Is It Too Late To Consider Madrigal Pharmaceuticals After Its Huge 2025 Share Price Surge?

- If you are wondering whether Madrigal Pharmaceuticals is still worth buying after its huge run, you are not alone. This is exactly the kind of setup where valuation really matters.

- Despite a recent pullback, with the stock down 4.7% over the last week and 2.0% over the past month, it is still up 73.5% year to date and 76.5% over the last year. A massive 353.2% gain over five years hints at how quickly sentiment can shift.

- Those swings have come as investors digest a stream of regulatory and clinical updates, as well as shifting expectations around Madrigal's lead NASH therapy and its commercial prospects. Together, these developments have reshaped how the market is pricing both the company’s long term growth runway and the risks around execution.

- Right now, Madrigal scores a 4/6 valuation check score, suggesting it screens as undervalued on most of our metrics. We will walk through those different valuation approaches next while also flagging a smarter, more holistic way to think about fair value at the end of the article.

Approach 1: Madrigal Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back to their value in today’s dollars.

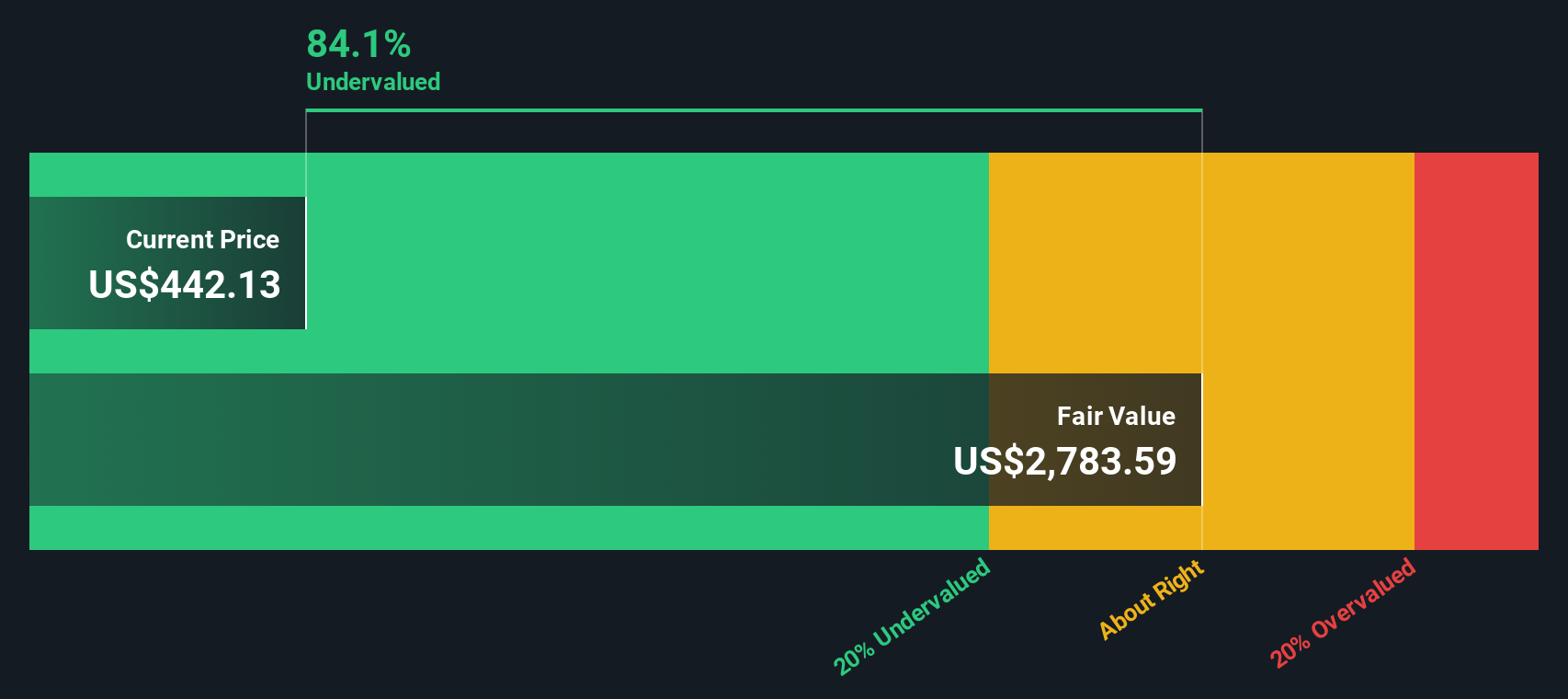

For Madrigal Pharmaceuticals, the latest twelve month free cash flow is a loss of about $164 million, reflecting heavy investment ahead of commercial scale up. Analysts and extrapolated estimates, however, point to a sharp inflection, with free cash flow expected to climb to roughly $1.6 billion by 2029 and continuing to grow strongly into the next decade in this 2 stage Free Cash Flow to Equity model.

Adding up those projected cash flows and discounting them gives an estimated intrinsic value of about $2,900 per share in $. Compared with the current share price, this implies the stock is trading at an 81.2% discount to its modeled fair value, suggesting the market is heavily underpricing Madrigal’s long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Madrigal Pharmaceuticals is undervalued by 81.2%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Madrigal Pharmaceuticals Price vs Sales

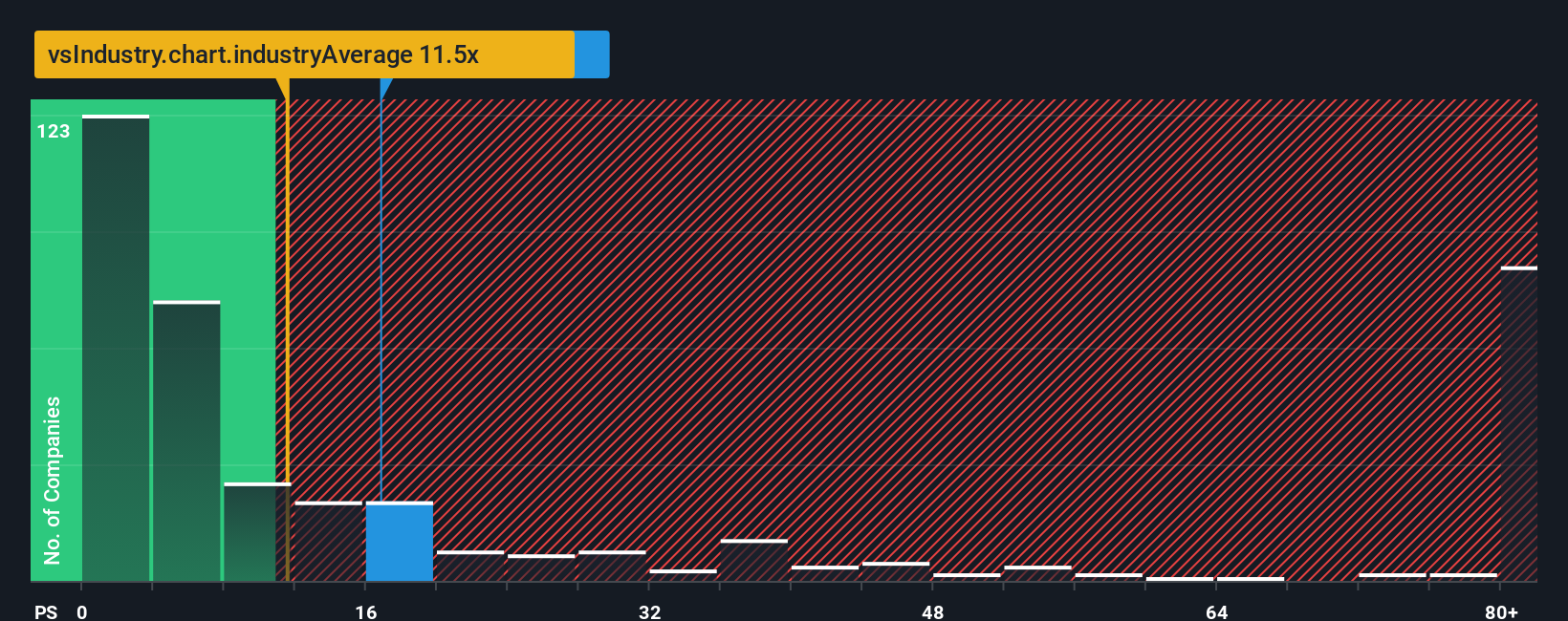

For a company like Madrigal that is still moving toward sustained profitability but beginning to generate meaningful revenue, the price to sales multiple is a useful yardstick because it anchors valuation to the scale of the commercial opportunity rather than current earnings volatility.

In general, higher growth and lower perceived risk justify a higher “normal” price to sales ratio. Slower growth or execution concerns usually warrant a discount. Madrigal currently trades on a price to sales of about 16.7x, which sits above the broader Biotechs industry average of roughly 11.8x but below the 25.4x average of its more closely comparable peers.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what multiple a stock should trade on, given its growth outlook, margins, industry, market cap and risk profile. For Madrigal, this Fair Ratio is 19.5x, implying the stock deserves a premium to the sector. Because this approach adjusts for the company’s specific fundamentals, it provides a more tailored benchmark than simple industry or peer comparisons. With the current 16.7x multiple sitting below the 19.5x Fair Ratio, Madrigal screens as undervalued on a price to sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Madrigal Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you write the story behind your numbers by linking your view of Madrigal’s business (its growth drivers, risks and competitive position) to a concrete financial forecast and Fair Value estimate. You can then compare that Fair Value to today’s share price to decide when to buy or sell. The Narrative automatically updates as new news or earnings arrive. For example, one investor might build a bullish Madrigal Narrative around decades of protected Rezdiffra growth, 54.6% revenue expansion and a fair value near $564 per share. Another may focus on reimbursement and competition risks, plug in much lower long term earnings and margins, and arrive at a far lower fair value and a decision to avoid or trim the stock even at the same current price.

Do you think there's more to the story for Madrigal Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報