Eaton (ETN): Has the Recent 9% Pullback Opened a New Valuation Opportunity?

Eaton (ETN) has quietly slipped over the past month, down about 9%, even though its long term performance remains strong. That gap between recent weakness and multi year returns is worth unpacking.

See our latest analysis for Eaton.

Zooming out, Eaton’s recent slide comes after a powerful run, with the 3 year total shareholder return above 100%. The softer 90 day share price performance suggests momentum is cooling as investors reassess growth and valuation.

If Eaton’s pullback has you rethinking where the next leg of growth might come from, it could be a good moment to scan aerospace and defense stocks for fresh ideas.

With earnings still growing double digits and the stock trading nearly 30% below consensus targets, is Eaton quietly slipping into undervalued territory, or is the market simply cooling on a story that already reflects future growth?

Most Popular Narrative Narrative: 23.1% Undervalued

Compared with Eaton’s last close at $315.95, the most followed narrative sees fair value meaningfully higher, implying upside if its earnings path plays out.

Strategic wins and technology leadership in the rapidly expanding data center end market are deepening Eaton's penetration and raising content per megawatt. Major partnerships (e.g., NVIDIA, Siemens Energy) and acquisitions (Fibrebond, Resilient Power) are positioning Eaton as the go-to provider for next-generation high-density and AI-centric infrastructure. This supports outsized revenue growth and structurally higher margins due to a richer, more sophisticated product mix.

Want to see how steady revenue expansion, rising margins and a premium earnings multiple combine into that higher fair value, and why 2028 is the pivotal test?

Result: Fair Value of $410.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, reliance on AI driven data center demand and execution risks around large acquisitions mean that any stumble could quickly challenge that undervalued narrative.

Find out about the key risks to this Eaton narrative.

Another Way to Look at Value

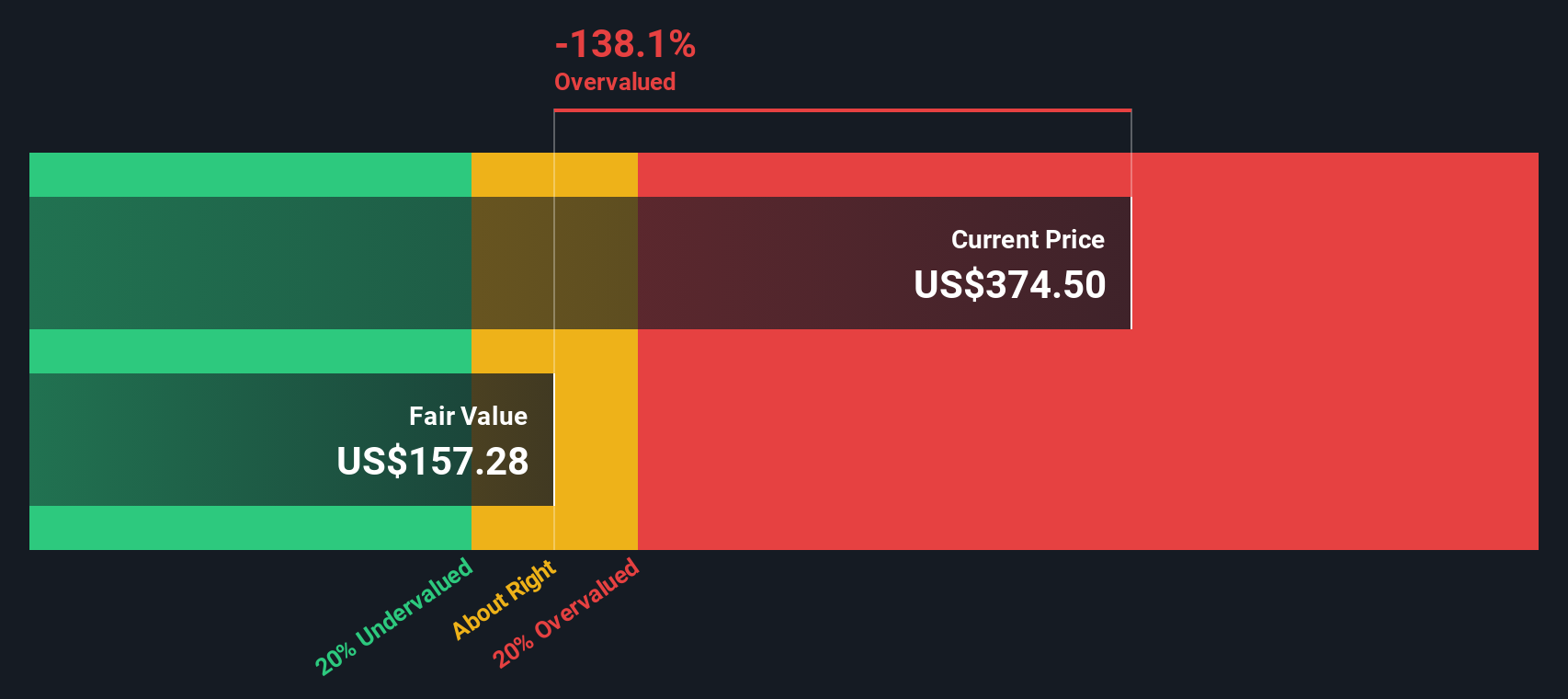

Our SWS DCF model paints a far more cautious picture, putting fair value at around $156.29, well below the current $315.95 share price and implying Eaton may be overvalued. If cash flows cannot keep pace with AI optimism, could today’s pullback be only the first step down?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eaton for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eaton Narrative

If you see Eaton’s story differently or want to dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A great starting point for your Eaton research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in an edge by using the Simply Wall St Screener to uncover focused, data driven ideas that most investors overlook.

- Target reliable payouts by scanning these 13 dividend stocks with yields > 3% that blend attractive yields with balance sheets built to sustain income through different market cycles.

- Ride powerful technological shifts by zeroing in on these 24 AI penny stocks positioned at the heart of automation, machine learning, and data driven innovation.

- Position early in potential turnaround stories by tracking these 80 cryptocurrency and blockchain stocks that are building real businesses around blockchain infrastructure and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報