Will Surging Defense Revenue And CFO Stock Sale Change nLIGHT's (LASR) Directed Energy Narrative

- In recent days, nLIGHT has drawn fresh attention after its CFO sold nearly US$2.4 million of stock while multiple research firms initiated or reaffirmed positive coverage, highlighting the company’s growing role in defense and directed energy applications.

- Amid this, analysts have pointed to a reported 50% increase in defense-related revenue year over year as a key reason for renewed optimism around nLIGHT’s position in next-generation military laser systems.

- Now we’ll examine how surging defense-related revenue and bullish directed energy commentary might reshape nLIGHT’s existing investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

nLIGHT Investment Narrative Recap

To own nLIGHT, you need to believe that its pure-play focus on high power lasers will translate rising defense interest into durable, profitable growth, despite its current losses and rich valuation. The recent CFO sale of about US$2.4 million in stock and upbeat analyst commentary around a 50% jump in defense revenue do not change the near term catalyst, which remains execution on major directed energy programs, or the biggest risk, which is heavy exposure to U.S. defense spending decisions.

The most relevant announcement here is Roth Capital’s new coverage, which frames nLIGHT as a beneficiary of growing adoption of directed energy weapons and a technology partner to prime contractors. That bullish stance aligns directly with the key catalyst of expanding aerospace and defense programs, but it also raises the stakes on nLIGHT’s ability to scale amplifier production and convert development work into higher margin product revenue.

Yet investors should also be aware that growing reliance on aerospace and defense revenue could quickly backfire if...

Read the full narrative on nLIGHT (it's free!)

nLIGHT's narrative projects $310.5 million revenue and $28.1 million earnings by 2028.

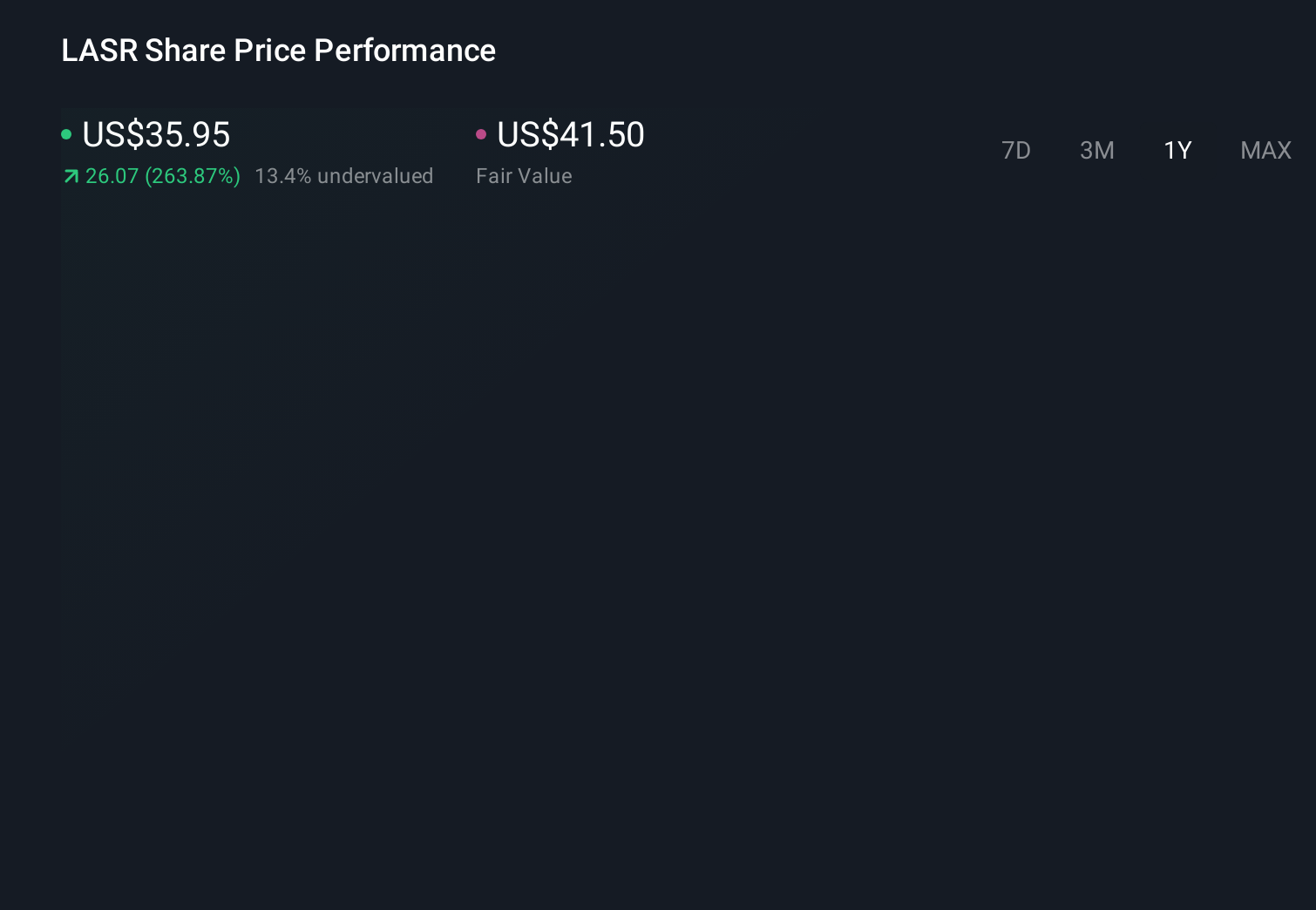

Uncover how nLIGHT's forecasts yield a $41.50 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Two fair value views from the Simply Wall St Community span about US$22.83 to US$41.50, underlining how far apart expectations can sit. Against that backdrop, nLIGHT’s concentrated exposure to U.S. defense budgets may either magnify future upside or amplify disappointment, so it pays to compare several perspectives before forming a view.

Explore 2 other fair value estimates on nLIGHT - why the stock might be worth 36% less than the current price!

Build Your Own nLIGHT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nLIGHT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free nLIGHT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nLIGHT's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報