2026 will usher in a “year of proof” for technology stocks: is it a bubble or a steady target?

The Zhitong Finance App learned that 2025 is nearing its end. This year, the artificial intelligence (AI) boom spread, and market concerns became more prominent: not only about the bubble in the stock market, but also about the disruptive power represented by this technology.

Although tech giants such as Alphabet Inc. (GOOGL.US) and Nvidia (NVDA.US) have brought strong returns, it has been proven that the neglected corners of the industry, such as memory chips and hard drives, are better places for investors. At the same time, competitive threats from wealthy giants (such as OpenAI and Anthropic) are putting pressure on software makers considered to be the most vulnerable to challengers.

As the US stock bull market continues into its fourth year, there are unprecedented concerns about the sustainability of AI calculations and whether the returns are worth investing in.

“There's a lot of optimism surrounding AI, but there's also a lot of hype,” said Anthony Sagrinburn, chief market strategist at Ameriprise. “2026 will be more of a 'proof' about AI. What is the return on investment (ROI) for hyperscale cloud computing companies that have been investing in capital? Will their profit growth continue to accelerate?”

Here's a review of some of the major events in the tech industry stock market in 2025, as well as an outlook for the new year.

Neocloud anxiety

New cloud companies (referring to companies that provide customized cloud computing services to AI customers) were in the limelight for most of 2025. But as we enter 2026, they seem more synonymous with the risk of an AI bubble.

The market's growing scrutiny of OpenAI's lack of profitability has raised questions about its ability to meet huge spending promises (including an alleged five-year, $300 billion cloud computing agreement with Oracle). Oracle (ORCL.US) was originally seen as the main beneficiary of AI growth, but as its association with OpenAI became a major concern, its stock price has fallen 45% since peaking in September.

“There are many concerns about OpenAI and the promises it has made,” said Adam Rich, Vaughan Nelson's Deputy Chief Investment Officer and Portfolio Manager, who has helped manage more than $17 billion in assets. “People can only make predictions based on what is known, and there's so much we don't know right now. As long as this continues, it will be difficult for a company like Oracle to regain its glory.”

Oracle is also facing other issues, including its huge expenditure on data center leasing, reported delays in some data center projects, and funding issues. Investors are particularly concerned about its growing debt burden, and one measure of the company's credit risk has soared to its highest level since the financial crisis.

In addition to Oracle, the new cloud provider CoreWeave Inc. (CRWV.US) has lost about two-thirds of its market value since hitting a high in June. Nebius Group (NBIS.US) shares fell more than 42% from their October high.

Boring tech stocks

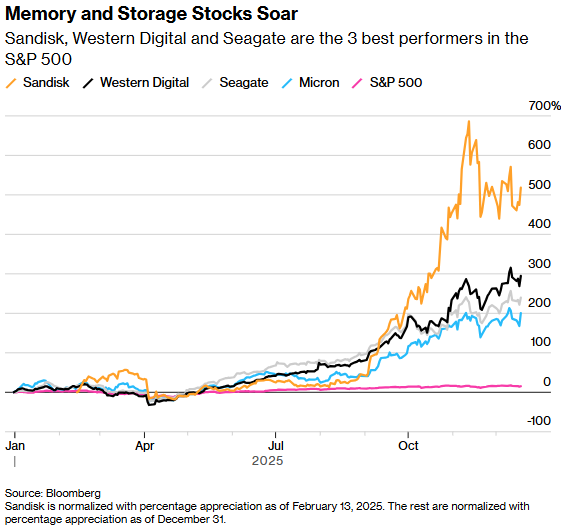

In 2025, investors discovered new AI transaction targets by tracking the promised multi-billion dollar capital expenditure flow. Just look at the top performers in the S&P 500 to discover this. Memory and storage company SanDisk (SNDK.US) topped the list, followed by hard drive manufacturer Western Digital (WDC.US) and its competitor Seagate Technology Holdings (STX.US). Micron Technology (MU.US), the largest manufacturer of memory chips in the US, is in fifth place.

This trend is expected to continue in 2026 as capital expenditure continues to grow. Investors are increasingly concerned about where the next wave will flock, and some are focusing on software stocks that have been hit hard.

“It's interesting to have something on the edge,” said Melissa Otto, head of technology, media and telecommunications research at Visible Alpha. “There is an AI ecosystem around the AI infrastructure itself.”

Software stocks are sluggish

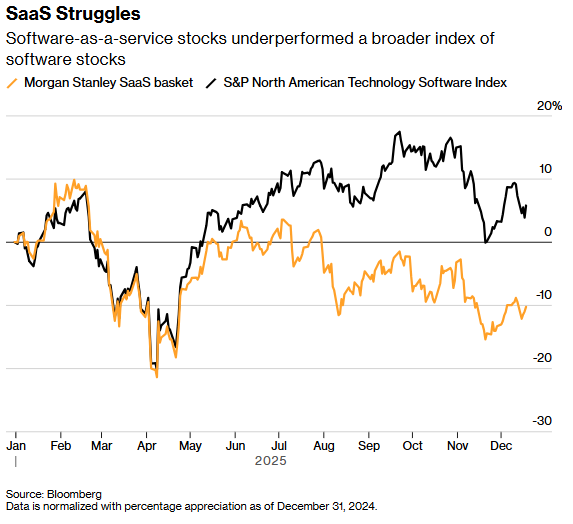

In 2025, the market capitalization of software stocks was at an attractive level, but this did not effectively attract investors. Shares of software-as-a-service (SaaS) companies have been particularly hard hit. The weakness largely reflects growing concerns in the market that the industry will be disrupted by AI as services like ChatGPT and Alphabet's Gemini erode software companies' demand or pricing capabilities.

A Royal Bank of Canada capital market analyst wrote in a research report this week that for some software companies, AI represents “competition for survival” because “the dominant position of AI chatbots and AI agents is becoming a core battleground.”

Companies such as Service Now (NOW.US), Adobe (ADBE.US), and CRM.US (CRM.US) were the weakest performing targets in the tech sector this year. The index of SaaS companies compiled by Morgan Stanley fell 10%, while the broader software index, which includes Microsoft and others seen as AI winners, rose 5%.

Whether the weak performance of software stocks will continue will be a key theme in the 2026 stock market. Some Wall Street professionals think they have overreacted so far. KeyBanc Capital Markets analysts wrote in a report to clients at the end of last month that the SaaS sector “has a 30% to 40% discount on transaction prices compared to the level implied by its fundamentals.”

The expensive one is more expensive

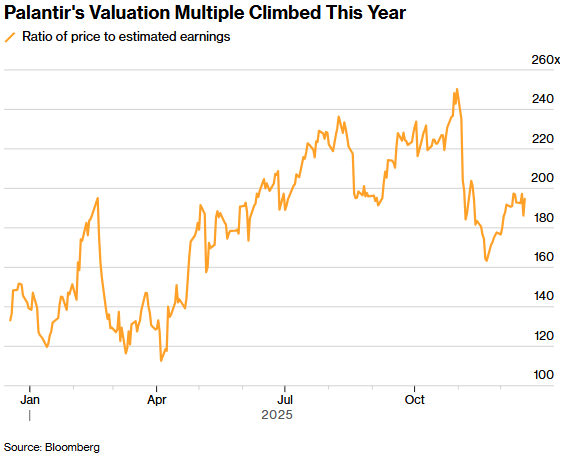

In 2025, people feared that excessive valuations would prevent some of the hottest stocks of 2024 from continuing their gains, but this concern proved superfluous. Palantir Technologies Inc. (PLTR.US) became one of the top performing stocks this year, even though its price-earnings ratio was over 200x (based on expected profit) for most of the time. With a 146% increase, the stock ranked 8th in the S&P 500.

Wall Street has long been skeptical about Palantir, mainly because its shares are overvalued. Of the 29 analysts that covered the data analysis software maker, only 9 gave it a “buy” rating. Despite this, the company is expected to expand at an enviable rate, with revenue expected to grow 43% in 2026 and 39% in 2027, according to analysts' average estimates.

Electric vehicle manufacturer Tesla Inc. (TSLA.US) has also overcome concerns about its valuation, which is far ahead of the “Big Seven” and is the most expensive. Despite having a price-earnings ratio of over 200 times (based on expected profits) and facing a series of headwinds ranging from slowing electric vehicle sales to safety concerns, the stock hit a record high this week.

Investors are optimistic about CEO Elon Musk's vision for the future of autonomous vehicles and the newly booming robotics business. After two years of stagnant revenue growth, Tesla's sales are expected to grow 13% in 2026 and 19% in 2027.

All of this makes the tech sector in much the same situation as it was a year ago when entering 2026. Shares are expensive, but growth opportunities still exist. It depends on the company's ability to deliver on its promises.

“Market expectations are high, and valuations are expensive,” said Sagrinburn of Ameriprise. “That means they need to prove something more, and they have to really exceed expectations to continue rising.”

Nasdaq

Nasdaq 華爾街日報

華爾街日報