Phoenix Financial (TASE:PHOE): Valuation Check After Strategic $5 Billion Credit Partnership With Blackstone

Phoenix Financial (TASE:PHOE) just unveiled a strategic partnership with Blackstone, committing up to 5 billion dollars across corporate, real estate, and asset based credit, a move that could reshape its long term earnings mix.

See our latest analysis for Phoenix Financial.

The move comes after a powerful run, with Phoenix Financial posting a roughly 36 percent 3 month share price return and a standout 5 year total shareholder return of about 714 percent. This suggests momentum is still very much on its side.

If this kind of re rating story has your attention, it is also worth exploring fast growing stocks with high insider ownership as a way to spot more under the radar compounders.

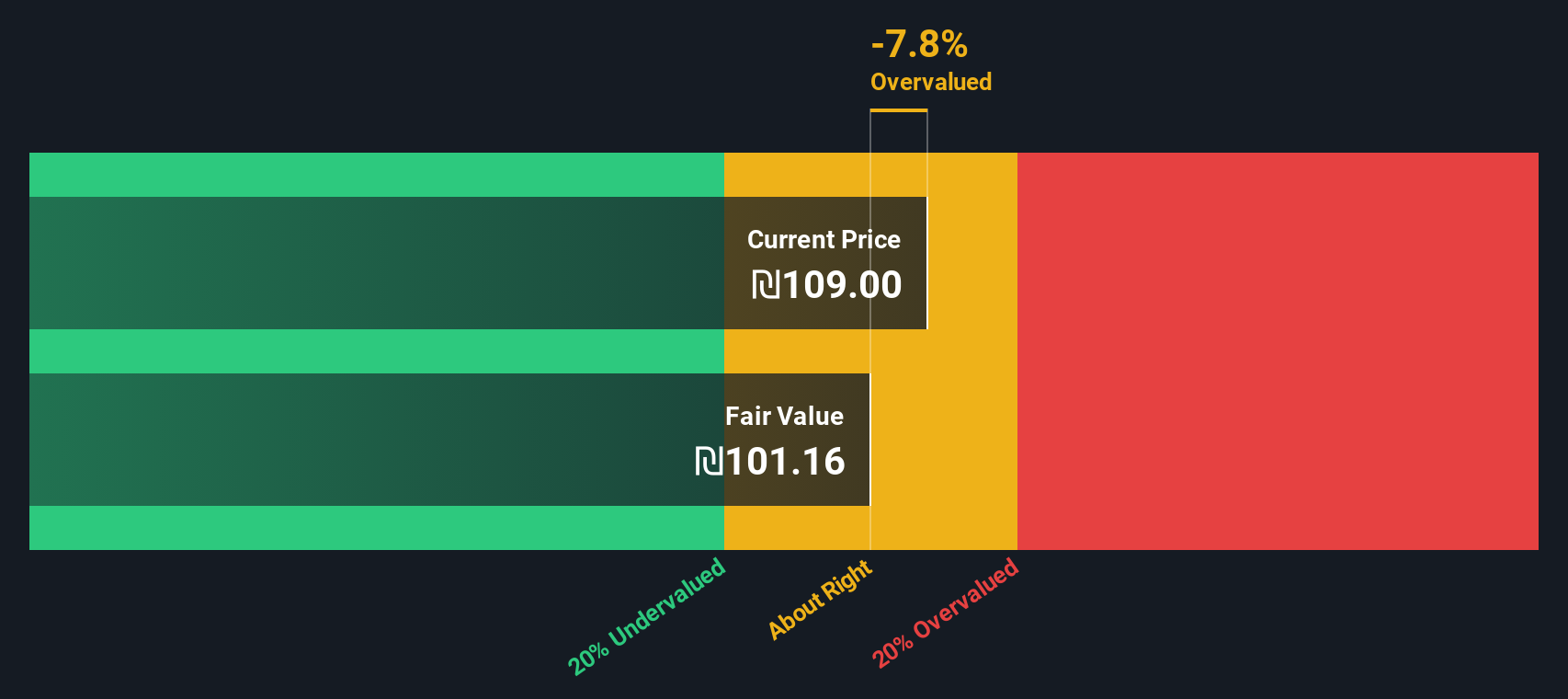

But after such a dramatic rerating, with the shares now hovering just below analyst targets and trading at a steep premium to some intrinsic models, is there still a buying opportunity here or is the market already pricing in years of growth?

Price-to-Earnings of 14.6x: Is it justified?

On a trailing Price to Earnings ratio of 14.6 times, Phoenix Financial screens slightly cheap versus the wider Israeli market but expensive against some valuation benchmarks.

The Price to Earnings ratio compares the company’s share price to its earnings per share, making it a central yardstick for insurers where profit consistency and return on equity matter. For Phoenix Financial, investors are paying 14.6 times earnings for a business delivering a high 21.4 percent return on equity and earnings growth of around 8 percent per year, with forecasts pointing to mid single digit profit growth ahead.

Relative to peers, the picture is mixed. The stock trades below the peer group average multiple of 17.3 times, which suggests the market is not paying a premium despite strong profitability. Yet it also sits above the Asian insurance industry average of 11.3 times and above the SWS fair Price to Earnings ratio estimate of 12.7 times, implying that part of the recent rally may already be capitalising on future earnings improvements.

Explore the SWS fair ratio for Phoenix Financial

Result: Price-to-Earnings of 14.6x (OVERVALUED)

However, risks remain, including a sharp slowdown in credit markets or regulatory shifts in Israel that could curb profitability and pressure valuation multiples.

Find out about the key risks to this Phoenix Financial narrative.

Another View: DCF Flags Clear Downside Risk

While the 14.6 times earnings multiple presents Phoenix Financial as only mildly stretched, our DCF model is harsher. With shares at ₪144.5 compared with an estimated fair value of about ₪100, the stock screens as materially overvalued. Is the market overpaying for quality and momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Phoenix Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Phoenix Financial Narrative

If you would rather dig into the numbers yourself and shape a view that fits your thesis, you can build a full narrative in minutes: Do it your way.

A great starting point for your Phoenix Financial research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to quickly pinpoint fresh ideas that match your style before the market moves on.

- Capture potential mispricings early by scanning these 918 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Position your portfolio for structural growth by targeting these 24 AI penny stocks benefiting from accelerating adoption of intelligent automation and data driven business models.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can help support returns even when markets get choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報