3 Undiscovered Gems in the US Market

As the United States market faces a downturn with major indexes like the S&P 500 and Dow Jones Industrial Average experiencing their fourth consecutive losses, investors are increasingly cautious amid concerns about an AI bubble and recent unemployment data. In such volatile times, identifying undiscovered gems within the small-cap sector could offer potential opportunities for growth, as these stocks often remain resilient due to their unique business models or niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Red Violet (RDVT)

Simply Wall St Value Rating: ★★★★★★

Overview: Red Violet, Inc. is an analytics and information solutions company that focuses on using proprietary technologies and analytical capabilities to provide identity intelligence services in the United States, with a market cap of $766.96 million.

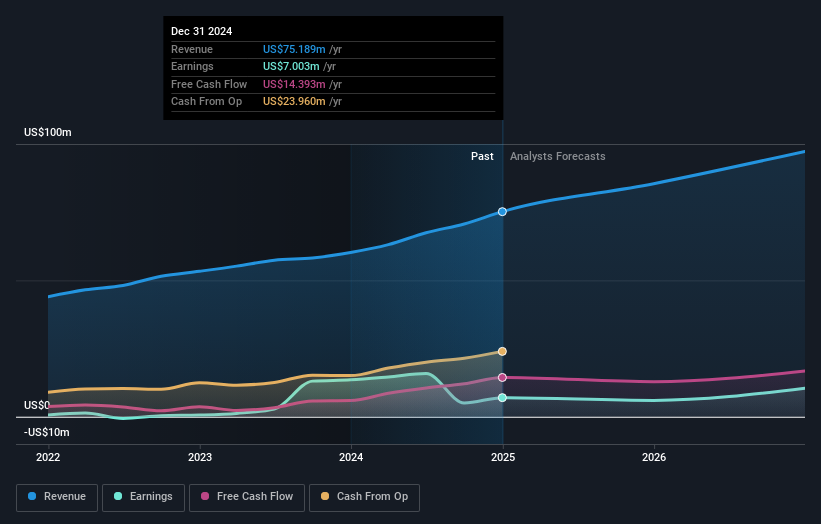

Operations: The company generates revenue primarily from its Identity and Information Solutions segment, which reported $86.43 million.

Red Violet, a nimble player in the analytics and information solutions space, has made notable strides with its debt-free status compared to five years ago when it had a 5% debt-to-equity ratio. The company reported impressive earnings growth of 120.9% over the past year, outpacing the software industry's 22.5%. Recent earnings for Q3 showed sales at US$23.08 million and net income at US$4.21 million, both up from last year’s figures of US$19.06 million and US$1.72 million respectively. While Red Violet's strategic investments in AI bolster its efficiency, challenges like supplier dependency and regulatory pressures remain pertinent considerations for future growth potential.

Innovative Aerosystems (ISSC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innovative Aerosystems, Inc. specializes in the engineering, manufacturing, and supply of advanced avionic solutions with a market cap of $253.79 million.

Operations: Innovative Aerosystems generates revenue through the sale of advanced avionic solutions. The company's cost structure primarily involves expenses related to engineering and manufacturing processes. Notably, its net profit margin has shown significant fluctuations over recent periods.

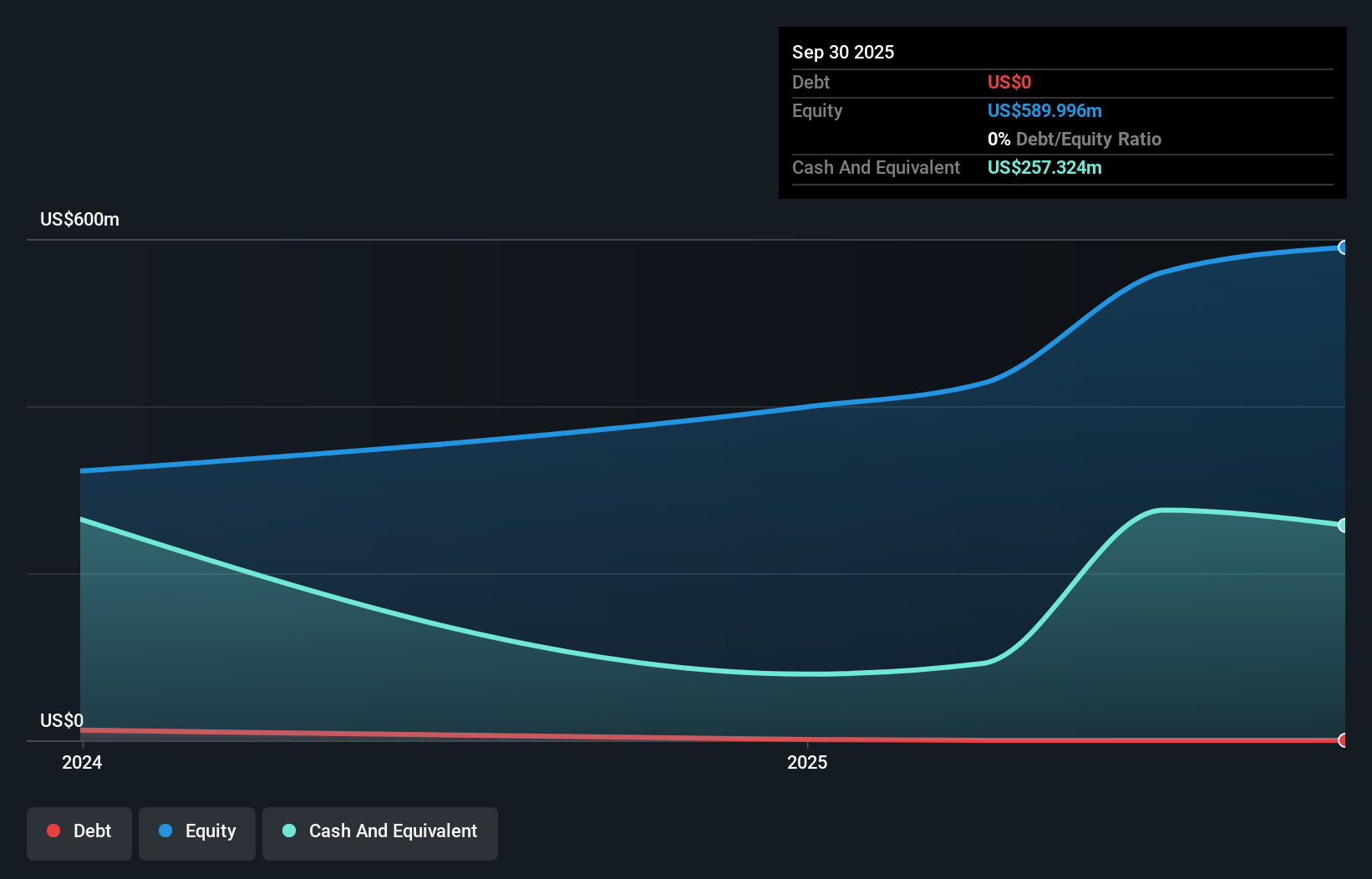

Innovative Aerosystems, a nimble player in the aerospace sector, recently reported substantial growth with annual revenue climbing to US$84.3 million from US$47.2 million last year and net income reaching US$15.63 million compared to US$7 million previously. The company is trading at 87.1% below its estimated fair value, offering potential upside for investors seeking undervalued stocks. Despite a rise in debt-to-equity ratio to 37.4% over five years, their interest coverage remains strong at 11.8x EBIT, indicating manageable financial obligations as they pursue strategic acquisitions and investments aimed at bolstering future growth prospects in avionics technologies.

Ategrity Specialty Insurance Company Holdings (ASIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Ategrity Specialty Insurance Company Holdings, with a market cap of $1.01 billion, operates through its subsidiaries to offer excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States.

Operations: ASIC generates revenue primarily from its insurance business, amounting to $405.66 million.

Ategrity Specialty Insurance Company Holdings, a nimble player in the insurance sector, has been making waves with its innovative Ategrity Select platform. This initiative targets 200,000 religious institutions for property and casualty coverage, streamlining quote generation to just 90 seconds. Financially robust, Ategrity reported Q3 revenue of US$116 million versus US$88.75 million last year and net income of US$22.66 million compared to US$12.86 million previously. Impressively trading at 43% below its estimated fair value and boasting an earnings growth of 83%, it remains debt-free with high-quality earnings that outpace industry standards.

Turning Ideas Into Actions

- Click here to access our complete index of 298 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報