narrative points to a higher fair value near $399.25, framing a modest upside path.

The recent acquisition of QSC, which enhances Acuity's capabilities in built space management and cloud connectivity, is expected to contribute to future sales growth and margin expansion in the Acuity Intelligence Spaces segment.

Want to see why this growth engine could justify a richer valuation multiple than many industrial peers? The narrative leans on layered revenue expansion, higher margins, and a future earnings profile that resembles a high quality compounder rather than a cyclical lighting name.

Result: Fair Value of $399.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained tariff pressures and any stumble integrating QSC could quickly erode margin gains and challenge the case for a higher valuation.

Find out about the key risks to this Acuity narrative.

Another View: Rich on Earnings

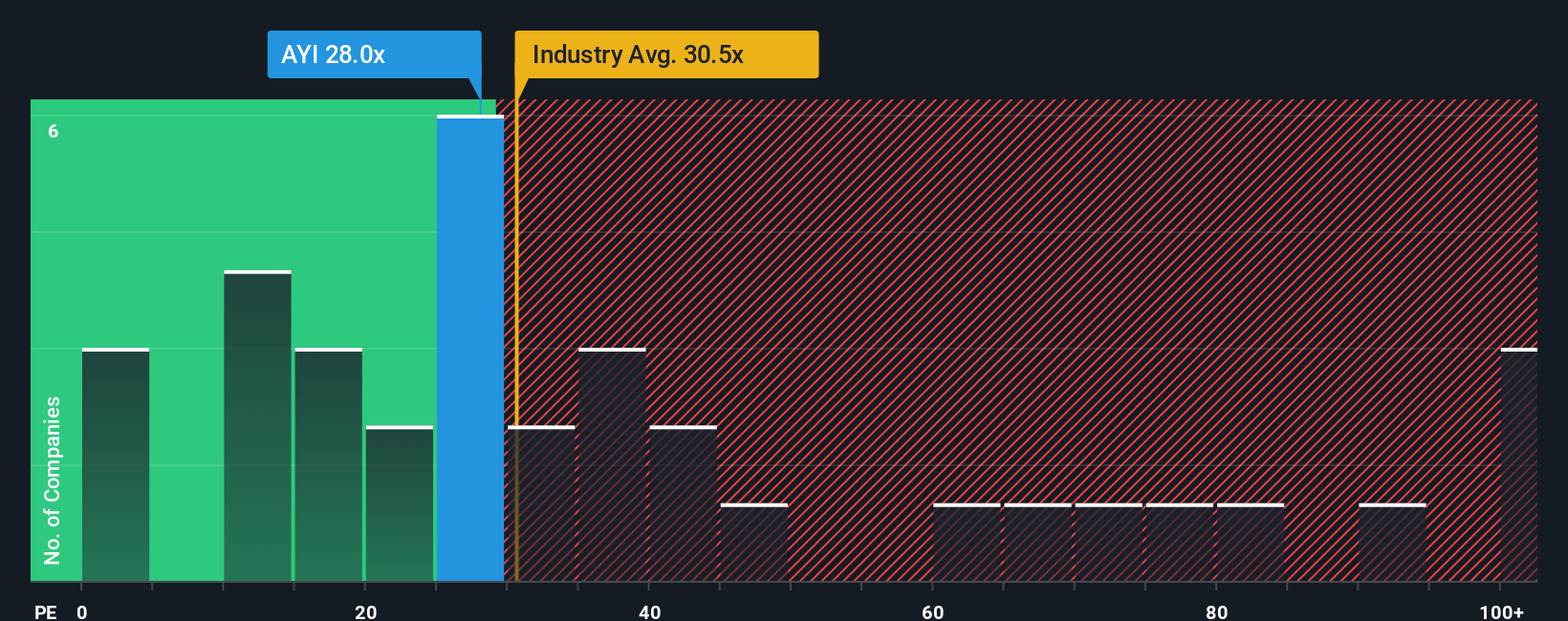

On earnings, Acuity looks less of a bargain. The current P E of about 27.6 times sits below the Electrical industry at roughly 31.2 times and peers near 34.5 times, but above a fair ratio closer to 25 times. This hints at limited margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Acuity Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom thesis in minutes: Do it your way.

A great starting point for your Acuity research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity; use the Simply Wall Street Screener to pinpoint stocks that match your strategy before others move first.

- Capture high potential early by reviewing these 3616 penny stocks with strong financials that pair low share prices with balance sheet strength and improving fundamentals.

- Position for the next wave of innovation by targeting these 25 AI penny stocks that apply artificial intelligence in ways that support revenue growth and competitive advantages.

- Seek stronger income streams by focusing on these 13 dividend stocks with yields > 3% that combine regular cash payouts with sustainable business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報