Terreno Realty (TRNO): Evaluating Valuation After New Doral Lease, Maryland Acquisition and Key Tenant Renewals

Terreno Realty (TRNO) has been busy, locking in a 117,000 square foot lease in Doral with an international freight forwarder while also expanding its industrial footprint and shoring up key tenants across Washington and Maryland.

See our latest analysis for Terreno Realty.

These new leases and the Maryland acquisition help explain why, despite a minor pullback in the latest 1 day share price return, Terreno Realty still shows positive momentum with its year to date share price return and a solid 1 year total shareholder return.

If you like the steady, fundamentals first story here, it could be worth seeing what else fits that profile by exploring fast growing stocks with high insider ownership.

But with the shares trading modestly below analyst targets and Terreno still posting healthy revenue growth despite softer earnings, is the market overlooking a long term compounding story here, or already pricing in the next leg of growth?

Price-to-Earnings of 19.6x: Is it justified?

On a price-to-earnings basis, Terreno Realty trades at 19.6 times earnings, which screens as good value versus its peers at the current 60.58 dollar share price.

The price to earnings ratio compares what investors are paying today to the company’s current earnings, a key lens for income focused real estate investors. For Terreno, a 19.6 times multiple looks restrained given its strong recent earnings momentum and significantly improved net profit margins, suggesting the market may be conservative about how durable those profits will be.

Against the broader peer set, the picture is mixed. Terreno looks cheap versus its direct peer average multiple of 32.4 times, yet screens expensive relative to the global Industrial REITs average of 16.3 times. Our work indicates a fair price to earnings ratio of 26.1 times, a level the market could gravitate toward if the company continues to deliver on revenue growth and margin expansion.

Explore the SWS fair ratio for Terreno Realty

Result: Price-to-Earnings of 19.6x (UNDERVALUED)

However, softer net income trends and any cooling in industrial leasing demand could challenge expectations for sustained multiple expansion and long term compounding.

Find out about the key risks to this Terreno Realty narrative.

Another View on Value

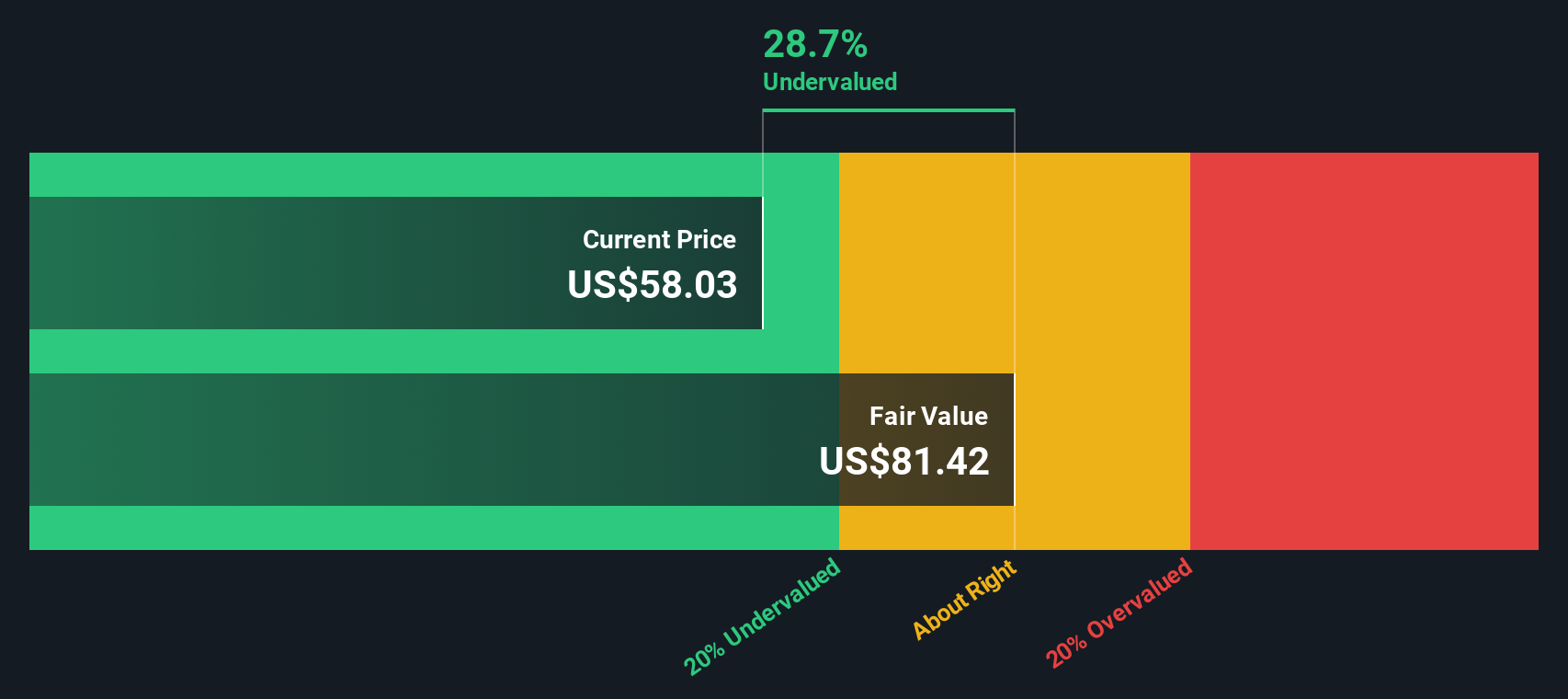

Our DCF model points to fair value around 70.54 dollars, about 14.1 percent above today’s price. This also suggests undervaluation, but on cash flow rather than earnings. If both signals line up, is this simply a discounted name or a value trap in slow motion?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Terreno Realty for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Terreno Realty Narrative

If you see the numbers differently or want to stress test your own assumptions using our tools, you can build a full narrative in under three minutes: Do it your way.

A great starting point for your Terreno Realty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not leave your next opportunity to chance. Put Simply Wall Street’s powerful Screener to work and uncover stocks that match exactly how you want to invest.

- Capture early stage growth potential by scanning these 3608 penny stocks with strong financials that combine smaller market caps with surprisingly resilient fundamentals.

- Target future facing innovation by zeroing in on these 24 AI penny stocks positioned to benefit from accelerating demand for intelligent automation.

- Lock in stronger income potential by focusing on these 13 dividend stocks with yields > 3% that can support reliable cash returns even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報