Is Atos a Turnaround Opportunity After Its 86% 2025 Surge?

- If you are wondering whether Atos at around €46 is a turnaround bargain or a value trap, you are not the only one. That is exactly what this breakdown is going to tackle.

- The stock has swung hard lately, down 15.9% over the last week but still up 6.0% over 30 days, with an eye catching 85.8% gain year to date and a 121.2% rise over the past year after a brutal multi year slide.

- Those moves come after years of restructuring and strategic shifts that have investors rethinking the long term future of the business, especially given how deeply the shares had fallen from their highs, with a 93.1% drop over 3 years and 99.2% over 5 years. Recent commentary around its transformation plan and asset disposals has fueled debate about whether the worst is behind it or whether risks are simply being repriced.

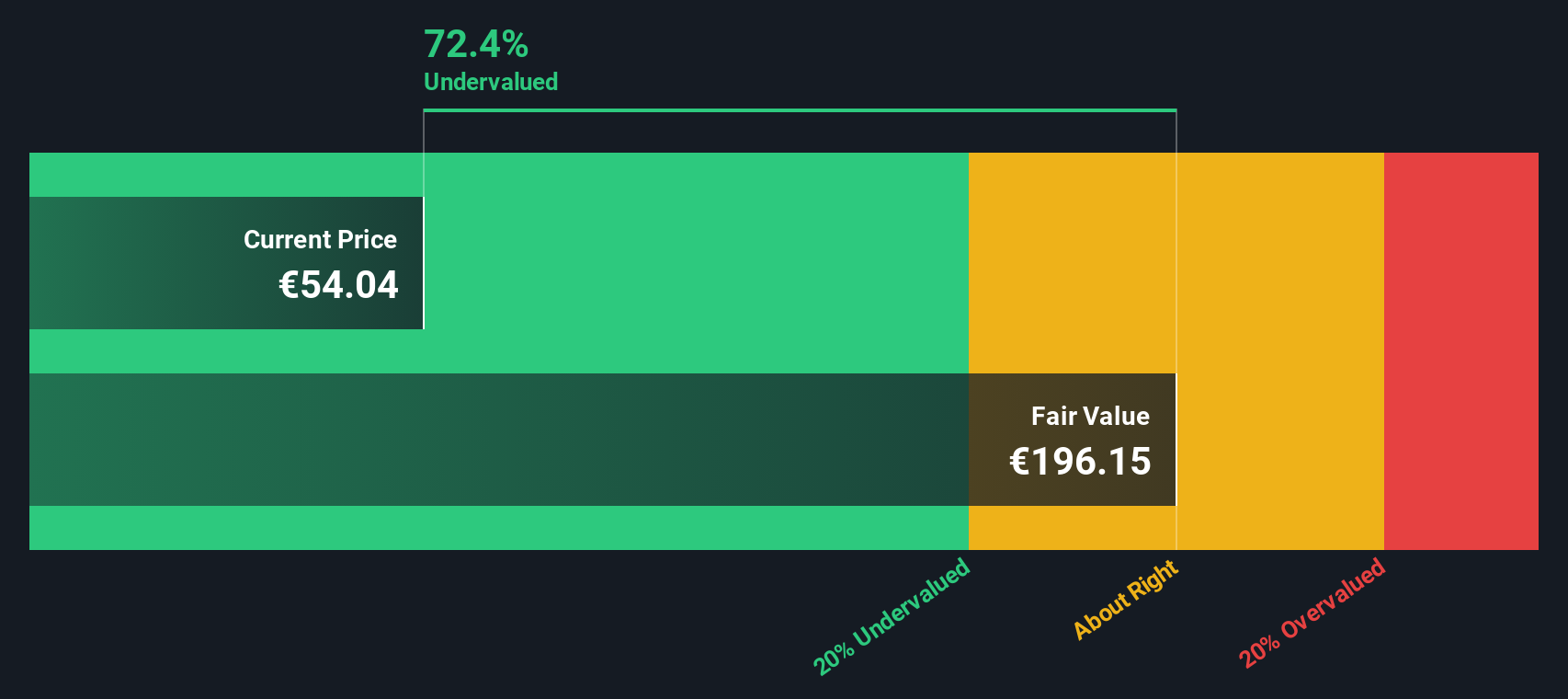

- On our checks, Atos scores a 5/6 valuation score, which suggests it screens as undervalued on most metrics. In the next sections we will walk through those traditional valuation approaches while also pointing to a more powerful way to judge what the market might really be missing.

Approach 1: Atos Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today, using a required rate of return.

For Atos, the latest twelve month free cash flow is negative at about €213 million, so the story starts from a weak base. Analysts expect free cash flow to recover into positive territory over the next few years, with projections turning positive by 2027 and reaching roughly €104 million by 2028. Beyond the analyst horizon, Simply Wall St extrapolates those estimates for a further decade, with cash flow rising steadily through the early 2030s as the turnaround gains traction.

When those projected cash flows are discounted back to today using a 2 Stage Free Cash Flow to Equity model, the implied intrinsic value comes out at about €253 per share. Against a current share price around €46, the DCF suggests the stock is trading at roughly an 81.6% discount, indicating a very wide gap between price and estimated value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Atos is undervalued by 81.6%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

Approach 2: Atos Price vs Earnings

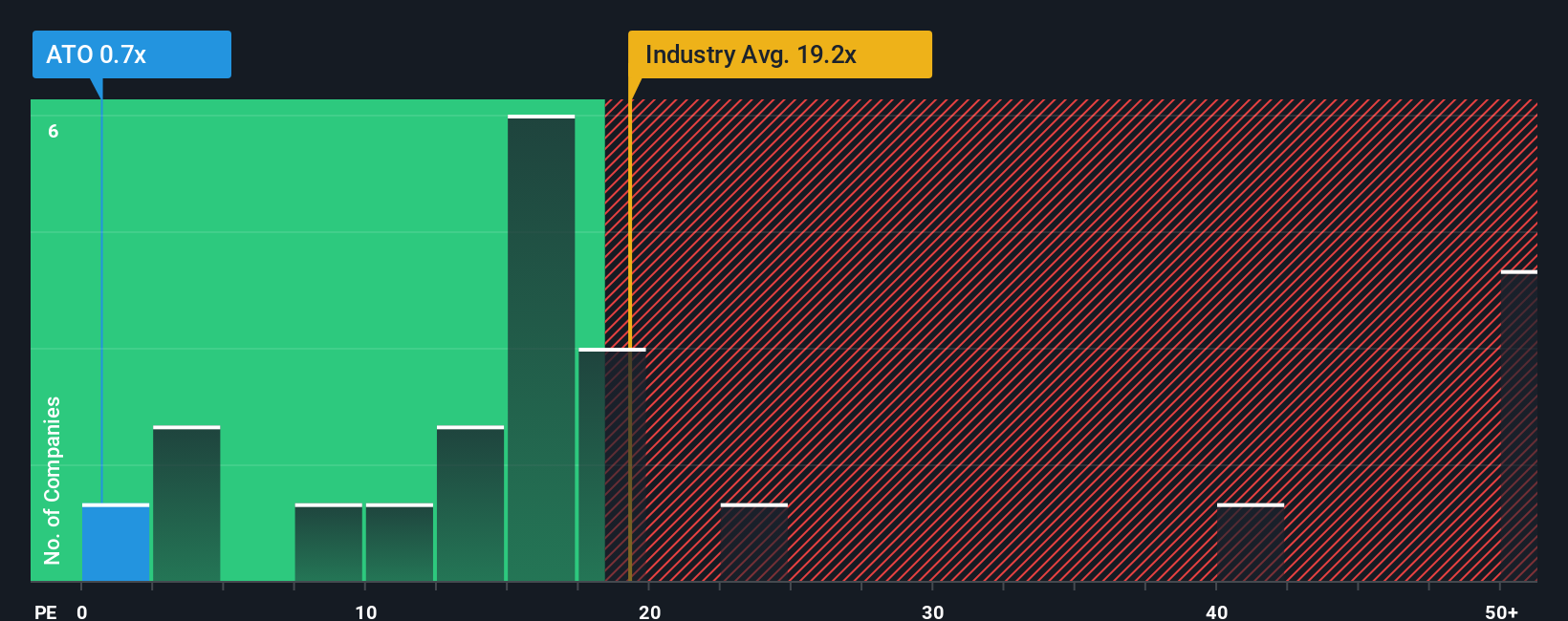

For companies that are generating profits, the price to earnings (PE) ratio is often the go to valuation tool because it directly links what investors pay for each share to the earnings that business is currently producing.

In general, higher growth and lower perceived risk justify a higher PE, while slower growth or elevated risk tend to pull a fair multiple down. Against that backdrop, Atos is trading on a PE of just 0.60x, far below both the broader IT industry average of about 21.17x and a peer group average near 18.74x. This immediately flags the stock as extremely cheap on a simple comparison basis.

Simply Wall St’s Fair Ratio adds another layer by estimating what PE Atos should reasonably trade on, based on its earnings growth outlook, profitability, industry, market cap and specific risk profile. For Atos, that Fair Ratio is 5.33x, still well above the current 0.60x. This suggests that even after accounting for its challenges, the market is pricing the shares far below what those fundamentals would typically imply.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Atos Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you attach a clear story about a company to your assumptions for future revenue, earnings, margins and fair value. It then compares that fair value with today’s price to help you decide whether to buy, hold or sell, all while automatically updating as new news or earnings arrive so your view does not go stale. A Narrative effectively links three things together: the business story you believe, the financial forecast that follows from that story, and the fair value that those numbers imply, making your investment logic explicit and easy to revisit. For Atos, one investor might build a more cautious Narrative that leans toward the lower end of recent fair value views around €20.6 per share. Another investor, more optimistic about restructuring and AI driven growth, could anchor closer to the upper end near €43. The platform makes both perspectives transparent so you can sense check where you stand.

Do you think there's more to the story for Atos? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報