Is Digital Realty Still Attractive After Its 16% Slide Amid AI Data Center Optimism?

- Wondering if Digital Realty Trust is a bargain after its recent slide? Let us unpack whether today is a smart entry point or a value trap in disguise.

- The stock has pulled back to around $147.93, slipping about 3.7% over the last week, 7.1% over the last month, and 16.4% year to date, even though it is still up 62.6% over three years and 28.0% over five.

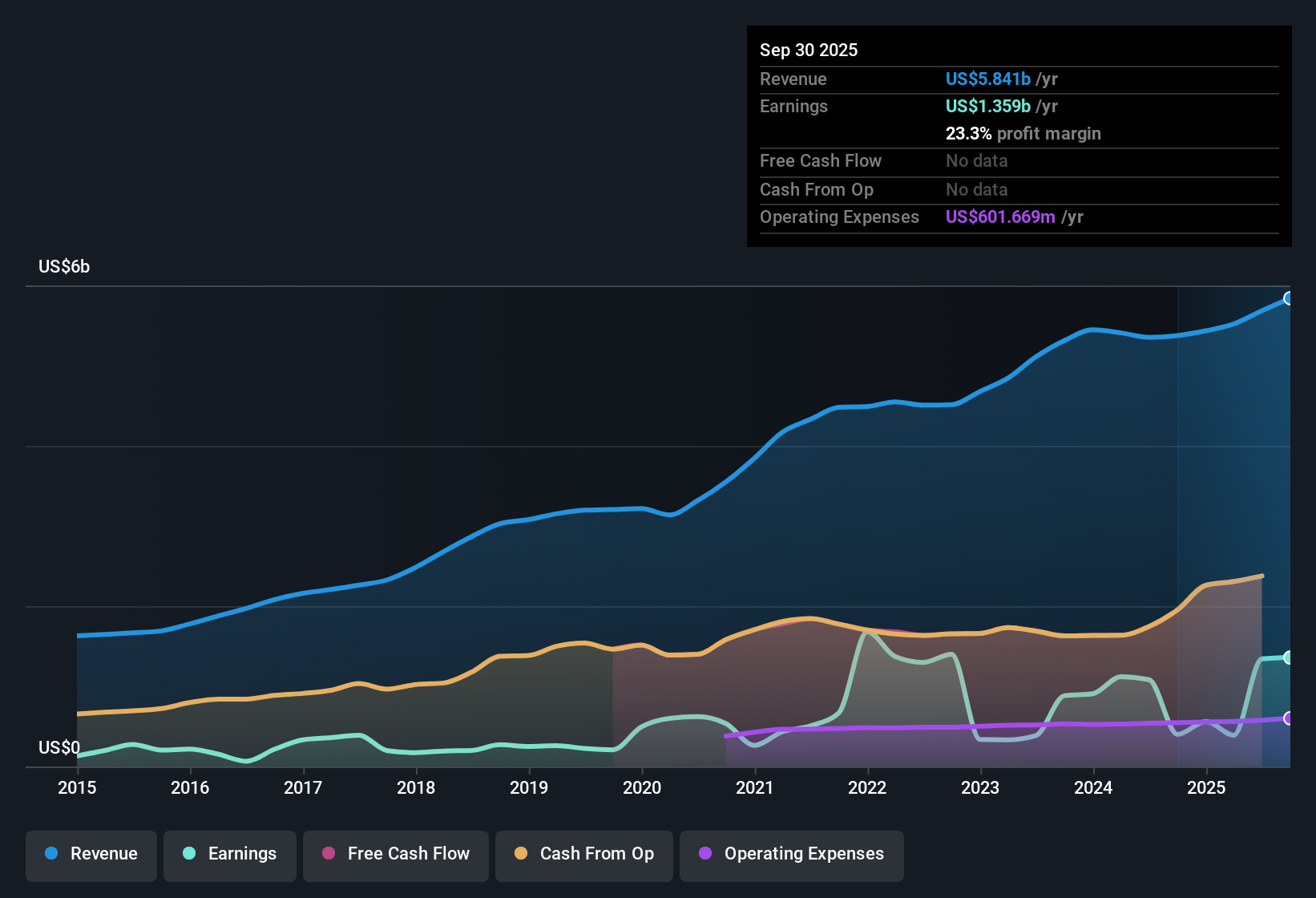

- Investors have been recalibrating their expectations as sentiment around data center REITs shifts with changing interest rate outlooks and growing demand for AI driven infrastructure. At the same time, Digital Realty has been in the spotlight for strategic partnerships and capacity expansions that aim to capture long term cloud and AI growth, even as the market debates how much of that upside is already priced in.

- Right now, Digital Realty scores a 3/6 valuation check score, suggesting pockets of undervaluation but also some areas where the market may be more cautious. Next, we will walk through the main valuation methods investors use, before finishing with a more holistic way to judge whether the stock is truly good value.

Find out why Digital Realty Trust's -14.6% return over the last year is lagging behind its peers.

Approach 1: Digital Realty Trust Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting its future adjusted funds from operations and then discounting those cash flows back to the present.

For Digital Realty, the latest twelve month free cash flow sits at about $2.0 billion. Analysts and model projections expect this to rise steadily, with free cash flow forecast to reach roughly $5.3 billion by 2035. The nearer term projections out to 2029 are based on analyst estimates, while the later years are extrapolated to reflect a gradually slowing, but still positive, growth profile as the data center portfolio matures.

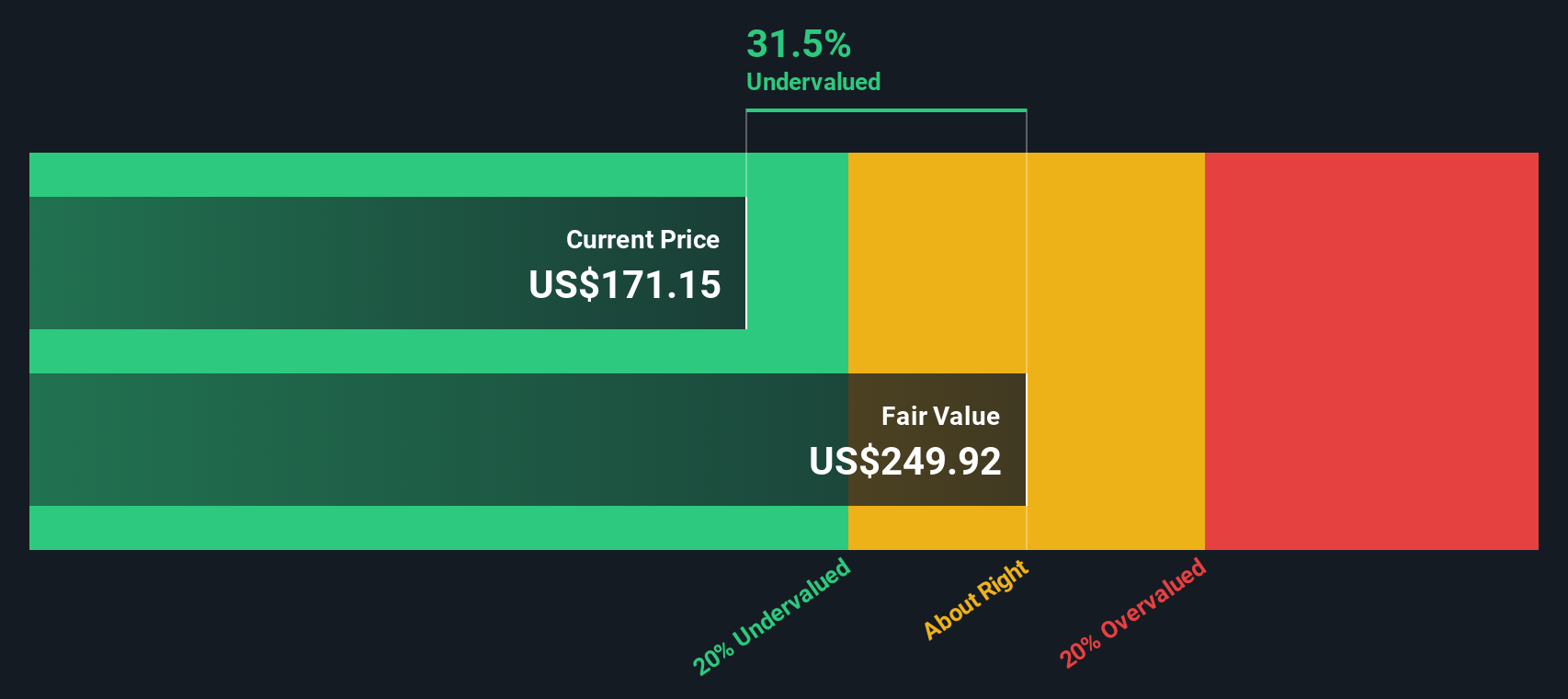

When all of these future cash flows are discounted back using a 2 stage Free Cash Flow to Equity model based on adjusted funds from operations, Simply Wall St estimates an intrinsic value of around $234.35 per share. Versus the current share price near $147.93, this implies the stock is about 36.9% undervalued, indicating potential upside if these cash flow assumptions prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Digital Realty Trust is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Digital Realty Trust Price vs Earnings

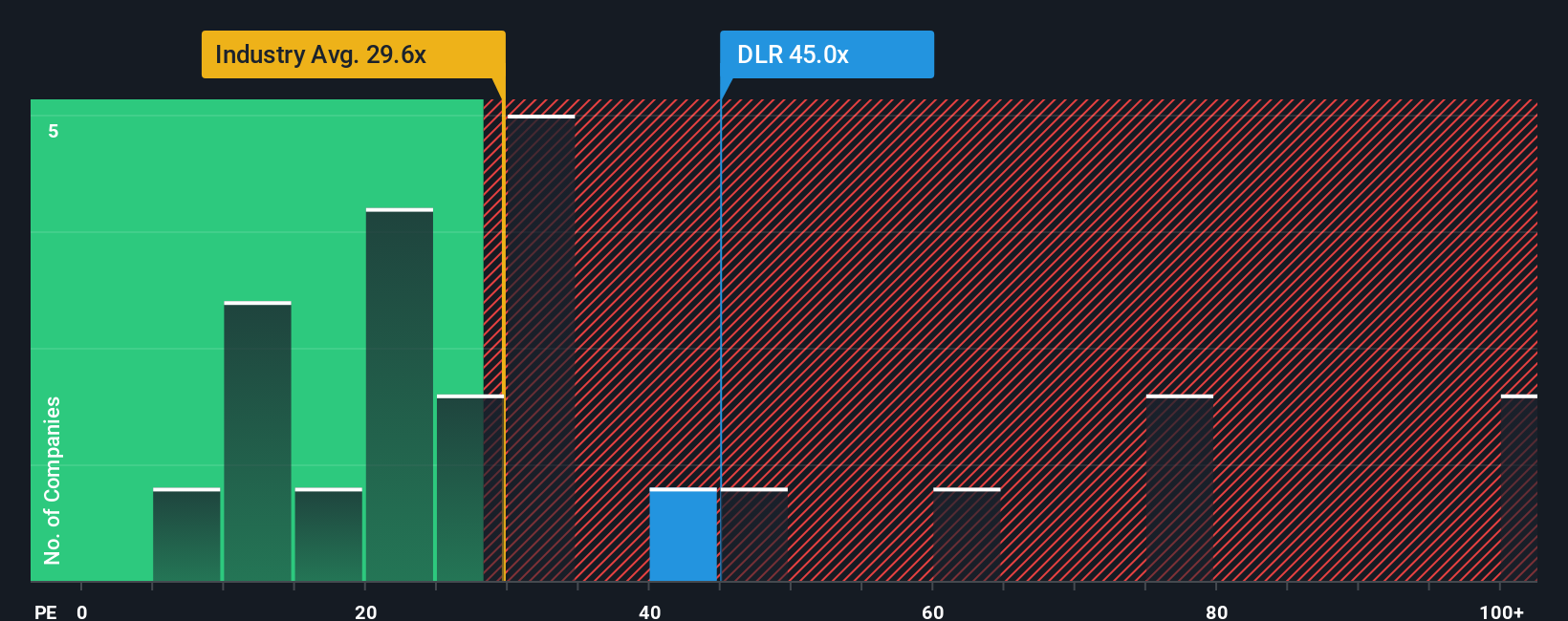

For profitable companies like Digital Realty Trust, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay today for each dollar of current earnings. A higher PE can be justified when markets expect faster, more durable growth or see the business as relatively low risk. Slower growth or higher uncertainty typically call for a lower, more conservative multiple.

Digital Realty currently trades on a PE of about 37.40x. That is well above the Specialized REITs industry average of roughly 16.55x and also higher than the 33.46x average of its direct peers, suggesting the market is already assigning a meaningful growth and quality premium. Simply Wall St’s proprietary Fair Ratio framework goes a step further by estimating what PE Digital Realty should trade at, based on its specific earnings growth outlook, margins, risk profile, industry positioning, and market cap. On this basis, Digital Realty’s Fair Ratio comes out at around 28.74x, notably below the current market multiple, implying investors are paying more than the model suggests is justified by fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Digital Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you attach a clear story to your numbers. You can link your view of Digital Realty’s business drivers to explicit forecasts for revenue, earnings, and margins, and then to a Fair Value you can compare with today’s price to decide whether to buy, hold, or sell. The platform keeps that Narrative up to date as news and earnings arrive. For example, one investor might plug in strong AI demand, rising international expansion, and resilient margins to reach a Fair Value close to $199 per share. Another investor, more cautious on overbuilding, competition, and interest rates, could assume slower growth and thinner margins that point to a Fair Value nearer $110. By seeing both stories side by side you can quickly judge which path seems more realistic for you and act accordingly.

For Digital Realty Trust, however, we will make it really easy for you with previews of two leading Digital Realty Trust Narratives:

🐂 Digital Realty Trust Bull CaseFair Value: $199.22

Upside vs current price: 25.8% undervalued

Forecast revenue growth: 12.98%

- Backlog of AI and cloud driven leases, a new hyperscale fund, and an expanding development pipeline are expected to support strong multi year revenue growth and resilient cash flows.

- Analysts see sustainability initiatives and scale efficiencies boosting long term profitability, even though reported profit margins are forecast to compress from current levels.

- Consensus fair value around $199 per share assumes robust revenue growth and premium valuation multiples, which implies the recent pullback could offer an attractive entry point if execution stays on track.

Fair Value: $110.45

Downside vs current price: 34.0% overvalued

Forecast revenue growth: 7.0%

- While AI and cloud demand are clear tailwinds, more moderate 7% to 9% revenue growth and 12% to 15% profit margins point to a steadier, less explosive trajectory than the market may be pricing in.

- Rising interest costs for this highly leveraged REIT, potential overcapacity in key markets, and intense competition from Equinix and hyperscalers are seen as major risks to valuation.

- On this view, if valuation multiples expand much above historical ranges without matching earnings growth, the stock would screen as fully valued to expensive relative to its fundamentals.

Ultimately, whether you lean toward the bullish or bearish Narrative, the key is to make the assumptions your own, test how sensitive fair value is to growth, margins, and interest rates, and decide if the current price of $147.93 offers enough upside for the risks you are taking.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Digital Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報