Birkenstock (NYSE:BIRK) Margin Expansion Reinforces Bullish Narratives After FY 2025 Results

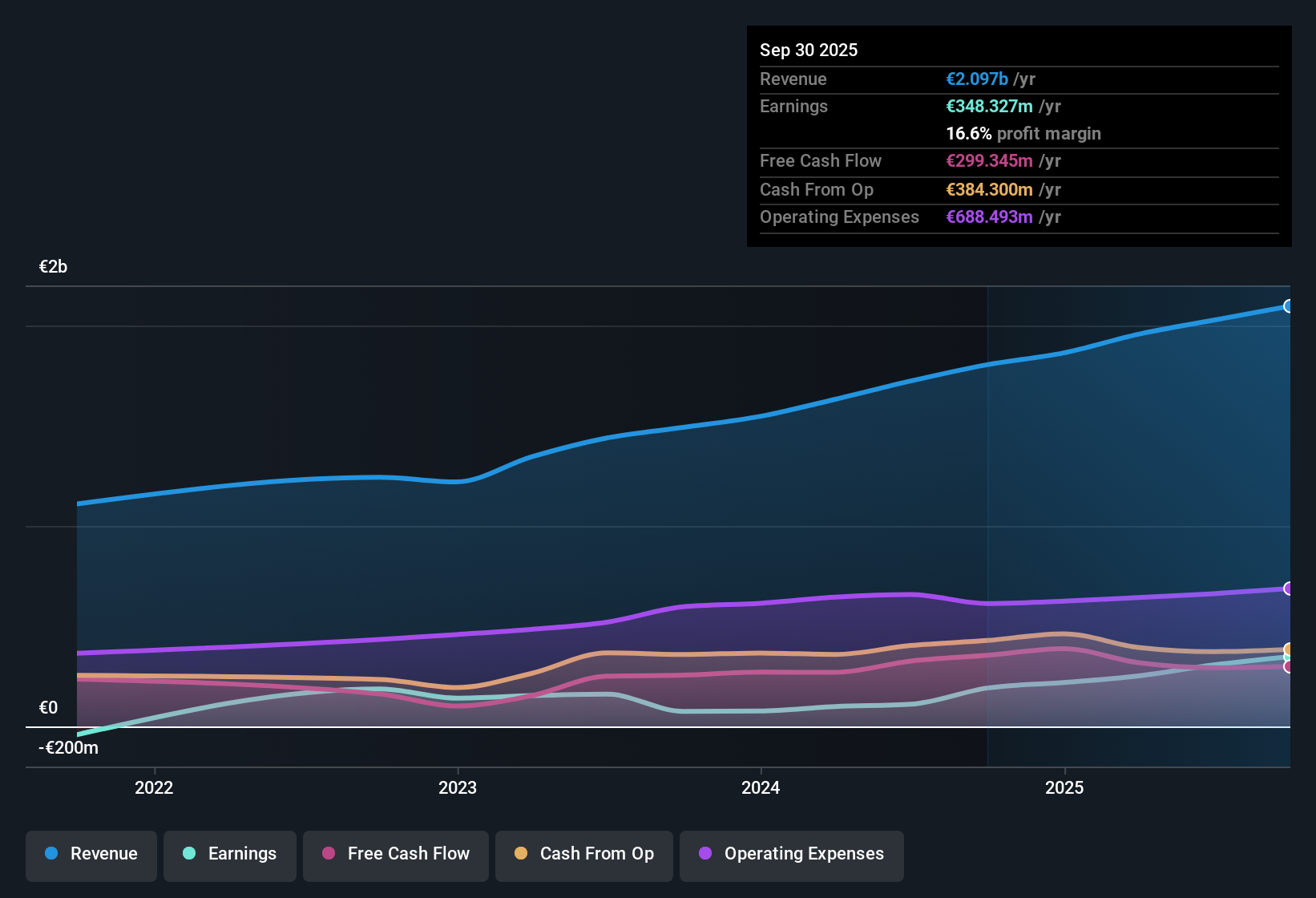

Birkenstock Holding (BIRK) closed FY 2025 with fourth quarter revenue of €526 million and EPS of €0.51, alongside net income of €93.9 million. This result underscores another solid print on the back of a strong year of demand for its core footwear franchise. The company has seen revenue move from €456 million and EPS of €0.28 in Q4 FY 2024 to €526 million and €0.51 in Q4 FY 2025, while trailing 12 month revenue reached about €2.1 billion and EPS hit €1.87, giving investors a clear view of consistent top and bottom line scaling. With net profit margins sitting comfortably in the mid teens, this latest set of numbers keeps the focus firmly on how much earnings power Birkenstock can sustain as growth narratives evolve.

See our full analysis for Birkenstock Holding.With the headline figures on the table, the next step is to line them up against the prevailing market stories about Birkenstock, testing where the growth and margin narratives match the data and where they might be due for a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Step Up To 16.6 Percent

- Over the last 12 months, Birkenstock converted €2.1 billion of revenue into €348 million of net income, which works out to a 16.6 percent net margin compared with 10.6 percent a year earlier.

- What stands out for a bullish view is how profit growth is outrunning sales, with trailing EPS up 81.8 percent year over year and five year earnings growth averaging 40.2 percent per year, while revenue is growing more slowly at a forecast 10.8 percent a year.

- Supporters point to that 16.6 percent margin as evidence the brand can keep more of each euro of sales than it did a year ago, which helps justify expectations for earnings to grow 13.9 percent per year.

- The same data set shows net income at €348 million on €2.1 billion of revenue, so the bullish case leans heavily on this improved profitability rather than just chasing higher volumes.

Valuation Sits Below Peers

- The stock trades on a trailing P E of 18.5 times, which is below both the 20.3 times US Luxury industry average and the 38.1 times peer average, and the €41.14 share price is about 16.9 percent under a €49.49 DCF fair value.

- Consensus style bullish arguments that Birkenstock is attractively priced are strongly backed by these numbers, but they still depend on the company delivering the forecast growth path.

- Analysts in the data expect the share price to rise toward a €63.31 target, which is a large gap from €41.14 today and aligns with the idea that current valuation does not fully reflect the 13.9 percent annual earnings growth forecast.

- At the same time, a P E that is lower than both peers and the broader luxury average means the market is not paying a premium despite the stronger margin profile, which is exactly the type of mismatch bullish investors look for.

Growth Pace Starting From A Higher Base

- Looking over the last few years, trailing earnings have climbed 81.8 percent in a single year and averaged 40.2 percent per year over five years, while forward looking forecasts now point to a slower but still solid 13.9 percent annual earnings growth and 10.8 percent annual revenue growth.

- Critics of an overly bullish stance may focus on that step down in growth rates, yet the figures still show a company that is adding profits on top of a much larger base than before.

- Bears can reasonably note that projected 13.9 percent earnings growth is lower than some higher growth stocks in the US market, so future share price moves are likely to track whether Birkenstock can keep margins near 16.6 percent rather than relying on explosive sales gains.

- On the other hand, the move from a 10.6 percent to a 16.6 percent net margin over the past year suggests a lot of the heavy lifting came from efficiency and pricing, which gives the business more room to absorb slower top line growth without giving up profitability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Birkenstock Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Birkenstock is posting higher margins and earnings, the noticeable slowdown from past hyper growth means future returns rely more on maintaining efficiency than on rapid expansion.

If you want ideas that pair strong current profitability with clear, forward looking earnings momentum, use our high growth potential stocks screener (44 results) now to hunt for established names still primed for robust growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報