First Watch (FWRG) Valuation Check After an Earnings Beat Masked by Cheaper Eggs and Emerging Structural Strains

First Watch Restaurant Group (FWRG) just posted a beat and raise quarter, but the upside was largely fueled by cheaper eggs, not lasting operational gains, and the market now has to parse that distinction.

See our latest analysis for First Watch Restaurant Group.

The upbeat quarter has nudged the share price to about $17.20, with a 90 day share price return of 7.9 percent. However, the year to date share price return is still negative and the one year total shareholder return is modestly negative, so recent momentum looks more like a short term repricing of risk than a sustained rerating.

If this earnings pop has you rethinking your watchlist, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other compelling growth stories with committed insiders.

With revenue growing but profits thin, the stock trading about 30 percent below consensus targets, and structural cracks emerging, is First Watch a discounted growth story, or has the market accurately priced in fading momentum?

Most Popular Narrative Narrative: 21.8% Undervalued

With the most followed narrative pointing to a fair value well above the recent 17.20 dollar close, the core debate is how durable growth really is.

The analysts have a consensus price target of $22.0 for First Watch Restaurant Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $17.0.

Want to see what justifies paying up from today’s price, yet still calling the stock cheap? The narrative leans heavily on rapid scaling, rising margins, and a future earnings multiple that assumes this breakfast focused chain matures like a category defining growth brand. Curious which specific revenue and profit inflection points have to fall into place to make that math work? Read on to unpack the full valuation playbook behind that target.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained commodity and wage inflation, or missteps in new market expansion, could quickly compress margins and call that growth narrative into question.

Find out about the key risks to this First Watch Restaurant Group narrative.

Another View: Cash Flows Paint a Harsher Picture

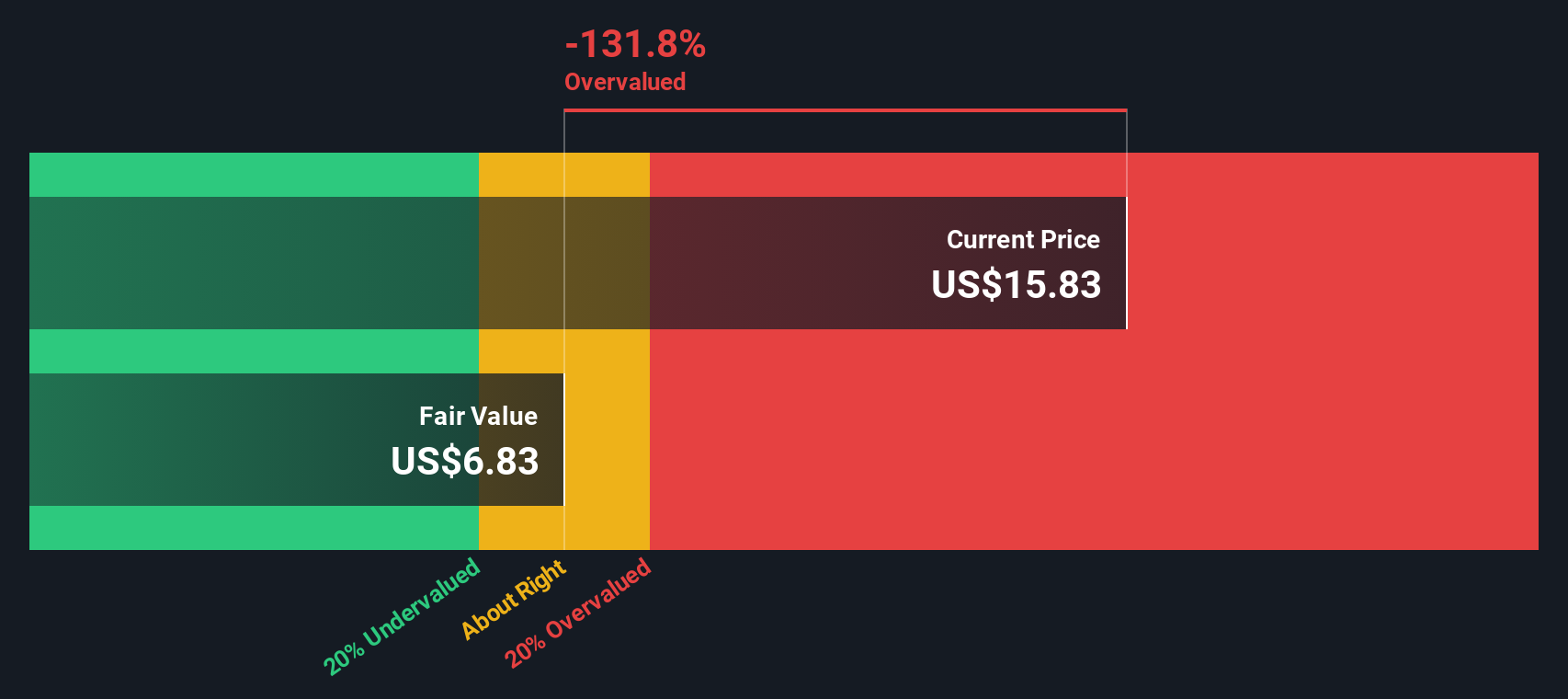

While the consensus narrative calls First Watch undervalued, our DCF model points the other way, suggesting fair value closer to $7.74, well below the current $17.20 price. If the cash flows are right, is the growth story already more than fully priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Watch Restaurant Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Watch Restaurant Group Narrative

If you want to stress test these assumptions or follow your own process instead, you can build a personalized narrative in just a few minutes, Do it your way.

A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock when you can quickly scan fresh opportunities using the Simply Wall St Screener for targeted, high conviction investment ideas.

- Capture potentially mispriced opportunities early by reviewing these 918 undervalued stocks based on cash flows that may be trading below what their cash flows justify.

- Ride the most powerful tech trends by focusing on these 25 AI penny stocks positioned to benefit from accelerating demand for artificial intelligence.

- Strengthen your income strategy by targeting these 13 dividend stocks with yields > 3% that can help support reliable long term portfolio cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報