3 Stocks Estimated To Be Undervalued By Up To 48.3%

As the U.S. stock market experiences a resurgence, with major indices like the Nasdaq and S&P 500 seeing notable gains driven by tech shares, investors are keenly observing opportunities that may arise from these fluctuations. In such an environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential growth while maintaining a balanced portfolio amidst shifting market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.40 | $52.50 | 49.7% |

| UMB Financial (UMBF) | $119.79 | $233.99 | 48.8% |

| Sportradar Group (SRAD) | $22.92 | $45.71 | 49.9% |

| QXO (QXO) | $21.88 | $43.36 | 49.5% |

| Perfect (PERF) | $1.77 | $3.43 | 48.4% |

| DexCom (DXCM) | $65.91 | $127.52 | 48.3% |

| Community West Bancshares (CWBC) | $23.31 | $45.31 | 48.6% |

| Columbia Banking System (COLB) | $28.86 | $57.13 | 49.5% |

| BioLife Solutions (BLFS) | $25.34 | $50.06 | 49.4% |

| American Superconductor (AMSC) | $30.59 | $59.58 | 48.7% |

Let's explore several standout options from the results in the screener.

Sotera Health (SHC)

Overview: Sotera Health Company offers sterilization, lab testing, and advisory services to the healthcare industry across the United States, Canada, Europe, and internationally with a market cap of approximately $4.78 billion.

Operations: Sotera Health's revenue is derived from three primary segments: Nordion ($194.58 million), Nelson Labs ($219.00 million), and Sterigenics ($736.80 million).

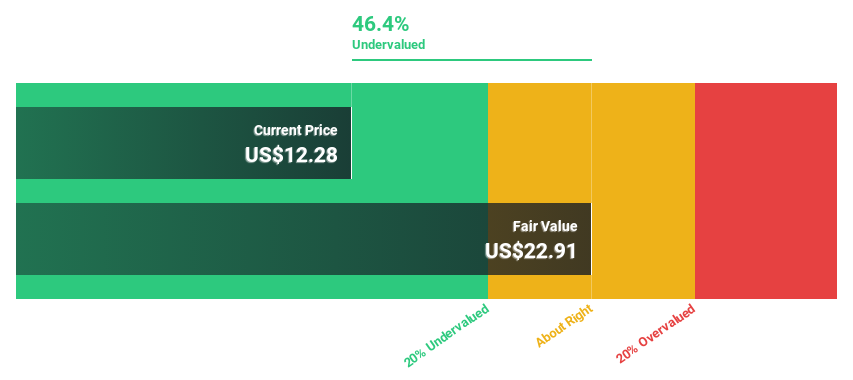

Estimated Discount To Fair Value: 32.7%

Sotera Health's stock appears undervalued based on discounted cash flow analysis, trading at US$17.11 compared to an estimated fair value of US$25.42, a significant discount. Despite slower revenue growth forecasts of 5.8% annually versus the market, earnings are expected to grow substantially at 56.4% per year, outpacing the market average. However, interest payments remain a concern as they are not well covered by earnings, and recent insider selling could indicate potential risks ahead for investors.

- In light of our recent growth report, it seems possible that Sotera Health's financial performance will exceed current levels.

- Take a closer look at Sotera Health's balance sheet health here in our report.

Udemy (UDMY)

Overview: Udemy, Inc. is a learning company that operates a global marketplace platform for acquiring skills, with a market cap of approximately $885.58 million.

Operations: The company's revenue is primarily derived from two segments: Consumer, contributing $275.82 million, and Enterprise, generating $519.99 million.

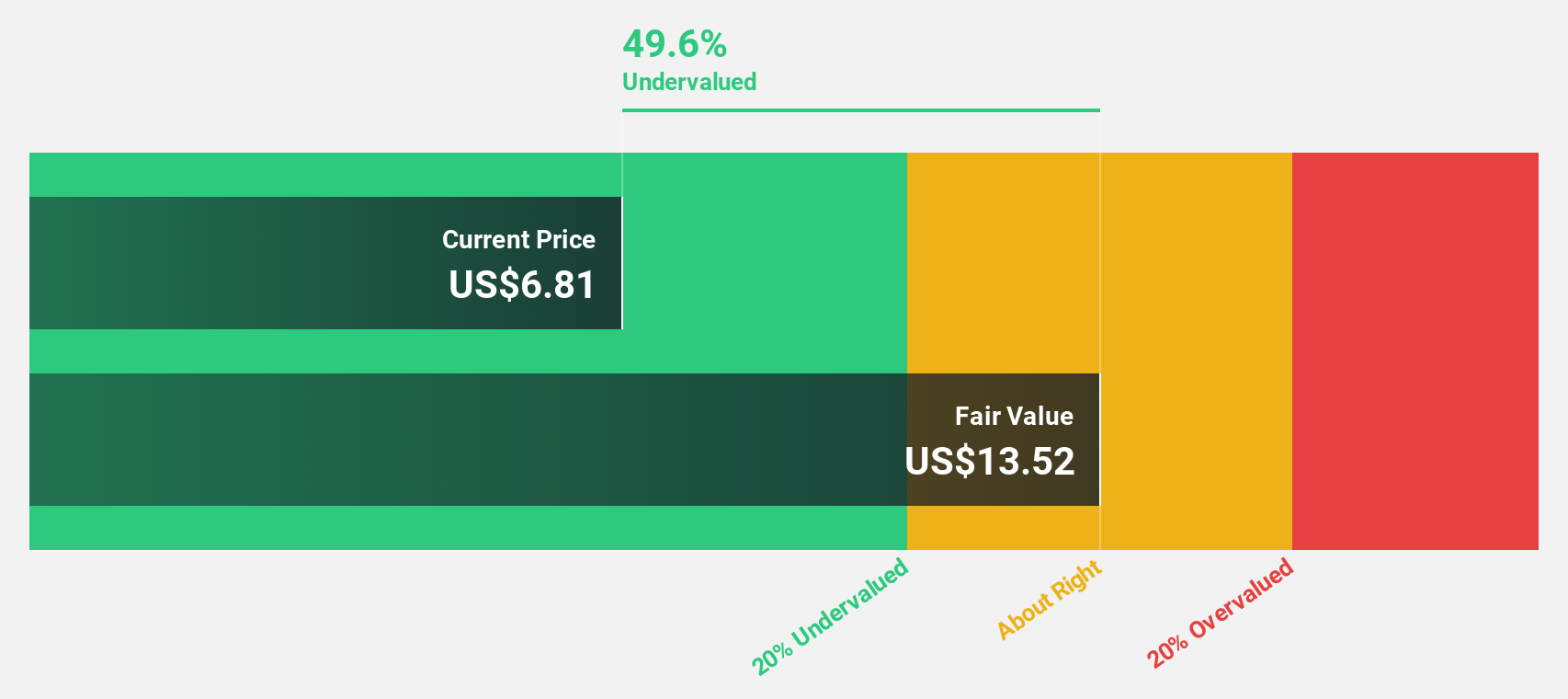

Estimated Discount To Fair Value: 48.3%

Udemy's stock is trading at a significant discount, valued at US$6.30 against an estimated fair value of US$12.19, indicating it is undervalued based on cash flows. While its revenue growth forecast of 4.6% annually lags behind the market, earnings are projected to rise by 57.29% per year, surpassing average market expectations. Recent developments include a merger agreement with Coursera valued at approximately US$1 billion and strategic partnerships expanding its global reach and AI capabilities.

- The analysis detailed in our Udemy growth report hints at robust future financial performance.

- Get an in-depth perspective on Udemy's balance sheet by reading our health report here.

Acadia Realty Trust (AKR)

Overview: Acadia Realty Trust is an equity real estate investment trust specializing in long-term, profitable growth, with a market cap of $2.79 billion.

Operations: The company generates revenue through its REIT Portfolio, which accounts for $234.10 million, and its Investment Management segment, contributing $154.86 million.

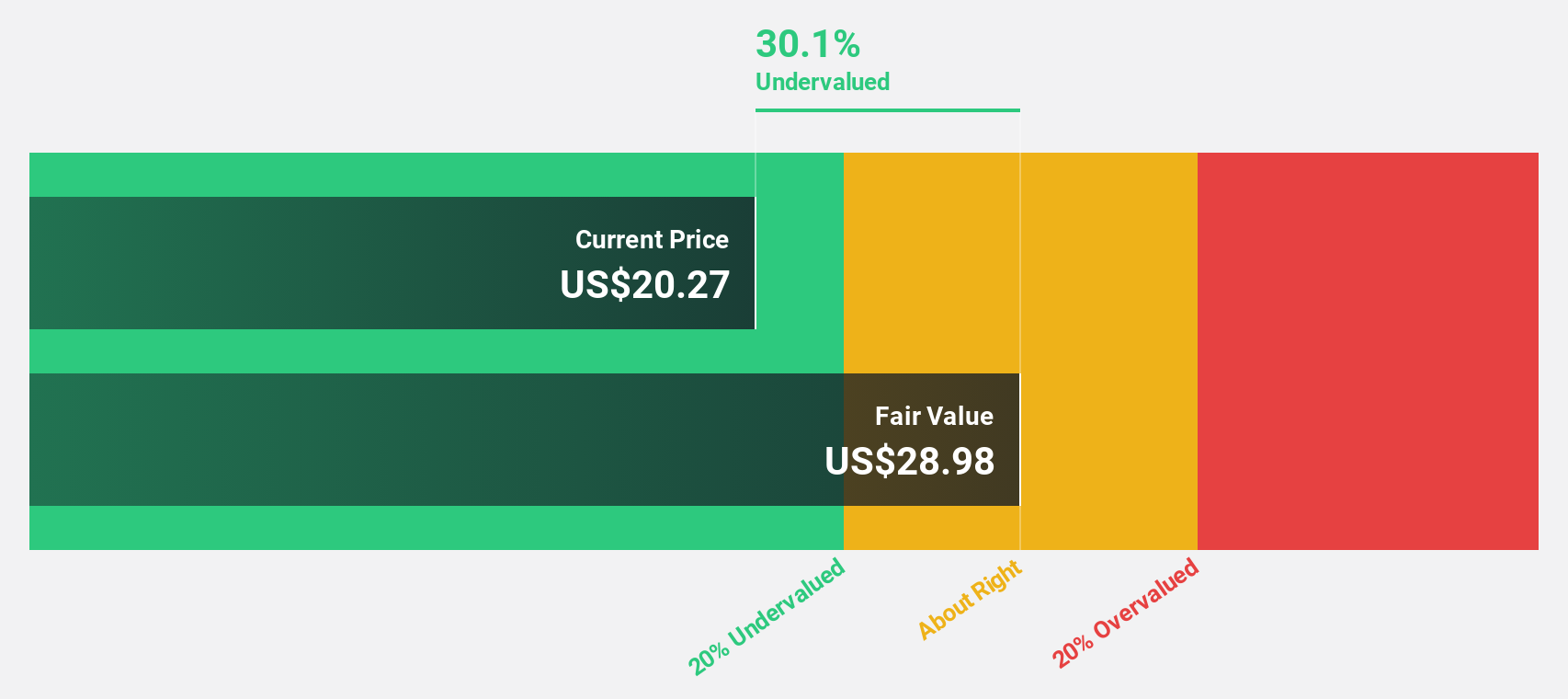

Estimated Discount To Fair Value: 29.8%

Acadia Realty Trust's stock is trading at US$20.49, below its estimated fair value of US$29.17, suggesting it may be undervalued based on cash flows. The company's revenue and earnings are projected to grow faster than the market at 12.1% and 20.2% annually, respectively, although the dividend track record remains unstable. Recent adjustments in earnings guidance reflect improved expectations for net earnings per share for 2025 amidst ongoing buyback activities totaling US$77.42 million since 2018.

- Our growth report here indicates Acadia Realty Trust may be poised for an improving outlook.

- Navigate through the intricacies of Acadia Realty Trust with our comprehensive financial health report here.

Make It Happen

- Click through to start exploring the rest of the 210 Undervalued US Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報