Nordson (NDSN) Stable 17.4% Margins Challenge 10% Earnings Growth Narrative

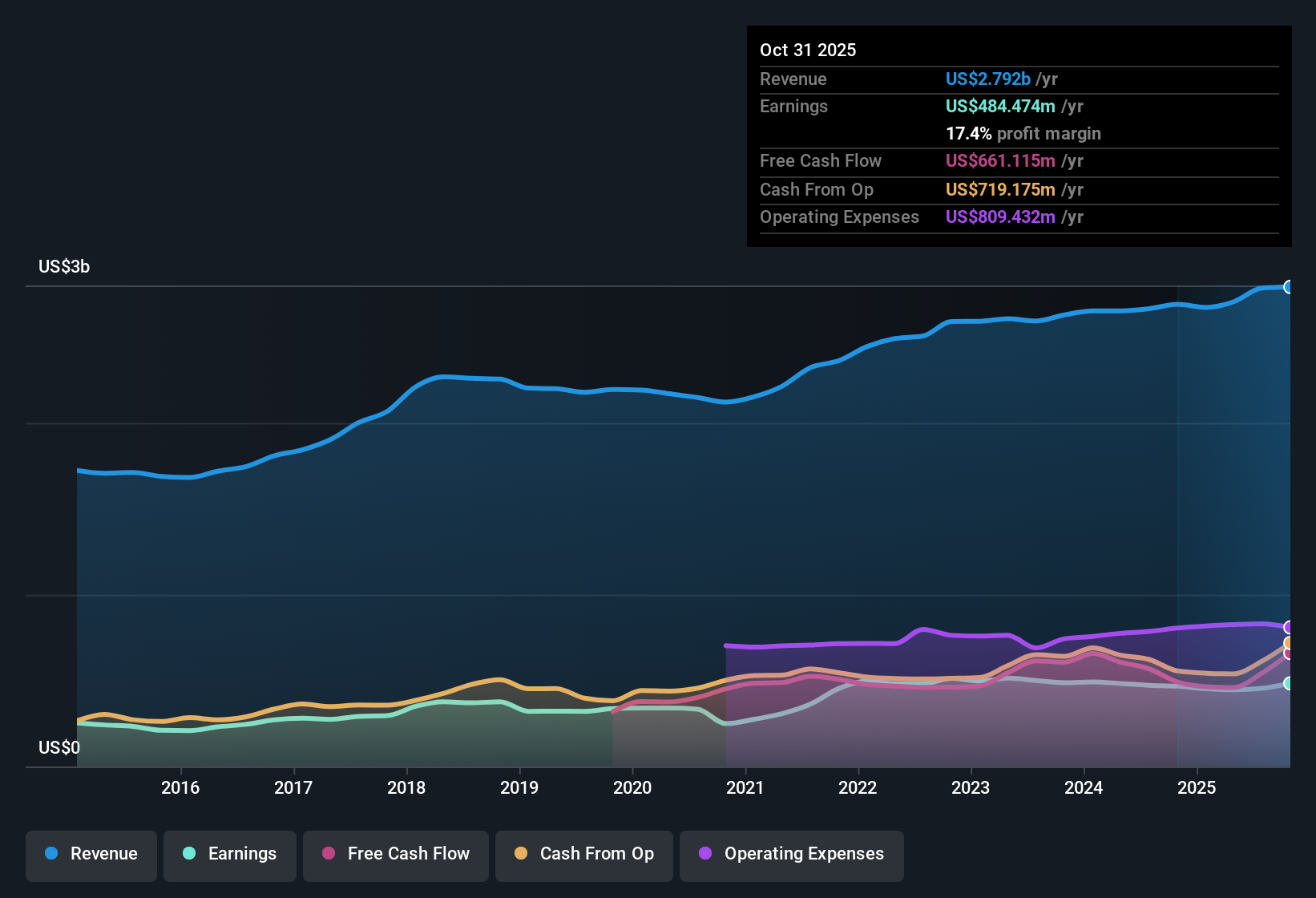

Nordson (NDSN) has just wrapped up FY 2025 with fourth quarter revenue of $751.8 million and EPS of $2.70, capping off a year where trailing 12 month revenue reached about $2.8 billion and EPS came in at $8.56. The company has seen quarterly revenue move from $615.4 million in Q1 2025 to $751.8 million in Q4, while EPS stepped up from $1.66 to $2.70 over the same stretch. This sets the stage for investors to focus on how durable these margins look heading into the next financial year.

See our full analysis for Nordson.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the most widely discussed narratives around Nordson's growth, profitability and execution.

See what the community is saying about Nordson

Net Margin Holds At 17.4%

- Nordson converted $2.8 billion of trailing 12 month revenue into $484.5 million of net income, keeping net profit margin at 17.4%, the same level reported last year.

- Analysts' consensus view links this steady 17.4% margin to a higher value business mix, yet it also flags that elevated spending and integration efforts could test that resilience over time.

- Margin stability lines up with the focus on recurring, higher margin revenue streams and portfolio optimization, which are expected to lift earnings resilience even if individual end markets move at different speeds.

- At the same time, consensus cautions that ongoing integration of deals like Atrion and higher SG and A plus R and D outlays could pressure profitability if revenue does not keep expanding as forecast at around 6% per year.

Earnings Growth Trails 10% Forecast

- Trailing 12 month earnings grew 3.7% over the last year and have averaged 6.6% annually over five years, compared with forecasts for about 10% yearly earnings growth ahead.

- Bulls point to secular drivers like advanced electronics and medical demand as justification for that faster 10% growth outlook, but the recent 3.7% pace shows the business still needs to accelerate to meet those expectations.

- Consensus highlights catalysts in semiconductor packaging, medical fluid components and emerging markets that are expected to push revenue growth toward roughly 6% per year and support higher earnings over time.

- Yet the reliance on recovery in areas like polymer processing and automotive related products means the recent moderate earnings growth rate remains an important reference point for how quickly those drivers are turning into profit.

Premium P/E Despite DCF Support

- The stock trades on a P or E of 27.6 times versus peer and industry averages of 24.4 times and 25.4 times, even though the current price of $238.34 sits only about 1.1% below a DCF fair value of roughly $240.88.

- Bears focus on this premium multiple and the company’s high debt level, arguing that any slowdown from the forecast 10% earnings growth could be felt quickly in the share price.

- The modest 1.1% gap between the share price and DCF fair value suggests there is limited valuation buffer if revenue growth tracks closer to the 3.7% trailing earnings growth instead of the higher forecast.

- With leverage already flagged as a risk, skeptics see the combination of a 27.6 times P or E and only a small discount to DCF fair value as leaving less room for disappointment if margins or growth soften.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nordson on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on the data and turn that into a concise narrative in just a few minutes: Do it your way.

A great starting point for your Nordson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Nordson’s modest 3.7% earnings growth, premium valuation and leverage concerns leave investors exposed if the expected acceleration in profitability does not materialize.

If that trade off makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1943 results) to quickly focus on financially stronger companies where lower debt and healthier balance sheets can better protect your capital.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報