Is It Too Late To Consider RenaissanceRe After Its Strong Multi Year Share Price Run?

- If you are wondering whether RenaissanceRe Holdings still looks attractive after its strong run, or if the easy gains are already behind it, this breakdown will help you assess whether the current price makes long term sense.

- The stock has quietly ground higher, up around 0.9% over the last week, 4.9% over the past month, 10.5% year to date, and 10.9% over the last year. Longer term holders have seen gains of 50.2% over 3 years and 77.3% over 5 years.

- Recent headlines have focused on the reinsurance sector's shifting risk landscape, including tighter catastrophe capacity, evolving climate related models, and changing terms with primary insurers. All of these factors feed directly into how investors view future profitability and risk. At the same time, macro concerns around interest rates and capital requirements have kept investors alert, helping explain why sentiment toward RenaissanceRe has improved but still feels cautious rather than euphoric.

- On our framework the stock scores a 5 out of 6 valuation check, suggesting it screens as undervalued on most of the metrics we track. Next we will walk through those valuation approaches, before finishing with a different way to think about what the market is really pricing in.

Approach 1: RenaissanceRe Holdings Excess Returns Analysis

The Excess Returns model looks at how much profit RenaissanceRe can generate above the return that investors require on its equity, then capitalizes that surplus to estimate what the business is worth today.

RenaissanceRe has an estimated Book Value of $231.23 per share and a Stable Book Value of $275.87 per share, based on forecasts from 6 analysts. Using expected profitability from 11 analysts, Stable EPS is projected at $42.10 per share, implying an Average Return on Equity of 15.26%.

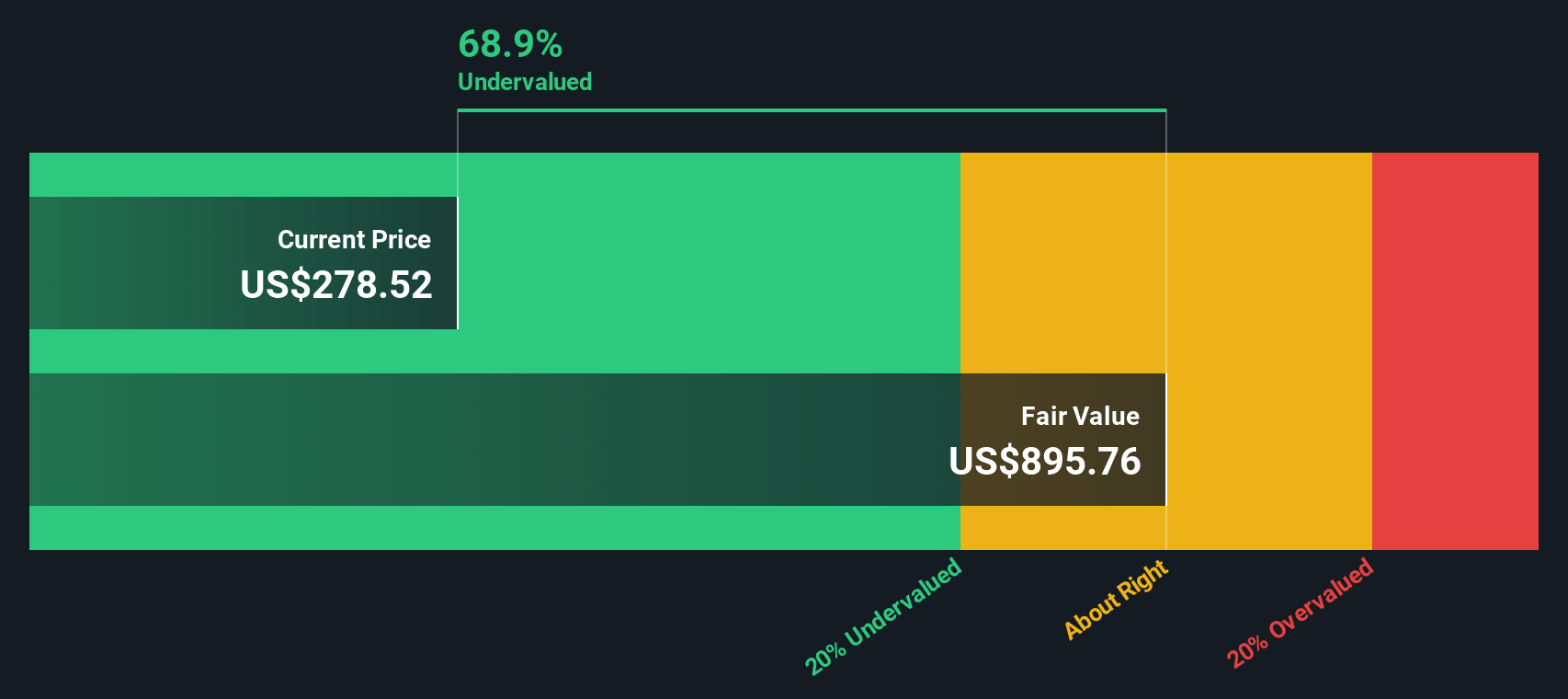

Investors are assumed to require a Cost of Equity of $19.19 per share. On this basis, the company is expected to earn an Excess Return of $22.91 per share on a stable basis. In this framework, those excess profits, combined with the growing book value base, drive an intrinsic value estimate of about $895.76 per share.

With the Excess Returns model indicating the stock is roughly 69.3% undervalued versus the current share price, the implication is that the market is underestimating both the durability and the profitability of RenaissanceRe’s capital base.

Result: UNDERVALUED

Our Excess Returns analysis suggests RenaissanceRe Holdings is undervalued by 69.3%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: RenaissanceRe Holdings Price vs Earnings

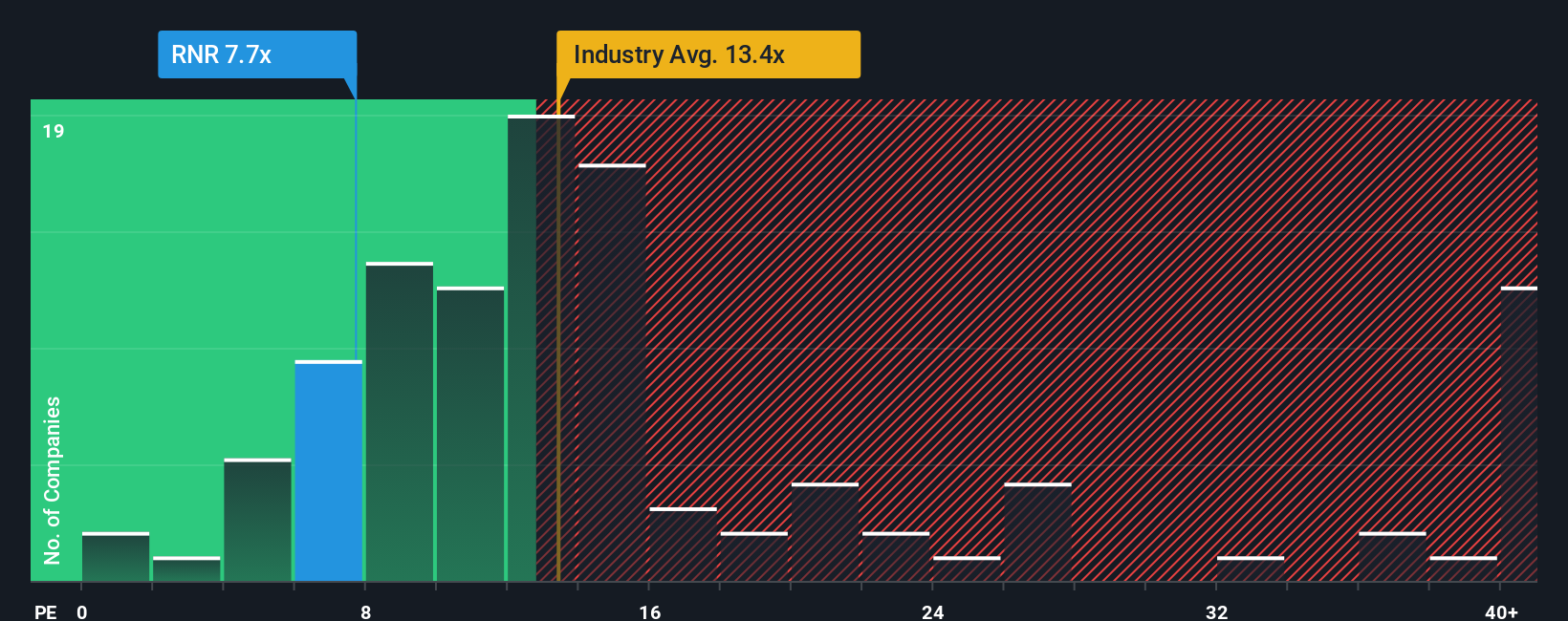

For consistently profitable companies like RenaissanceRe, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It naturally links today’s share price to the level and quality of profits the business is generating.

In broad terms, faster growth and lower perceived risk justify a higher, or more generous, PE multiple, while slower growth and higher risk usually pull a fair PE down. RenaissanceRe currently trades on about 7.59x earnings, well below both the Insurance industry average of roughly 13.49x and the broader peer group average of about 16.32x, suggesting the market is taking a relatively conservative view of its prospects.

Simply Wall St’s Fair Ratio is designed to refine that comparison by estimating what PE multiple would be appropriate once factors like expected earnings growth, profit margins, risk profile, industry dynamics and company size are all considered together. For RenaissanceRe, this Fair Ratio is 11.03x, comfortably above the current 7.59x. On this basis, the shares screen as undervalued on earnings, with the market pricing in more caution than the fundamentals appear to warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your RenaissanceRe Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to connect your view of RenaissanceRe Holdings with the numbers. Narratives turn your story about its future, including assumptions for revenue, earnings and margins, into a financial forecast and a Fair Value that you can easily compare with the current share price. All of this is available within the Narratives tool on Simply Wall St’s Community page. The tool updates automatically as new news or earnings arrive and makes it clear when your Fair Value suggests buying, holding or selling. It also lets you see how other investors can reasonably disagree. For example, one Narrative may lean closer to the lower analyst target of about $237, focused on softening reinsurance pricing and higher catastrophe risk. Another may point toward the high end near $422, emphasizing resilient margins, strong catastrophe demand and disciplined capital management. This helps you quickly decide which storyline and which valuation feel most realistic to you.

Do you think there's more to the story for RenaissanceRe Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報