Top Growth Companies With Strong Insider Ownership December 2025

As the U.S. stock market faces a downturn with major indexes like the S&P 500 and Dow Jones Industrial Average posting consecutive losses, investors are increasingly cautious about tech stocks amid concerns of an AI bubble. In such volatile times, companies with strong insider ownership often attract attention as they may indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.9% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.3% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.2% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Let's explore several standout options from the results in the screener.

Tesla (TSLA)

Simply Wall St Growth Rating: ★★★★☆☆

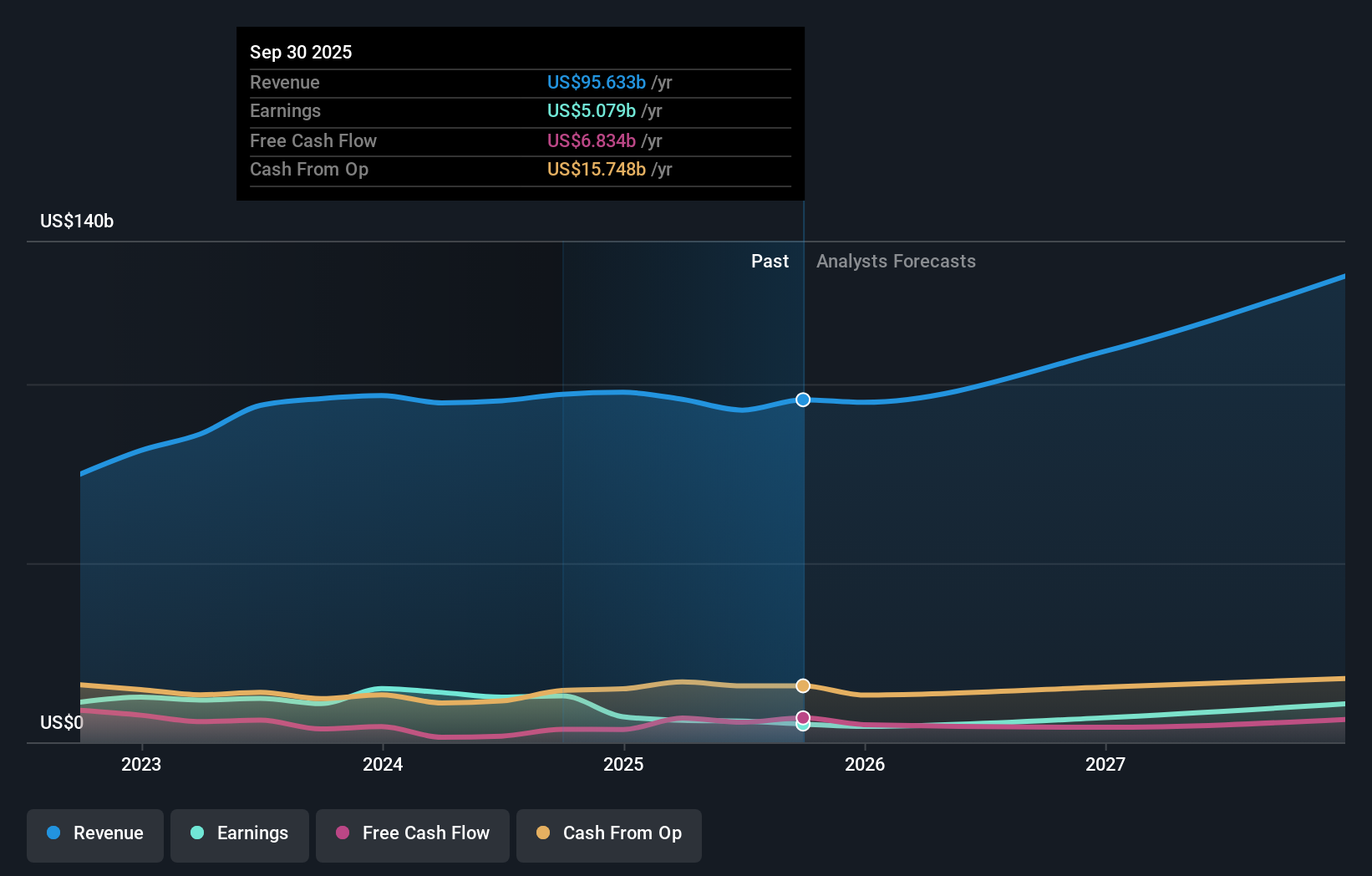

Overview: Tesla, Inc. is engaged in the design, development, manufacture, leasing, and sale of electric vehicles as well as energy generation and storage systems globally, with a market cap of approximately $1.55 trillion.

Operations: Tesla's revenue primarily comes from its Automotive segment, generating $83.64 billion, and its Energy Generation and Storage segment, contributing $11.99 billion.

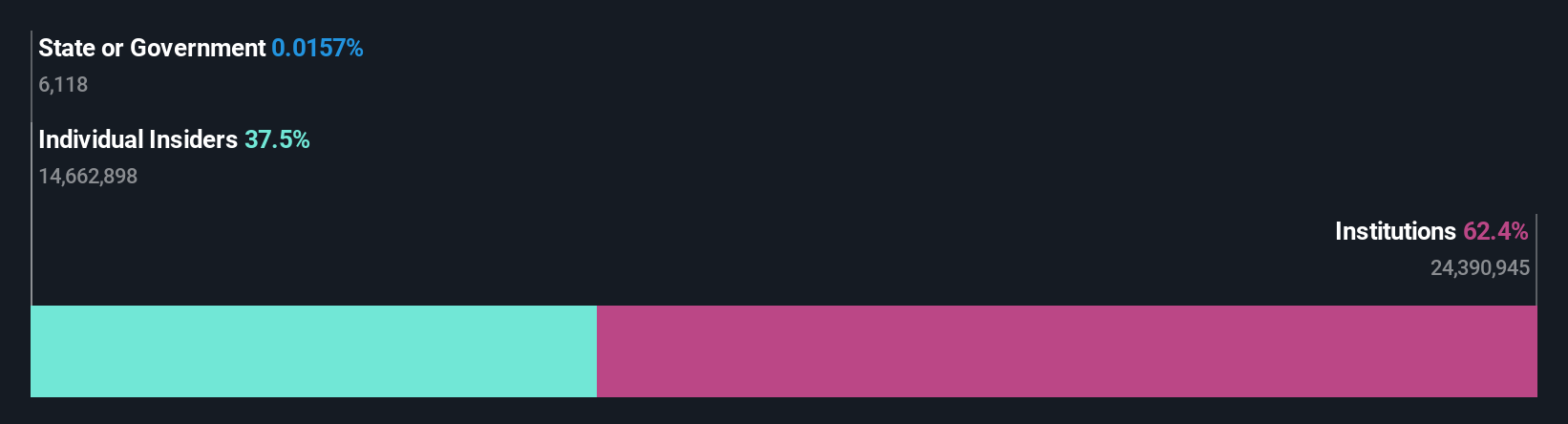

Insider Ownership: 28.2%

Tesla's growth prospects are bolstered by its significant insider ownership, although recent months have seen substantial insider selling. The company is expected to achieve robust annual earnings growth of 33.8%, outpacing the broader US market, despite a forecasted low return on equity of 9.2% in three years. Recent collaborations, such as the European framework agreement with SPIE for battery energy storage projects, highlight Tesla's strategic initiatives in renewable energy infrastructure expansion across Europe.

- Click here to discover the nuances of Tesla with our detailed analytical future growth report.

- The analysis detailed in our Tesla valuation report hints at an inflated share price compared to its estimated value.

Marcus & Millichap (MMI)

Simply Wall St Growth Rating: ★★★★☆☆

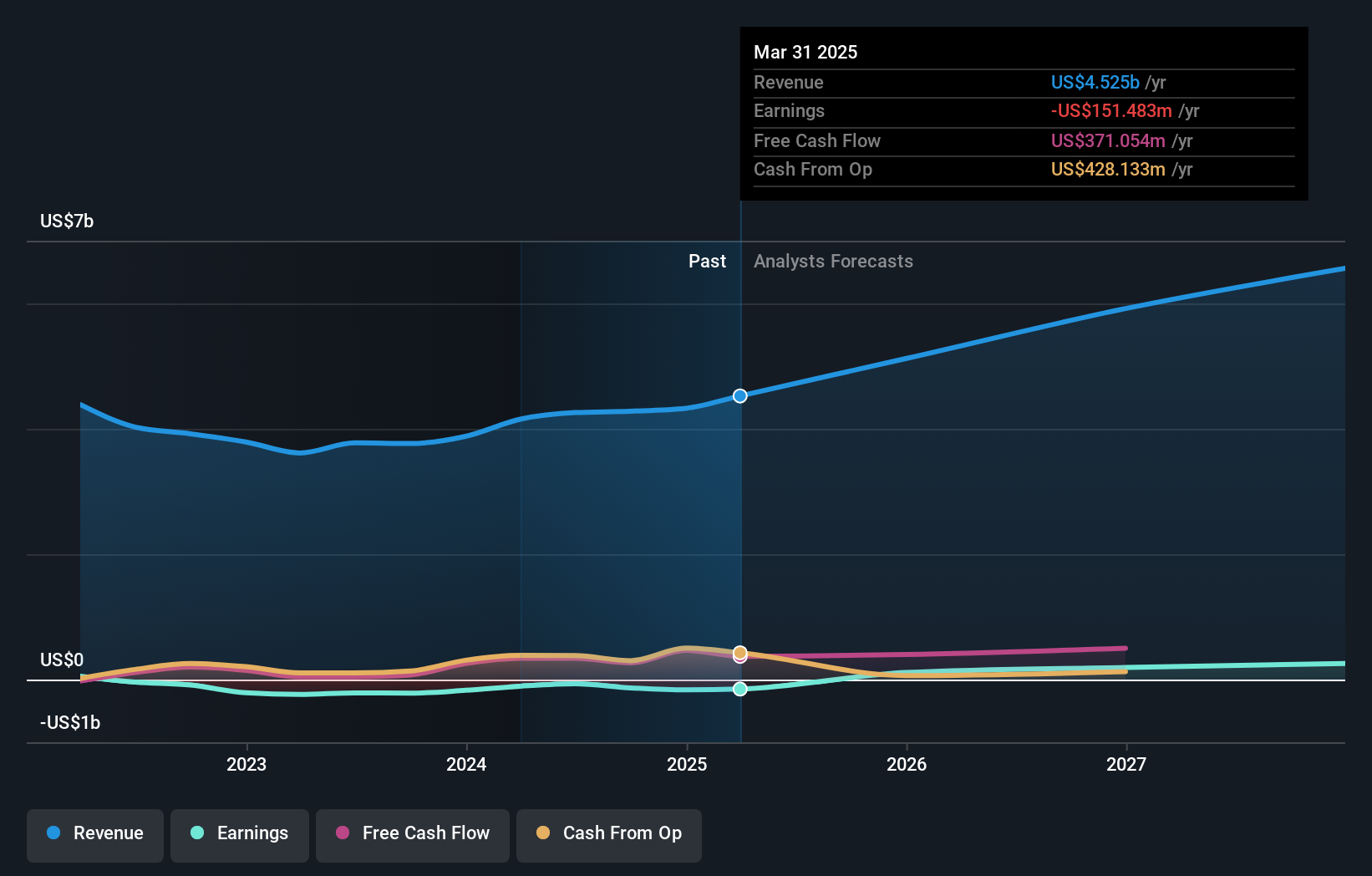

Overview: Marcus & Millichap, Inc. is an investment brokerage company offering real estate investment brokerage and financing services to commercial real estate buyers and sellers in the United States and Canada, with a market cap of $1.09 billion.

Operations: The company generates revenue primarily from its Commercial Real Estate Services segment, which amounted to $751.28 million.

Insider Ownership: 37.2%

Marcus & Millichap's insider ownership aligns with its growth trajectory, as the company focuses on strategic acquisitions and technology investments. Recent earnings show a revenue increase to US$193.89 million for Q3 2025, with net income turning positive at US$0.24 million from a prior loss. Forecasts indicate revenue growth of 12.8% annually, outpacing the US market average, while profitability is projected in three years, despite current dividend sustainability concerns due to low coverage by earnings.

- Navigate through the intricacies of Marcus & Millichap with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Marcus & Millichap shares in the market.

Tutor Perini (TPC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients globally, with a market cap of $3.57 billion.

Operations: The company's revenue segments are comprised of Civil (Including Management Services) at $2.86 billion, Building (Including Management Services) at $1.77 billion, and Specialty Contractors at $742.35 million.

Insider Ownership: 14.2%

Tutor Perini's high insider ownership supports its growth potential, with insiders buying more shares recently. The company reported Q3 2025 sales of US$1.42 billion, up from US$1.08 billion a year ago, and net income of US$3.63 million compared to a significant loss previously. Earnings are forecast to grow at 95.88% annually, while revenue is expected to rise by 13.2%, surpassing the broader market's growth rate and indicating robust future performance prospects.

- Get an in-depth perspective on Tutor Perini's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Tutor Perini's share price might be on the cheaper side.

Turning Ideas Into Actions

- Investigate our full lineup of 207 Fast Growing US Companies With High Insider Ownership right here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報