Kubota (TSE:6326) Share Retirement: What the Buyback Move Signals for the Stock’s Valuation

Board moves to retire shares

Kubota (TSE:6326) has kicked off December with a board meeting focused on retiring a portion of its common stock under Japan’s Companies Act, a textbook move to tighten the share count and support long term value.

See our latest analysis for Kubota.

That decision lands against a strong backdrop, with Kubota’s 1 month share price return of 13.87 percent and 3 month share price return of 23.16 percent pointing to building momentum, while a 1 year total shareholder return of 29.30 percent reinforces the longer term uptrend.

If this kind of shareholder friendly move has you thinking more broadly about opportunities, it could be worth exploring fast growing stocks with high insider ownership as a way to spot the next potential outperformers.

With shares rallying and fresh buybacks tightening supply, investors now face a key question: Is Kubota still trading below its true worth, or are markets already pricing in the company’s next leg of growth?

Price-to-Earnings of 14.9x: Is it justified?

Kubota's latest close at ¥2,286.5 comes with a 14.9x price to earnings multiple, which screens as good value versus its fair and peer levels.

The price to earnings ratio compares what investors pay today for each unit of current earnings. This is a core yardstick for a mature, profitable manufacturer like Kubota.

In Kubota's case, the 14.9x price to earnings multiple sits below the estimated fair price to earnings level of 22.1x. This suggests the market is assigning a lower earnings valuation than regression based fair value would indicate and may be underestimating the sustainability of its profit base.

However, that same 14.9x multiple looks punchy against the broader JP Machinery industry, where the average stands at 12.3x. This underscores that investors are already paying a premium to sector peers even if the fair ratio signals room for upward rerating over time.

Explore the SWS fair ratio for Kubota

Result: Price-to-Earnings of 14.9x (UNDERVALUED)

However, investors should still watch for a cyclical pullback in machinery demand or a slowdown in Kubota’s earnings growth, which could cap valuation upside.

Find out about the key risks to this Kubota narrative.

Another look at value

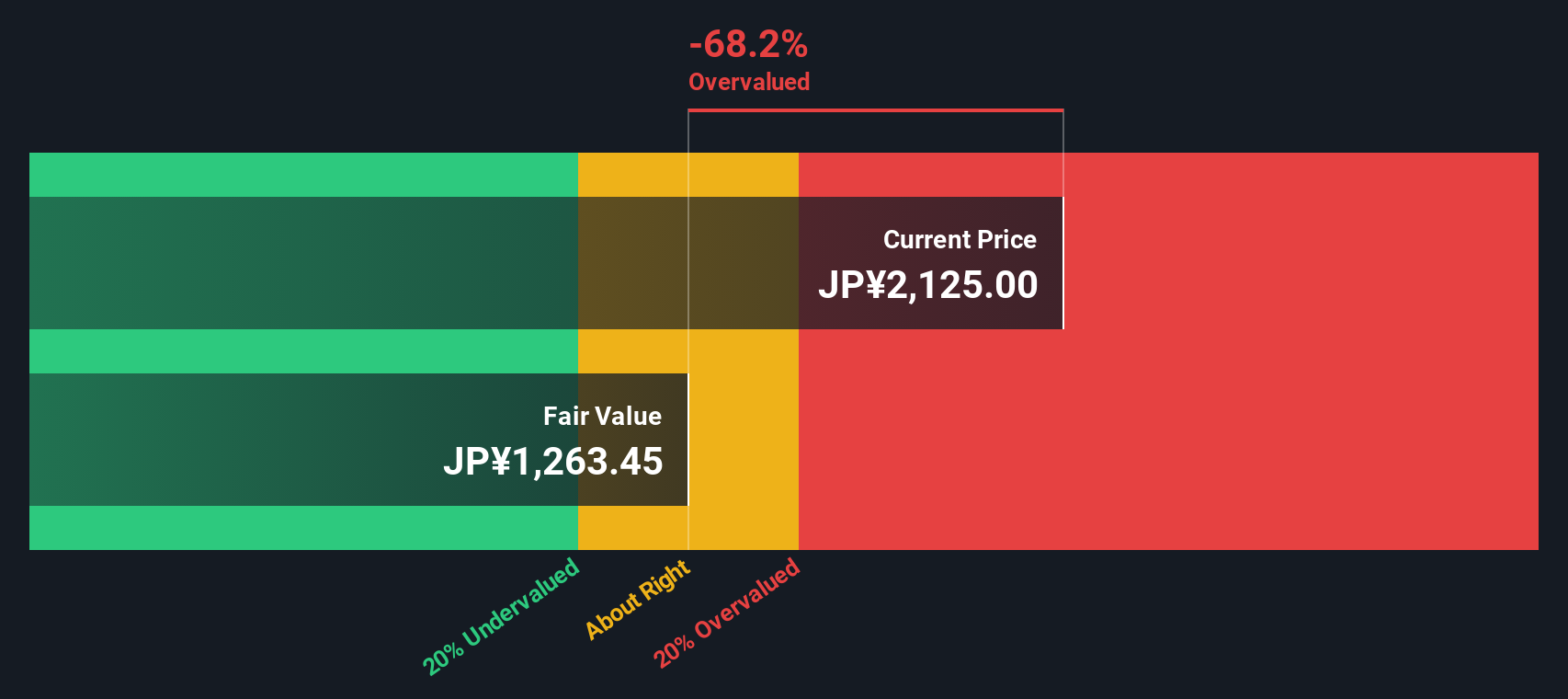

Our SWS DCF model paints a very different picture, putting Kubota’s fair value closer to ¥1,303.76 versus the current ¥2,286.5 share price. This implies the stock screens as overvalued on cash flows, even as earnings-based ratios look supportive. Which signal should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kubota for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kubota Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Kubota research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover more stocks that fit your strategy before the market catches on.

- Capture potential market mispricings by running through these 918 undervalued stocks based on cash flows that may still trade below their intrinsic worth based on future cash flows.

- Tap into powerful secular trends in automation and smart technology with these 24 AI penny stocks that could reshape entire industries over the coming decade.

- Strengthen your income strategy by targeting these 13 dividend stocks with yields > 3% that combine reliable payouts with fundamentally sound businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報